More than half of U.S. adult broadband users watch FAST services on TV

Thursday, August 19th, 2021

TDG: More Than Half Of Adult Broadband Users Watch Free Ad-Supported Streaming Video On TV

- Pandemic Acceleration of Streaming Video Behaviors Impacting AVOD

LOS ANGELES, CA, United States — TDG, a division of Screen Engine-ASI, estimates that six-in-ten connected-TV households now watch a free ad-supported streaming service on television. YouTube remains the dominant FVOD provider, with free ad-supported streaming TV services (FASTs) such as Pluto TV and IMDb enjoying growing audiences.

“Clearly the effects of work-from-home and lack of traditional leisure options during the pandemic accelerated consumer use of free ad-supported streaming services,” says Doug Montgomery, TDG Senior Analyst and a 15-year veteran with WarnerMedia. “Most major video providers have been preparing for this moment for years and thus able to quickly adapt to an accelerated timeline. It is a unique moment in the history of the entertainment business and those who move quickly and boldly will likely reap the benefits for years to come.”

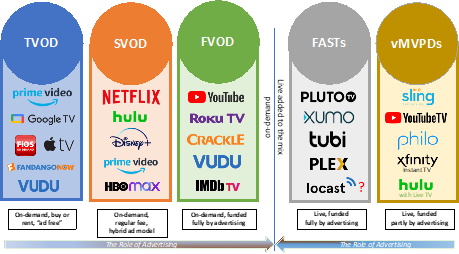

Montgomery notes that, while there is “a kaleidoscope” of new providers, pricing plans, and content sources available to the CTV viewers, yesterday’s video revenue models persist—that is, à la carte, subscription, and free. Technologies may change, but the fundamental revenue models do not.

He also recognizes widespread confusion among both industry and popular press as to what “AVOD” actually means. Two distinct streaming-video revenue models, FVOD and FASTs, are folded under the AVOD umbrella, when in fact any streaming revenue model can have an advertising component. Advertising, then, should be understood not as a vertical but rather as a common revenue model that all verticals can leverage for revenue.

Just as with broadcast and cable, advertising-based revenue models span both on-demand and live (e.g., FVOD IMDb and vMPVD Sling TV), as well as transactional, subscription, and free distribution models (e.g., TVOD Vudu, SVOD Netflix, and YouTube). Thus, the “AVOD” acronym should be eliminated from industry vocabulary and “ad-supported streaming video” used in its place. More letters, yes, but also more accurate.

TDG research finds that, among those that view free ad-supported streaming video on TV, 24% do so daily and another 32% weekly, which is encouraging given that these services are primarily comprised of older shows and movies—at least the on-demand portion. The remaining 44% view monthly or less.

Other findings of TDG’s new report include the following.

- 76% of those that view free ad-supported streaming video services on TV watch YouTube, more than twice the audience of its closest competitors.

- Among free ad-supported streaming-TV providers (FASTs), Pluto TV leads the pack, followed by Tubi TV. Fox’s Xumo has its work cut out, with usage in the single digits.

- When asked about the role of free ad-supported streaming services within their household’s total TV viewing, only one-in-eight Pluto and Tubi users use the service as their first choice for shows.

- In Q2.21, YouTube generated as much ad revenue as Netflix did subscription revenue.

TDG’s latest report, ‘The Rise of Free Ad-Supported Streaming’, is available for free to TDG Members and for purchase to all others. For more information about the report, contact TDG directly.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally