Rebound in Mini LED shipments expected in 2024

Friday, November 3rd, 2023

Rebound in Mini LED Product Shipments to 13.79 Million Units in 2024, Continued Growth Expected Until 2027, Says TrendForce

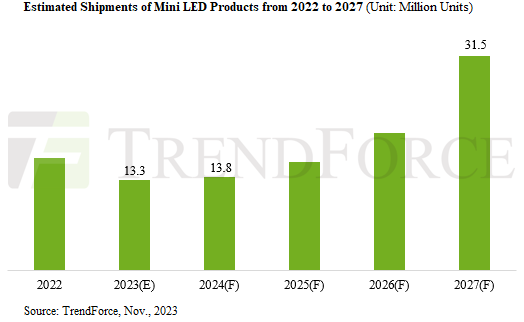

TrendForce’s “2024 New Mini LED BLU Display Trend Analysis” report reveals that due to declining demand in consumer electronics, shipments of Mini LED products are expected to decrease to 13.337 million units in 2023. However, the market is projected to rebound in 2024, with shipments estimated at 13.792 million units, and the growth trend is expected to continue through 2027. This decline is part of a larger trend of decreasing prices for Mini LED products, setting the stage for sustained growth in shipments. The report predicts that by 2027, shipments could reach as high as 31.453 million units, with a CAGR of approximately 23.9% from 2023 to 2027.

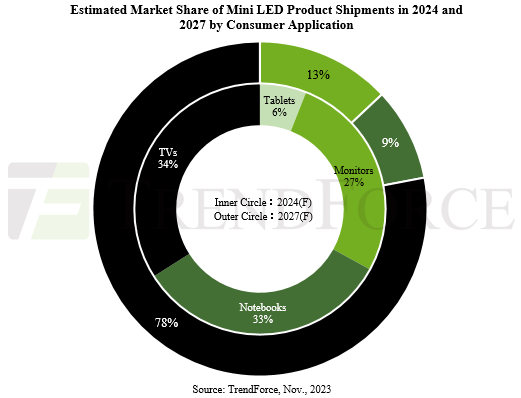

In the television sector, despite the robust increase in LCD panel prices and the continued high depreciation costs of OLED products, Mini LED component prices are on a downward trend. Now, apart from the relatively small-scale and still early-stage glass-based Mini LEDs, the costs of various other Mini LED TV panels are lower than those of White OLED and QD OLED. Thus, TrendForce maintains that Mini LEDs remain the most effective and optimal solution for enhancing contrast. Against this backdrop, the forecast for Mini LED TVs is positive, with an expected continuous growth in shipment volumes. Shipments are projected to reach 6.21 million units by 2024, marking a 53.5% YoY increase. Moving forward to 2027, shipment volumes are projected to hit 24.4 million units, capturing roughly 12.1% of the overall TV market. The CAGR for this segment from 2023 to 2027 is projected to be around 56.7%.

In IT applications, Mini LED monitor shipments are estimated at 296,000 units in 2023. Due to the diverse range of form factors available for monitors, including COB and POB, the cost structure is more flexible. After the market for OLED monitors gradually saturates and the costs of Mini LEDs continue to decrease, Mini LED monitors are expected to enter a growth phase between 2026 and 2027, with a significant increase in market penetration expected by 2027, estimated at around 3.1%.

Notably, as RGB OLED continues to expand, both Mini LED tablets and notebooks are facing potential threats and both applications are expected to reach an inflection point this year. The shipment volume for Mini LED notebooks is estimated to decrease by approximately 39% YoY. Meanwhile, with the 12.9-inch iPad Pro expected to be discontinued in 2024, the shipment volume of Mini LED tablets is expected to decrease by about 15.6% YoY, making these two the only applications expected to decline.

For the automotive market, even though inflation in Europe and the US is slowing down in 2023, the global economy remains weak. Automakers are stimulating demand through price reductions, inadvertently leading to a price war across the entire automotive market. However, the adoption of Mini LEDs in automotive displays is gradually expanding. With the development of smart cockpits, there is a trend towards a higher-end upgrade of in-car screens.

TrendForce investigations reveal that automakers, including BMW, Mercedes-Benz, Volvo, NIO, Roewe, and Li Auto are actively entering the Mini LED automotive display market. Mini LED COB technology, which uses blue LED combined with QD/phosphor, will compete with Mini LED POB/OLED display technology in the automotive display market.

Links: TrendForce

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally