Tele Columbus TV households down 40% YoY in 3Q 2024

Monday, November 25th, 2024Tele Columbus defies the headwind caused by elimination of cable TV fees from ancillary rental costs with further strong IP growth

Results of Tele Columbus AG for the third quarter of 2024

- IP new customer growth increased again in the third quarter (+113.1% YoY)

- EUR 325.0 million revenue in the first nine months of 2024 (-2.3% YoY)

- Reported EBITDA -14.2% to EUR 105.4 million in the first nine months of 2024 burdened by one-off expenses

- Normalised EBITDA stable year-on-year at EUR 141.6 million despite loss of revenue due to elimination of cable TV fees from ancillary rental costs

- Operating cash flow significantly improved to EUR 124.3 million (+21.5% YoY) due to strict capital allocation and positive effects in net working capital

BERLIN — Tele Columbus AG (“Tele Columbus”, “the Company” or “the Group”), one of Germany’s leading fiber network operators, today published its results for the third quarter and thus for the first nine months of the 2024 financial year.

New customer growth in the IP segment increased significantly again in the third quarter with an increase of 113.1% YoY compared to 54.1% YoY in the second quarter of 2024. More than 50% of PŸUR’s new IP customers chose tariffs with bandwidths of 500 Mbit/s or faster in the third quarter, confirming the widespread trend towards higher internet speeds.

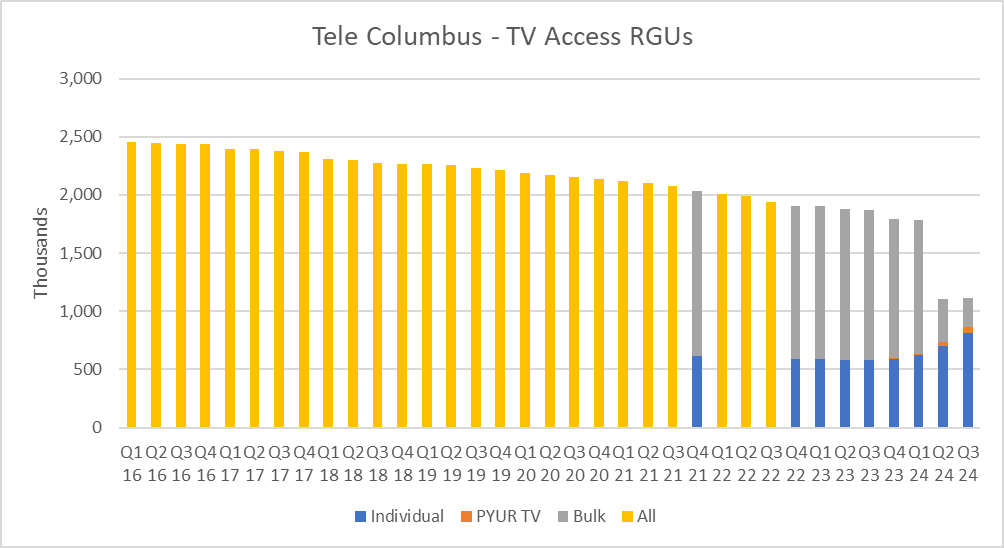

The elimination of cable TV fees from ancillary rental costs, which has been legally applicable since 1 July 2024, continued to have an impact on the TV customer base compared to the previous quarter. The total number of TV households in the third quarter of 2024 decreased year-on-year to 1.1 million (-40.4% YoY), but remained stable compared to the second quarter of 2024. The share of individual user contracts included in this figure rose by 130k to 863k in the third quarter and slightly more than compensated for the decline in collective collection contracts with +10k households overall. The company expects the increase in individual user contracts to continue in the fourth quarter based on increased sales activities.

At EUR 325.0 million, revenue development remained almost at the same level as the previous year in a nine-month comparison (-2.3% YoY), despite the loss of revenue due to the elimination of cable TV fees from ancillary rental costs. Normalised EBITDA remains largely stable in a nine-month comparison (from EUR 141.5 million to EUR 141.6 million). Reported EBITDA fell from EUR 122.9 million in the first nine months of 2023 to EUR 105.4 million (-14.2%) due to the ongoing transformation activities within the Group, the completed A&E financing process and the elimination of cable TV fees from ancillary rental costs.

The forecast for the full year 2024 was adjusted at the end of the quarter to take into account a lower initial conversion ratio in the bulk migration campaigns and stricter capital allocation to sales channels. In addition, the division of the Group into a network and a service company has already been largely finalised, which in turn has led to higher one-off expenses. As a result, the Executive Board expects a decline in revenue and reported EBITDA compared to the previous year and a better development of the liquidity situation than originally planned – primarily due to the optimisation of net working capital and capital allocation/investments.

Links: Tele Columbus

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally