Digital pay TV revenues rocket in Eastern Europe

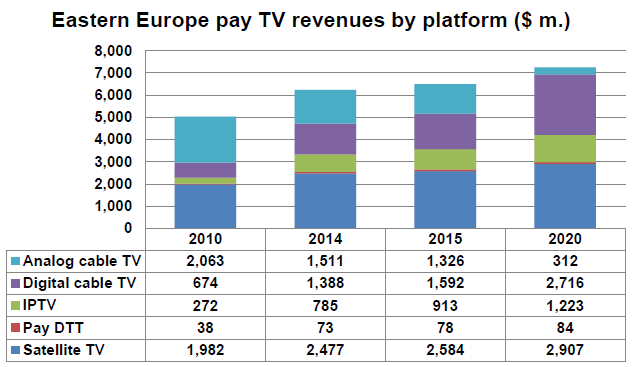

Tuesday, March 31st, 2015Despite the incessant gloomy economic and political news from the region, pay TV revenues in Eastern Europe will be 45% higher in 2020 ($7,269 million) than in 2010 ($5,029 million), according to Digital TV Research. However, the fifth edition of the Digital TV Eastern Europe Forecasts report states that increase will only be 17% between 2014 and 2020 – although this is still an increase of $1 billion.

Digital pay TV revenues will increase by $4 billion between 2010 and 2020 to $7 billion. They will increase by 47% (or $2.2 billion) between 2014 and 2020. Digital cable revenues will more than double between 2014 and 2020, with IPTV up by 56% and pay DTT up by 53%. However, satellite TV revenues (the main earner) will only grow by 17% over the same period.

Source: Digital TV Research Ltd.

The number of digital pay TV subscribers will increase from 25.8 million (20.7% of TV households) in 2010 to 51.0 million (40.0%) in 2014 and onto 76.7 million (59.4%) by 2020.

Simon Murray, Principal Analyst at Digital TV Research, said: “Pay TV analysis in Eastern Europe has long been distorted by the legacy of analog cable. Many homes traditionally received a limited number of channels for a very small fee over analog networks. These subscribers are rapidly converting – mostly to digital cable but also to IPTV, satellite TV and DTT.”

Total cable subscriptions will fall by 8.9 million between 2010 and 2020. Digital cable subs will grow from 4.6 million to 27.6 million, but analog subs will fall from 36.8 million to 4.9 million over the same period. Overall cable penetration will reach a quarter of TV households by 2020, down from a third in 2010.

Cable TV revenues will hardly grow between 2014 and 2020, despite more homes taking the more expensive digital packages. Digital cable TV revenues will more than double to $2.7 billion, with analog cable TV falling from $1.5 billion to $0.3 billion.

Pay TV will be taken by 63.2% of the region’s TV homes in 2020, up from 50.1% at end-2010, but only up from 60.9% at end-2014. This converts to 19.0 million more pay TV subscribers between 2010 and 2020, with Russia supplying about 12.0 million of this total. Pay TV penetration in 2020 will range from 89% in Estonia to only 25% in the Ukraine.

Russia will contribute $2.29 billion (31%) to the pay TV revenues in 2020 – overtaking Poland in 2015. Russia will be responsible for nearly two-thirds of the region’s $1 billion additional pay TV revenues between 2014 and 2020.

At the other end of the scale, Estonia and Slovenia will experience falling pay TV revenues between 2014 and 2020. Furthermore, Bosnia, Hungary, Latvia, Lithuania, Poland, Romania and Slovakia will grow by less than 5%.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally