South Korea telecom and pay TV revenue to increase at 1.9% CAGR

Thursday, December 26th, 2024

South Korea telecom and pay-TV services revenue to increase at 1.9% CAGR over 2024-29, forecasts GlobalData

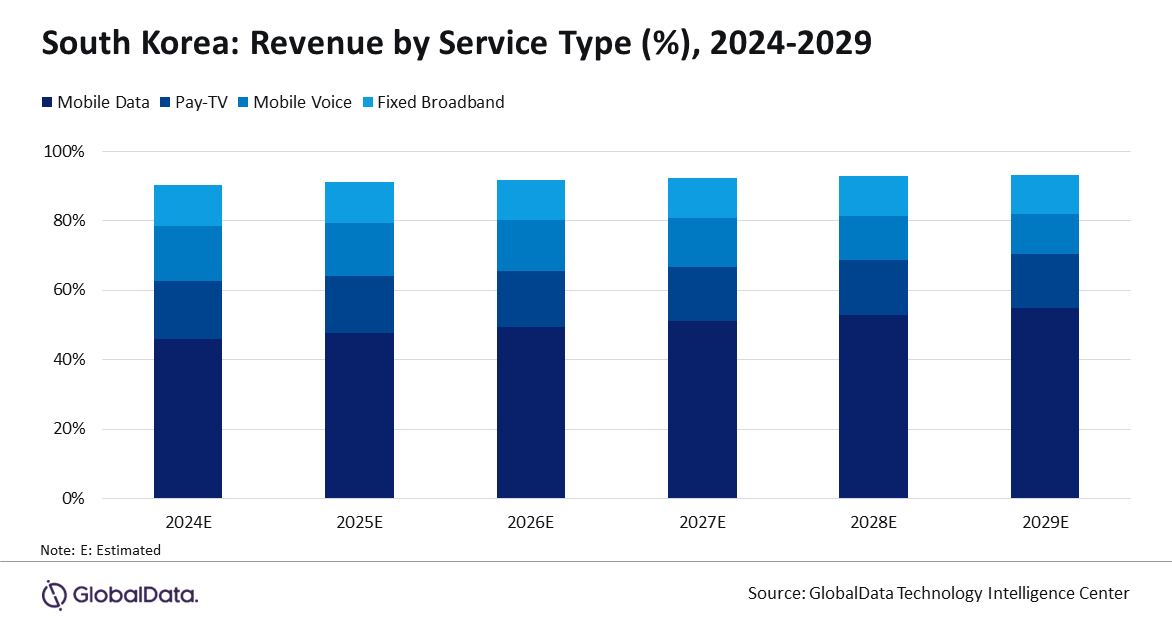

The telecom and pay-TV services revenue in South Korea is expected to increase at a compound annual growth rate (CAGR) of 1.9% over the forecast period 2024-2029 from $32.3bn in 2024 to $35.4bn in 2029, supported by strong growth in the mobile broadband segment, forecasts GlobalData, a leading data and analytics company.

GlobalData’s “South Korea Telecom Operators Country Intelligence Report” reveals that the mobile data service revenue in the country will increase at a healthy CAGR of 5.6% over the forecast period, driven by growing 5G subscriptions, which yield a higher mobile data average revenue per user (ARPU).

Mobile voice service revenue, on the other hand, will decline during the forecast period in line with a steady drop in mobile voice service ARPUs with operators increasingly bundling free voice minutes in their mobile service plans and a growing shift to OTT communication platforms.

Kantipudi Pradeepthi, Telecom Analyst at GlobalData, says: “5G services will account for the largest share of the total mobile subscriptions in South Korea in 2024. The share will increase rapidly to reach 89.2% in 2029, driven by a strong focus of the government and MNOs on 5G network expansions and service improvements. The government’s 5G+ strategy, for instance, aims to accelerate 5G network expansions and achieve over 90% mobile user access to 5G by 2026 by encouraging investments, removing regulatory barriers, and offering test beds for 5G infrastructure developments.”

In the fixed communication services segment, voice service revenue will decline over 2024-29 due to a decrease in fixed voice service ARPU and subscription losses in both the voice over Internet Protocol (VoIP) and circuit-switched segments. Fixed broadband service revenue, on the other hand, will grow at a CAGR of 1.2% during the period, primarily supported by growth in FTTH/B service adoption.

Pradeepthi adds: “Growing demand for higher-speed broadband connectivity and increasing adoption of fiber broadband services on the back of government and operators’ efforts to expand and modernize their fiber-optic network infrastructure across the country will support growth in FTTH/B service revenues over the forecast period.”

Pay-TV service revenue in South Korea is expected to see a marginal increase, registering a CAGR of 0.4% during 2024-29. While a continued drop in cable TV and DTH subscriptions will drag down overall revenue growth, a steady rise in IPTV subscriptions will lend support to the overall market and prevent further decline in total pay-TV revenue.

Pradeepthi concludes: “SK Telecom will lead the mobile services market in 2024 in terms of subscriptions and will continue to hold the top position throughout the forecast period, supported by its discounted monthly pricing along with unlimited and shareable data options. The company is also focusing on M2M/IoT services to drive opportunities in the enterprise segment.

“KT will lead the fixed voice, fixed broadband, and pay-TV segments by subscription shares in 2024. In the fixed broadband market, KT will maintain its leading position, supported by its strong position in the FTTH and xDSL segments. The company has been promoting discounted multiplay packages bundling fixed broadband and pay-TV services to increase their broadband adoption rates.”

Links: GlobalData

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally