52% of U.S. consumers stop paying attention when ads come on the TV

Thursday, July 29th, 2021

Advertising suffers in the saturated attention economy alongside other content

- New MIDiA report explores how advertising can adapt more flexibly to consumer preferences and lean-forward behaviours

LONDON — As consumers have been forced to self-filter what they spend their attention on in an increasingly saturated attention environment, it is increasingly ads which are not making the cut, a new report from MIDiA has found.

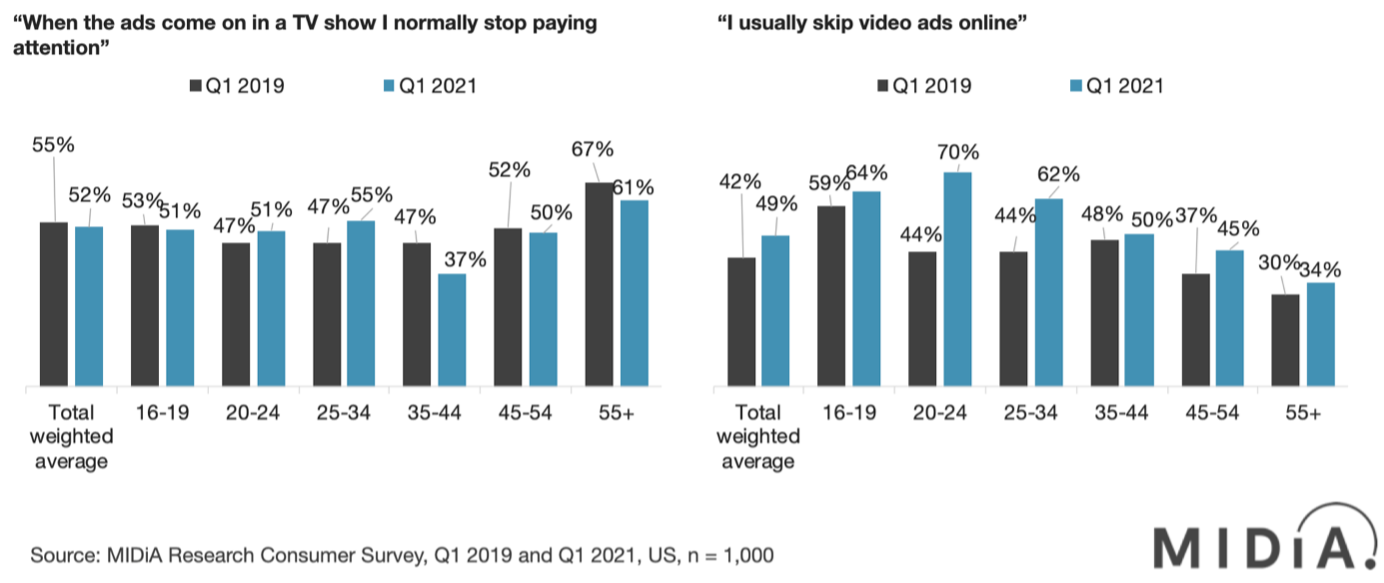

According to the report, ‘Ad strategy in a digital-first environment: Rethinking acceptance, tolerance and effectiveness’, 52% of all consumers stop paying attention when ads come on the TV, rising to 61% of the age 55+ cohort – the legacy patrons of pay-TV. However, as weekly linear TV viewing is decreasing (from 40% in the US in Q1 2019 to 38% in Q1 2021), a reduction in ad aversion here is underpinned by the long-term trend away from live TV engagement overall.

While the shift to digital-first life has long been underway, the COVID-19 pandemic has accelerated it. 40% of US consumers over the age of 55 were binge-viewers of TV shows in Q1 2021, and 33% pay a monthly subscription for video – up from only 26% in Q1 2019.

In the digital realm, skipping video ads online has increased since Q1 2019 across all age groups, most strikingly for those age 20-24 (up 26 points) and 25-34 (up 18 points). As consumers spend more time online growing accustomed to having control over what they consume and when, their tolerance for served ads deceases.

In an entertainment context where consumers are increasingly preferring lean-in, ads are inherently lean-back, so they are prime for being ‘tuned out’ in favour of a quick scroll through social media or a snack break.

Although ad targeting on platforms like Facebook and Instagram can be very specific, this can often mean a users’ experience is subjected to similar ads for competing brands in a very short period of time, ultimately both undermining brand recognition entirely and potentially inciting negative sentiment.

Report author and MIDiA analyst Hanna Kahlert said: “Advertising has turned from brand recognition and loyalty to a click-through-to-purchase, instantaneous and one-off interaction – which is more of a roulette game to see which ad the user clicks on in their feed, rather than a long-term brand-consumer relationship.

“In short, advertising budgets may be higher than ever – with expectations that the ad market will quickly rebound to growth in 2021 – but they are delivering far less return overall.”

To better meet consumer preferences for lean-in content and sentimental appeal, alternative strategies, such as cross-platform content partnerships can generate native appeal and tap into existing fandom, which is now the main sentiment driver for repeat return-to-service and is driven by content IP rather than brand.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally