Telecom and pay-TV revenue in Japan to exceed $130bn in 2027

Tuesday, April 18th, 2023

Telecom and pay-TV services revenue in Japan to surpass $130 billion in 2027, forecasts GlobalData

The total telecom and pay-TV services revenue in Japan is expected to grow at a compound annual growth rate (CAGR) of 4.7% over the forecast period 2022-2027, mainly supported by the mobile data and fixed broadband service segments, according to GlobalData, a leading data and analytics company.

GlobalData’s Japan Telecom Operators Country Intelligence Report states that the mobile voice service revenue will decline over the forecast period in line with the steady decline in mobile voice service ARPU, with users increasingly shifting to OTT communication platforms and operators too offering free voice minutes as a part of their mobile plans.

Mobile data service revenue, on the other hand, will continue to increase, driven by the continued growth in smartphone and M2M/IoT subscriptions, and an increase in the adoption of relatively high ARPU-yielding 5G services.

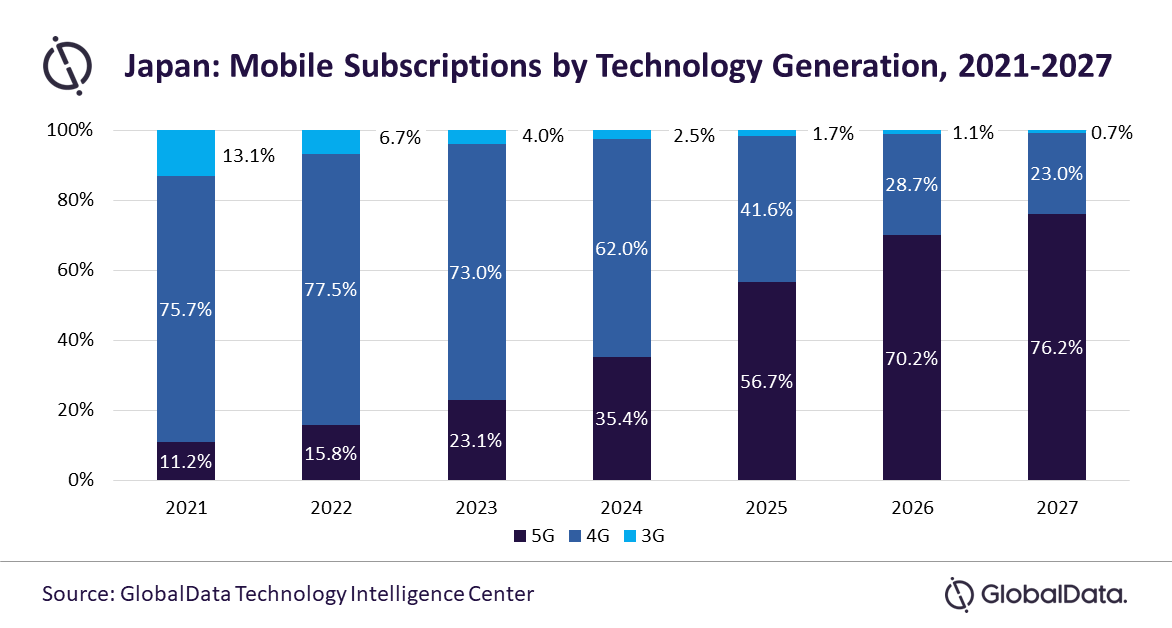

Sarwat Zeeshan, Telecom Analyst at GlobalData, says: “4G services accounted for a majority share of the overall mobile subscriptions in 2022 in Japan. 5G subscriptions, however, will increase at a rapid pace and surpass 4G’s share of subscriptions in 2025, driven by the rising demand and growing availability of 5G services with operators expanding their 5G networks across the country. For example, in March 2022, NTT Docomo planned to expand its 5G coverage to 1,741 municipalities, reaching at least 90% of the population coverage by March 2024.”

In the fixed communication services segment, fixed broadband service revenue will grow at a CAGR of 4.5% over 2022 2027 period, supported by the steady growth in fiber-optic subscriptions, on the back of the rising demand for higher speed broadband connectivity and the government’s focus on fiber-optic network expansion. Fixed voice services, on the other hand, will continue to weaken given the steady decline in circuit-switched subscriptions.

Growing demand for high-speed broadband connectivity, government’s focus on fiber-optic network expansion in the country, and the gradual phasing out of DSL services will support growth in fiber broadband subscriptions over the forecast period. Japan has set a target to expand fiber-optic networks to 99.9% of households by the end of March 2028.”

Zeeshan concludes: “NTT Docomo topped mobile, fixed voice, and fixed broadband service segments, in terms of subscriptions in 2022. While the ongoing expansion of the 5G network and focus on M2M/IoT offerings will help the operator maintain its leadership in the mobile services segment, in the fixed broadband segment, its focus on offering different tariff plans based on data usage will attract customers from basic level of usage to premium usage.”

Links: GlobalData

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally