NextGen TV offers clear upside potential according to BIA

Thursday, January 16th, 2020

Sizing Growth Opportunities for NextGen TV in Local Markets: Clear Upside Potential According to BIA Study

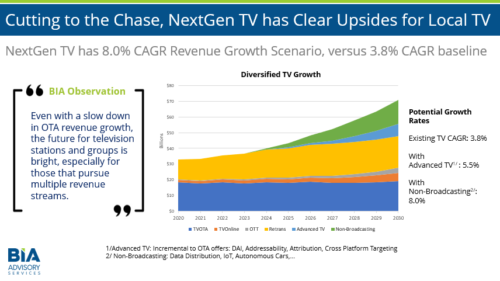

- NextGen TV has 8.0% CAGR Revenue Growth Scenario, versus 3.8% CAGR baseline

CHANTILLY, VA — BIA’s forecast for NextGen TV reveals that local TV Groups stand to increase their revenue growth by 50 percent within the next ten years from NextGen TV rollouts. The potential growth rate with advanced TV has an 8.0 percent CAGR revenue growth opportunity compared to a 3.8 percent CAGR baseline. In addition to Advanced TV, BIA’s forecast examined growth across TV OTA, TV Online, OTT, Retransmission and Non-Broadcasting.

BIA’s Managing Director, Rick Ducey, and BIA’s Chief Economist and SVP, Mark Fratrik, presented BIA’s NextGen TV forecast at SMPTE’s DC Chapter Meeting, “How ATSC 3.0 Will Transform TV, on January 16, 2020.

BIA’s managing director Rick Ducey offered key assertions from the forecast, including, “While a number of questions remain, there are clear upside scenarios for local TV groups investing in NextGen TV. Consumer side revenue business models will take longer to scale, but business and government business models can scale much faster.”

Ducey pointed to the strategic value NextGen TV provides to local TV by creating a capable new form of broadband, wireless, point-to-multipoint, local market distribution.

“Competitive distribution platforms such as 4G/5G mobile and MVPDs are making investments in their capabilities,” said Ducey. “NextGen TV represents an historically significant thrust by local TV broadcasters to establish themselves as an Internet-native, mobile first, advanced TV capable distribution platform.”

BIA’s SVP and Chief Economist Mark Fratrik offered some caution, “Even with the new capabilities NextGen TV provides, traditional linear TV advertising and retransmission will continue to account for the lion’s share of revenues throughout the 2020s.”

The Advanced TV services included in the BIA study focused on both broadcast-only and interactive services requiring an Internet connection from homes, vehicles and mobile devices. Consumer based business models require a longer adoption curve, particularly since the FCC has specified there is no mandatory adoption set for ATSC 3.0 by broadcasters, and roll-out is on a market by market basis. The first significant push by the consumer electronics industry to release NextGen TV receivers came with this month’s Consumer Electronics Show from several leading manufacturers.

BIA’s study featured some strategic takeaways including, “If Data is the New Oil, local TV operators might be forgiven for mistaking their towers for oil rigs; and NextGen TV + Data = high value/high impact business model marrying premium video to targeted audiences.”

Latest News

- Amagi report shows rise of a diverse global FAST marketplace

- Broadpeak to power targeted advertising on new TF1 video service

- AA/WARC reports UK 2023 ad spend at £36.6bn

- FCC restores net neutrality

- Five leading TV stations launch NextGen TV in Portland, Maine

- U.S. digital video ad spend growing ~80% faster than media overall