Video spend in Sweden up 9% in 2022 versus 2021

Wednesday, March 15th, 2023Mediavision: Positive outlook for the Swedish subscription market

Swedish media is mainly financed by advertising and consumer payments. The advertising market is largely affected in an economic downturn. However, Mediavision can show that households’ interest in paying for media, for example through subscriptions, continues to increase – despite the economic decline. For many media companies, consumer revenues will increase in importance if Sweden enters a recession.

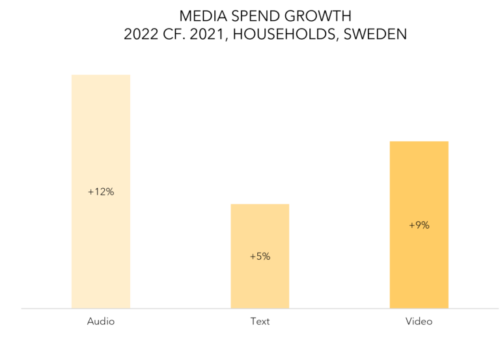

Swedish household media spend has gradually increased and despite economic concerns, 2022 was no exception. Average media spend increased 8 percent compared to 2021, and now amounts to SEK 685 per month. Looking across the three main categories text, audio and video[1], audio services increased the most, with a whopping 12 percent. At the same time, text grew by 5 percent and video by 9 percent compared to 2021. For the advertising market, development was significantly weaker and, according to IRM, a decrease of just over 2 percent was noted in the last quarter of the year, compared to the same period in 2021.

For advertising revenue in 2023, IRM expects a continued decline of 0.7 percent. For consumer payments, Mediavision currently sees no signs of a similar decline. On the contrary, preliminary data for the first months of the year shows continued growth. Bottom line is that consumer payments are stable or increasing, despite economic instability. When consumers are asked about their plans in financially tougher times, other expenses than media are opted out first.

“We recognize this pattern from previous economic downturns. Household spend on media is more stable than advertising revenue,” comments Marie Nilsson, CEO at Mediavision. “Therefore, it is particularly important in these times to closely monitor, for example, customer satisfaction and price sensitivity. Bundling different types of media services can also be a way to strengthen the relationship with consumers.”

1. Text: Digital/printed newspapers, magazines and books (subscription and purchase per unit). Audio: audiobooks, music and podcasts (subscription and purchase per unit). Video: Trad. TV, SVOD, TVOD, cinema and DVD/Blu-ray.

Links: Mediavision

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally