Japan multi-play revenues to increase at 7% CAGR over 2021-2026

Tuesday, October 18th, 2022

Japan multi-play service revenue to increase at 7% CAGR over 2021-2026, forecasts GlobalData

The total multi-play service revenue in Japan is set to increase at a compound annual growth rate (CAGR) of 7% from $32.5 billion in 2021 to $45.6 billion in 2026, driven by strong demand for blended services and growing number of multi-play households in the country, according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Japan Multi-Play Forecast Model (Q2-2022) indicates that the average monthly household spend on multi-play service bundles will increase from $63.5 in 2021 to $77.3 in 2026, primarily driven by the increasing adoption of high value triple-play and quad-play service bundles built on fiber optic (FTTH/B) broadband services, and plans with premium benefits such as gigabit speeds, and unlimited access to music platforms.

Aasif Iqbal, Telecom Analyst at GlobalData, says: “The adoption of multi-play packages in Japan will be boosted by growing broadband network coverage in the country, especially the increasing availability of high-speed fiber-optic broadband services.”

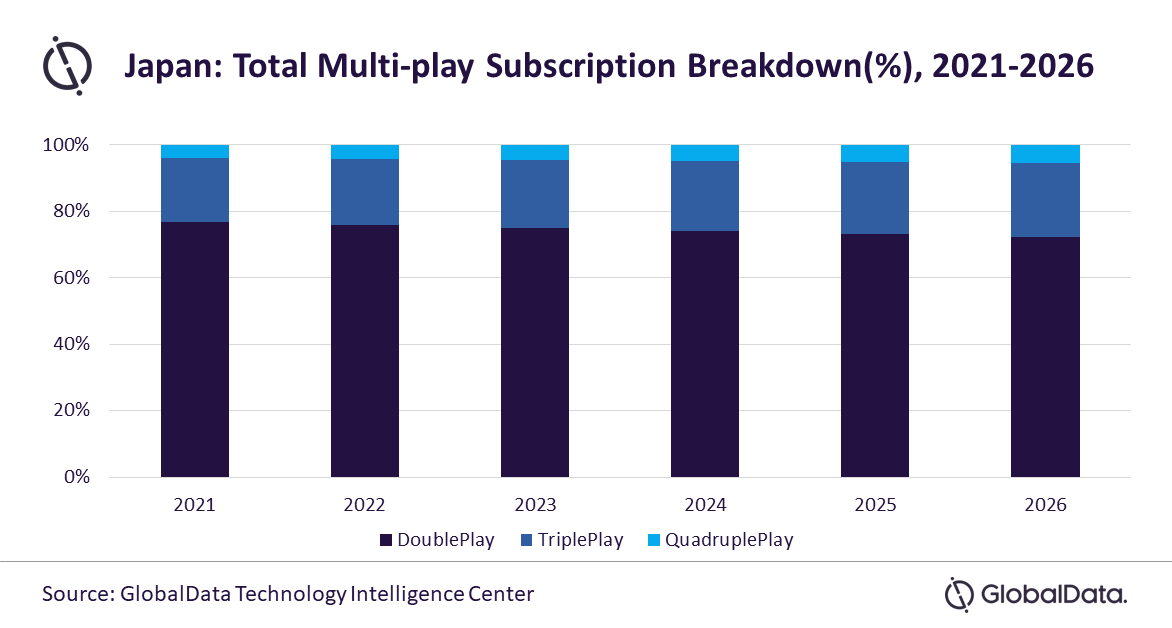

Though double-play services will remain the most popular multi-play service category through the forecast period, its share of total multi-play households will drop from 76.8% in 2021 to 72.4% in 2026. Triple-play and quad-play services, on the other hand, will see their household share grow from 19.2% and 4% in 2021 to 22.1% and 5.5% in 2026, respectively.

Iqbal concludes: “KDDI will lead the double-play market, by subscription share, through the forecast period banking on its promotional service bundles inclusive of fixed broadband, telephony, pay-TV, and mobile services along with access to music platforms and other value-added benefits, at discounted rates. NTT, on the other hand, will continue to lead the triple-play and quad-play segments in terms of households through 2026.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally