Residential pay TV subscribers up 1.5% YoY in Portugal in 3Q 2024

Friday, December 6th, 2024

Fiber optics is the main form of access to subscription TV

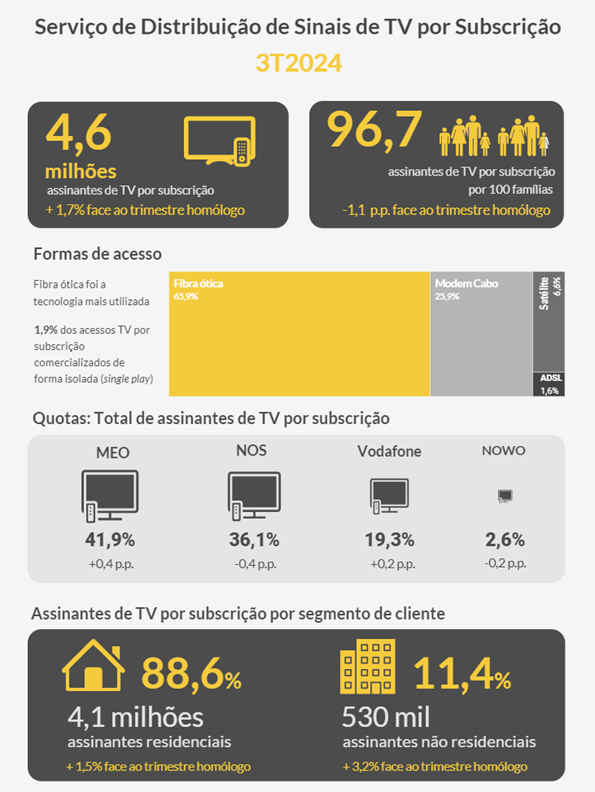

According to Anacom, at the end of the 3rd quarter of 2024, there were 4.6 million subscribers to pay TV in Portugal, 75 thousand more than in the same quarter of the previous year. The growth rate in the number of subscribers has slowed down, recording the lowest annual increase (+1.7%) since 2006.

In the residential segment, pay TV penetration reached 97 per 100 families. The overwhelming majority of pay TV subscribers subscribed to this service as part of a package. In the 3rd quarter of 2024, only 1.9% of pay TV accesses were sold in isolation (single-play).

Fiber (FTTH/B) represented 65.9% of total subscribers, followed by cable TV (25.9%), satellite TV – DTH (6.6%) and ADSL (1.6%).

FTTH was also solely responsible for the growth in the number of pay TV subscribers, with this technology reaching 3.1 million subscribers in this quarter and registering 173 thousand more subscribers compared to the same quarter of the previous year (+6%). This growth resulted not only from the acquisition of new customers, but also from the transfer to FTTH/B of customers who were previously supported by other networks. However, this is the lowest annual growth since the emergence of this technology (in 2007).

At the end of the 3rd quarter of 2024, there were 4.1 million residential subscribers to pay TV, 59 thousand more (+1.5%) than in the same quarter of the previous year, representing 88.6% of the subscriber total.

In the non-residential segment, the number of subscribers totaled 530 thousand, representing 11.4% of the total number of subscribers, registering a growth of 3.2% compared to the same quarter of the previous year.

MEO was the provider with the highest share of pay TV subscribers (41.9%), followed by the NOS Group (36.1%), Vodafone (19.3%) and NOWO (2.6%). MEO and Vodafone were the providers that, in net terms, attracted the most subscribers compared to the same quarter of the previous year, with their shares increasing by 0.4pp and 0.2pp, respectively. On the other hand, the shares of the NOS Group (-0.4 pp) and NOWO (-0.2 pp) decreased.

In the residential segment, MEO and the NOS Group held the highest shares (40.2% and 37.3%, respectively) while in the non-residential segment MEO held more than half of the subscribers (54.8%).

Links: Anacom

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally