1Q24 LCD TV panel shipments estimated at 55.8 million units

Friday, March 1st, 2024

Q124 LCD TV Panel Shipments Estimated at 55.8 Million Units, Expected to Continue Growing in Q2, Says TrendForce

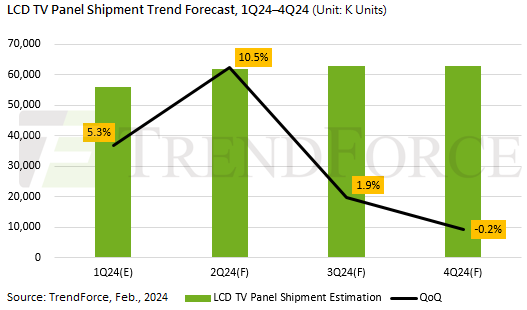

TV panel inventories returned to a healthy and slightly low level at the beginning of 2024 thanks to panel makers effectively controlling production rates. Demand started to show a significant rebound from January, driven by psychological expectations of price increases, stockpiling for shopping festivals and sporting events, as well as extended shipping times and increased freight rates due to conflicts in the Red Sea. As a result, TrendForce estimates that shipments of LCD TV panels will reach 55.8 million units in the first quarter—a 5.3% QoQ increase.

The first quarter coincided with the Lunar New Year, prompting panel makers to reduce production costs by scaling back production in February during the traditional off-season. This led to panel materials being concentrated in January and March, further driving a rebound in prices for medium and small-sized TV panels from January.

TrendForce anticipates that TV panel prices are likely to increase in Q2, enhancing manufacturers’ production willingness and potentially boosting shipments to 61.5 million units, a 10.5% QoQ increase. Demand is expected to be supported by promotions for the 618 Festival in April and May, along with stockpiling for the Paris Olympics, However, clients may adopt a conservative stockpiling attitude in June as they await actual sales outcomes, making it a crucial time for observing changes in TV panel prices.

Panel makers brace for price and volume showdown in second half

The TV panel market atmosphere improved in the first half of the year, but slow global economic recovery and increased geopolitical risks make the demand peak season for TV panels in the second half uncertain. Compared to the IT panel market, which is experiencing supply-demand imbalances, the TV panel market has stabilized and become profitable, making it critically important for panel makers’ performance in the latter half of the year. TrendForce reports that current shipment targets set by panel makers have increased by 6.7% compared to 2023, indicating that after becoming profitable, panel makers still aim to ship aggressively.

However, the latter half of 2024 could witness pivotal challenges, especially if demand is adversely impacted by the volatile global situation. With the supply side now relatively balanced and LGD’s Guangzhou plant slated for restart in 2024, any downturn in demand could potentially skew market supply dynamics, necessitating a delicate balance between volume and pricing strategies for panel makers.

Links: TrendForce

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally