Traditional US pay-TV services face continued decline

Wednesday, November 29th, 2023

Traditional US pay-TV services face continued decline due to cord-cutters and cord-nevers, says GlobalData

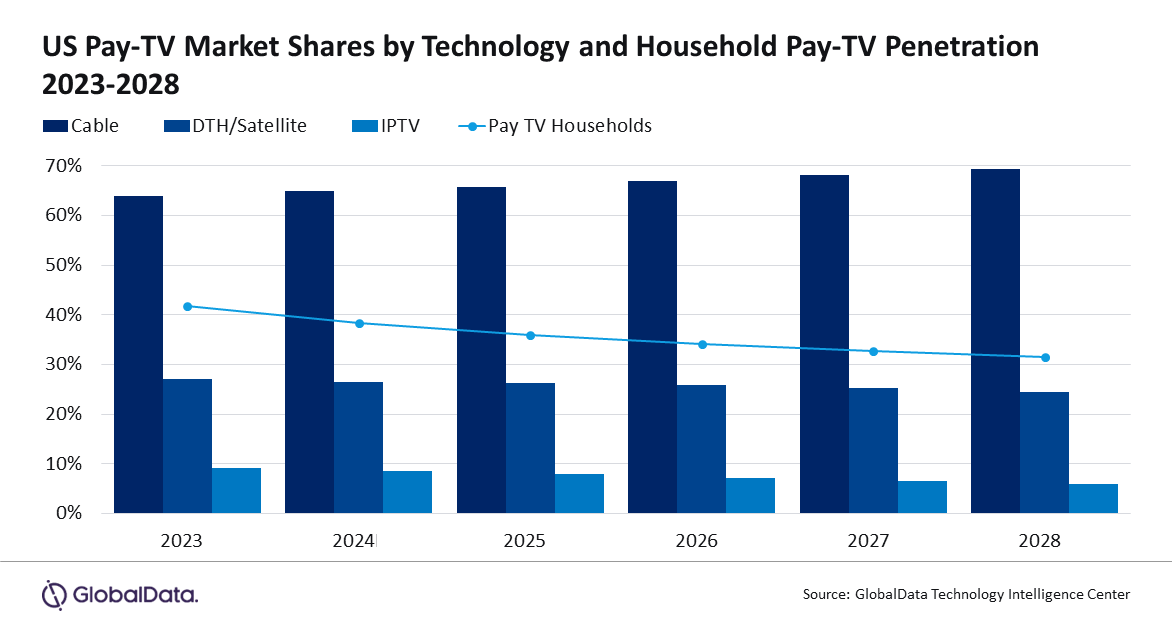

The US cable and satellite pay-TV services are set to face subscription declines in the coming years as their remaining viewers increasingly shift to over-the-top (OTT) streaming services. Complicating matters are the younger viewers who have never even subscribed to a traditional pay-TV service and likely never will. Those factors are leading to a dramatic decline in total US pay-TV household penetration from the industry’s halcyon days of 2009-2010, when penetration exceeded 85%, to 2023’s expected household penetration of only 42%, which will drop even further to 32% in 2028, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, “United States Pay-TV Forecast,” reveals that the total linear US pay-TV subscriptions will fall below 50 million by 2025, as viewers continue turning away from cable TV, satellite TV, and broadband-delivered IPTV subscriptions.

Winning the viewers’ attention are ad-supported streaming video (AVOD) and free ad-supported streaming TV (FAST) services like The Roku Channel, Tubi, Peacock, and Pluto TV; virtual multichannel video programming distributors (vMVPDs) like YouTube TV, Hulu + Live TV, and Sling TV; as well as streaming video on demand (SVOD) services like Netflix and Amazon Prime Video, either with or without ads.

Viewers who are ending traditional pay-TV subscriptions in favor of streaming services are considered cord-cutters or cord-shifters, while young adults who have never subscribed to cable, satellite TV, or IPTV make up the cord-nevers.

Jesús Romo, Principal Analyst at GlobalData, comments: “Younger generations tend to adopt new technologies and services like video streaming, but an additional element of the cord-nevers is the emergence of the ‘generation rent’ phenomenon. Younger consumers who are priced out of the housing market and rent for longer periods may prefer more flexible entertainment options that do not require a physical installation, are generally unbundled, and allow them to cancel and resubscribe.”

Tammy Parker, Principal Analyst at GlobalData, comments: “Sports programming has been the chief redeeming feature for traditional pay-TV services, which is still true to a point, but streaming video providers are increasingly encroaching on that sacrosanct relationship, with certain live sports events having already migrated to streaming platforms. For example, viewers who want to watch NFL Thursday Night Football or Major League Soccer’s MLS Season Pass need to turn to Amazon Prime or Apple TV+, respectively. Disney’s expected launch of a standalone ESPN streaming service will further encourage a viewer exodus from traditional linear TV providers.”

As traditional pay-TV service providers continue to lose customers, cable’s share of that shrinking market will grow in the coming years; cable is expected to control 69% of the US pay-TV market in 2028, up from 64% this year. This is largely due to the satellite pay-TV providers’ more rapidly shrinking customer bases. Although US cable’s subscriber rolls will shrink at a CAGR of -3% from this year through 2028, satellite-based providers will see a decline of -6% CAGR, and IPTV providers will fare even worse, with a CAGR of -12%.

Parker concludes: “Pay-TV subscription revenues are taking a hit as well. Though price increases have helped cable and satellite TV providers grow their average revenue per subscriber (ARPS), traditional pay-TV revenue is on the decline. Total annual US pay-TV subscription revenue is expected to plummet from $80.8 billion in 2023 to less than $63.6 billion in 2028, registering a declining CAGR of nearly -5%.”

Links: GlobalData

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally