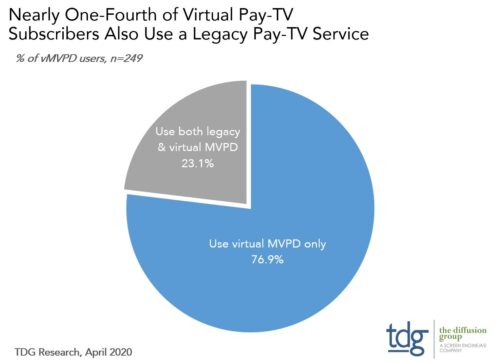

23% of U.S. vMVPD subscribers also use a legacy pay TV service

Wednesday, June 10th, 2020

TDG: 23% of U.S. Virtual MVPD Subscribers Also Use a Legacy Pay-TV Service

- Overlap has declined by a third since mid-2018, as virtual pay-TV operators expand their offerings

LOS ANGELES — New research from TDG, a division of Screen Engine/ASI, finds that nearly one-fourth of virtual pay-TV households in the U.S. also subscribe to a traditional cable, satellite, or telco pay-TV service. TDG will discuss this and many other data-based insights at Stream TV’s Summer Research Summit on June 29, 2020.

Dual-service use peaked at 37% of vMVPD subscribers in 2018, a time when Sling TV dominated the landscape, leaving many users without live programming from the “big-4” national broadcast networks (ABC, CBS, Fox, and NBC). Given their absence from the Sling offering, as well as widespread uncertainty as to the replacement value of virtual pay-TV services, two-in-five virtual users needed a second pay-TV service to satisfy household needs.

According to Michael Greeson, co-founder and President of TDG, this overlap remains largely ignored by the major firms industry leaders rely on for an accurate pay-TV subscriptions tally. “Simply adding legacy and virtual pay-TV subscription counts to arrive at cumulative estimates of pay-TV subscriptions is invalid,” says Greeson. “The overlap between the two services should be recognized, as it (1) is quite real, and (2) speaks to the continuing reticence about service substitution value among many virtual pay-TV users.”

Today, Hulu Live TV and YouTube TV have emerged as market leaders, both of which include the four major broadcast networks. Hence, the need for a second pay-TV service has diminished significantly. TDG predicted in 2018 that dual-service use would decline from 37% to 10% of vMVPD users by 2022, a trajectory supported by the new data.

Greeson adds that, as more channels have been added to the “skinny bundle” which previously defined virtual pay-TV services, its substitution value has improved. “Most OTT pay-TV services now provide a full complement of both broadcast and cable channels, meaning they are more capable of competing head-to-head with ‘fat’ legacy offerings. This, in turn, has led to a decline in the number of dual-service users.”

Among the 23% of vMVPD subscribers that use a legacy pay-TV service, such use is justified by the programming requirements of the household, as well as the need for a second service when away from home. Notably, 71% of dual-service users see their legacy service as primary, i.e., as the service used most often at home.

TDG will be discussing this data and other insights during the inaugural virtual Stream TV’s Summer Research Summit on June 29, 2020. For more information about TDG’s consumer research, please contact Laura Allen Phillips.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally