China’s appetite for broadband fuels growth in CPE market

Wednesday, September 23rd, 2015

China’s Appetite for Broadband Fuels Growth in CPE Market, Reports IHS

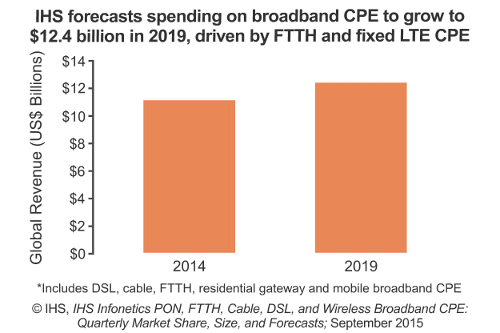

CAMPBELL, Calif. — IHS (NYSE: IHS) raised its outlook for the broadband customer premises equipment (CPE) market, which includes DSL, cable, fiber-to-the-home (FTTH), residential gateways and mobile broadband CPE. In a September report, the firm noted it increased its 2019 worldwide broadband CPE forecast by 8 percent, to US$12.4 billion.

“The primary source for raising our global broadband CPE forecast is the massive investment currently ongoing in China. Despite reported economic headwinds, the Chinese government continues to subsidize telco investments in fiber infrastructure to expand accessibility and throughput. The result is heavy spending on GPON and EPON ONTs,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

“At the same time, the shift from fiber-to-the-building (FTTB) to FTTH architecture is well underway in China. A primary reason for this architectural shift is that FTTB plus ADSL take-rates at China Telecom have been disappointing; consumers aren’t interested in a connection that offers only a marginal improvement over what they already have. If they are to subscribe to a home broadband service, it needs to provide a minimum of 8MB to 10MB speeds,” Heynen said.

BROADBAND CPE MARKET HIGHLIGHTS

- The big story this quarter is FTTH optical network terminals (ONTs) in China, unit shipments of which more than doubled year-over-year, from 9.8 million to over 20 million from 2Q14 to 2Q15

- In 2Q15, the global broadband CPE market grew 5 percent from the previous quarter, to $2.9 billion; unit shipments grew 11 percent, to 61 million

- Worldwide total broadband CPE revenue is up 7 percent from the year-ago second quarter, when it was just under $2.7 billion

- Quarter-over-quarter, from 1Q15 to 2Q15:

- DSL CPE unit shipments were down 1 percent to 23 million, with VDSL IADs posting the highest growth (+11 percent)

- Cable CPE units were up 1 percent to 11.6 million (90% of which were WiFi-enabled), with DOCSIS 3.0 modems posting the highest growth (+13 percent)

- Fixed LTE CPE shipments grew 4 percent

BROADBAND CPE REPORT SYNOPSIS

The quarterly IHS Infonetics PON, FTTH, Cable, DSL, and Wireless Broadband CPE market research report tracks DSL, cable and FTTH CPE; mobile broadband routers; and residential gateways. The research service provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends. Companies tracked include Alcatel-Lucent, Arris Group, AVM, Cisco Systems, Comtrend, D-Link, Dasan Networks, Fiberhome, Hitron, Huawei, Mitsubishi, Netgear, OF Networks, Pace plc, Sagemcom, SMC Networks, Sumitomo, Telsey, Technicolor, TP-Link, Ubee Interactive, Zhone, ZTE, ZyXel, and others.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization