2014 4K×2K TV shipments to rise dramatically in China

Tuesday, December 24th, 2013

Chinese brands scramble for market share, using 4K×2K TV and competing on price; 4K×2K TV demand limited outside of China

SANTA CLARA, Calif. — Interest in 4K×2K TVs is at a fever pitch as a critical moment is approaching in the market: 4K×2K is transitioning from early adopters to more mainstream consumers. Rapidly falling prices, particularly in China, will fuel adoption.

“As the manufacturers of 4K×2K TV LCD panels and sets expect strong growth in 2014, the supply chain focus on growing demand is rising dramatically,” noted Paul Gagnon, director for global TV research at NPD DisplaySearch. “Panel makers are planning for nearly 27 million 4K×2K TV panels to be produced next year, while brands have somewhat more modest expectations for the end market. There is a significant difference in outlook between China and other regions.”

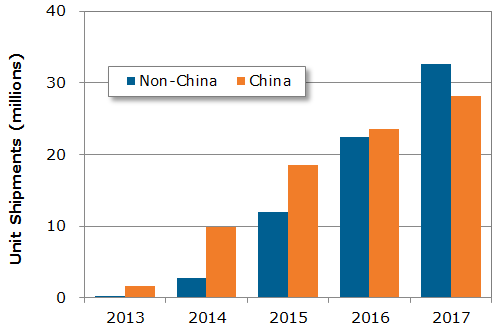

According to the latest NPD DisplaySearch Quarterly Global TV Shipment and Forecast Report – Advanced, 4K×2K TV shipments are expected to total 1.9 million units in 2013, rising to 12.7 million units in 2014. China will have an 87% share of 4K×2K TV units in 2013, dropping only slightly to 78% in 2014. This means that 4K×2K TV shipments within China will lead all other regions combined by a factor of three in 2014. Eventually other regions will catch up, but China will remain the leading region for 4K×2K TV shipments throughout the forecast, enabled by intense competition and very low price points. 4K×2K TV average prices are expected to fall below $1,000 in China during 2014, while the worldwide average remains over $1,100 and close to $2,000 in North America.

Figure 1: 4K×2K LCD and OLED TV Forecast

Source: NPD DisplaySearch Quarterly Global TV Shipment and Forecast Report – Advanced

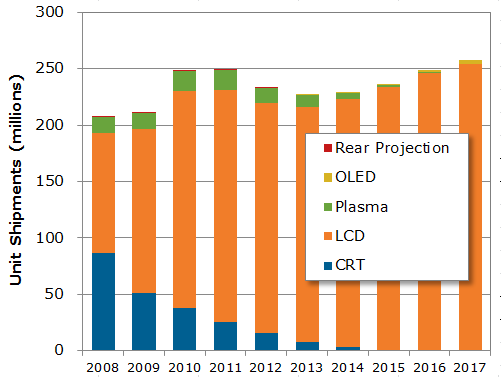

Overall TV demand is expected to fall 3% in 2013, after a 6% decline in 2012. Overall demand in many regions is still affected by the accelerated demand in 2010 and 2011, which pulled in demand from future years. Total TV shipments should grow about 1% in 2014 to 229 million units, with LCD TV shipments rising to 220 million, or 96% of overall units. Plasma and CRT TV shipments are declining rapidly, ending by 2016. “OLED TV technology is not expected to yield significant growth for two to three more years,” Gagnon said. “4K×2K has therefore become a technology focal point in the interim.”

Figure 2: TV Shipment Growth by Technology

Source: NPD DisplaySearch Quarterly Global TV Shipment and Forecast Report – Advanced

The NPD DisplaySearch Q4’13 Quarterly Global TV Shipment and Forecast Report – Advanced, available now, includes panel and TV shipments by region and by size for nearly 60 brands, and also includes rolling 16-quarter forecasts, TV cost/price forecasts, and design wins. This report is delivered in PowerPoint and includes Excel-based data and tables. For more information about the report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, e-mail contact@displaysearch.com or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan for more information.

Latest News

- Larger-sized TVs to drive 8% growth in display area demand

- DASH Industry Forum (DASH-IF) becomes part of the SVTA

- Sky Stream to launch in Germany on July 31st

- Bitcentral ViewNexa integrates Pixalate Analytics

- Canal+ could be listed on the London Stock Exchange

- OKAST and Bouygues Telecom launch app for tourists in France