CCID Consulting: the Sales Revenue of China's IC Market Reached 562.37 Billion Yuan in 2007

Monday, March 10th, 2008BEIJING — CCID Consulting, China’s leading research, consulting and IT outsourcing service provider, and the first Chinese consulting firm listed in Hong Kong (Hong Kong Stock Exchange: HK08235), recently released its report on China’s IC market.

China’s IC market in 2007

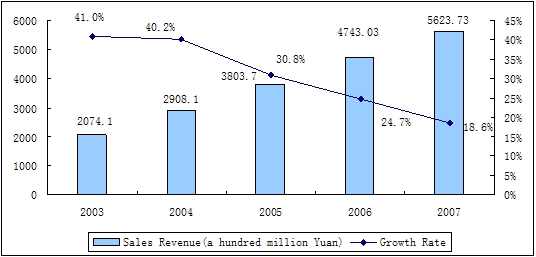

Sales revenue of China’s IC market reached 562.37 billion Yuan in 2007, up 28.6% over 2006. The market still maintained a high growth rate, but negative growth rates have been recorded for four consecutive years.

2007 has the lowest growth rate of China’s IC market in the past five years. With the increase of market cardinal number, growth rates gradually decreased as the growth rates of many complete machines became saturated. The high growth rate of China’s IC market depended on the high increase of complete machines’ output downstream. After many years of rapid development, output of China’s downstream complete machines began to reduce, with saturation of complete machines in many fields, some products even showed a slowdown trend. As for application, none except the auto electronics fields showed remarkable growth rates. However, the market share of auto electronics is too small to drive an overall increase in the whole market.

Figure 1. Sales revenues and growth rates of China’s IC market, 2003-2007

Source: Jan 2008, CCID Consulting

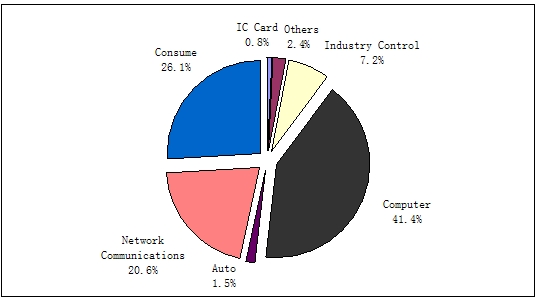

Computer, consumption, network communications accounted for nearly 90% of China’s IC market

Three major fields –computer, consumption and network communications accounted for 88.1% of China’s IC market in 2007. The market share of computer products is the biggest. Although the output of printers has reduced, with rapid development in notebook, China’s computer IC market developed rapidly in 2007 and with a growth rate of over 20%. In the network communications IC market, demand for mobile phones and other products drove communications products up, reviewed by a growth rate of 19.2%. With a decrease in complete machines output, the growth rate of consumer IC market was 15.6%. Noticeably, although the growth auto electronics market reviewed a slowdown trend, the growth rate was 38.2% in 2007.

Figure 2. The application structure of China’s IC market in 2007

Source: Jan 2008, CCID Consulting

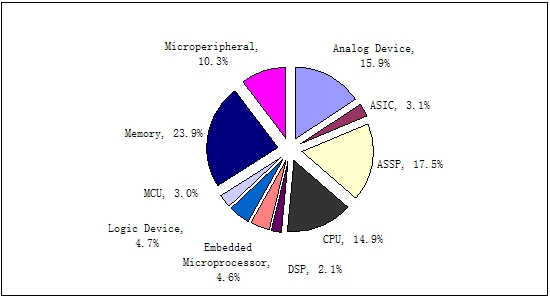

The market share of memory remained largest, with the upward trend of analog IC slowed down

As for product structure, memory accounted for the biggest share. Although prices of memory products showed huge fluctuations, driven by NAND Flash and DRAM, this situation had been changed. The NAND Flash’s market remained normal, but as supply exceeds demand for DRAM products, DRAM products showed a sharp fall in price in 2007. CPU and embedded processor maintained higher growth rates. Affected by price reductions and waning demands, the growth rate of analog IC slowed down.

Figure 3. The product structure of China’s IC market

Source: Jan 2008, CCID Consulting

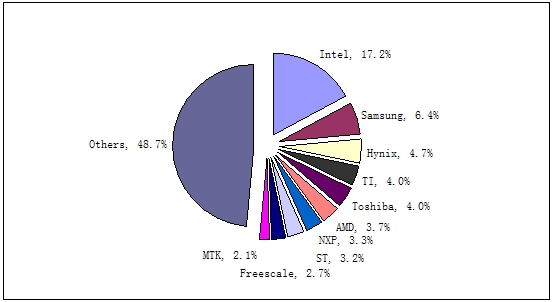

Competition pattern steady with MTK entered top ten

There were no change to the top four manufacturers positions in China’s IC market. Intel still accounted for the largest market share. Although affected by reduction in prices for DRAM products, Samsung and Hynix performed well. Affected by price reductions in analog IC, the growth rate of TI slowed down. Attributed to better presentation on flash memory and consumption market, Toshiba instead of AMD ranked the fifth. Because AMD was in an inferior position in its competitions with Intel, AMD’s market share reduced. With a better presentation in the mobile phone platform, MTK successfully entered China’s top ten enterprises. Affected by price reductions in DRAM, Qimonda was out of China’s top ten enterprises in 2007.

Figure 4. The brand structure of China’s IC market

Source: Jan 2008, CCID Consulting

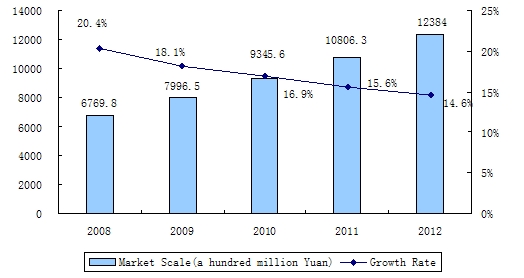

Market growth to slow down in the next five years; market scale to exceed one trillion in 2011

With a slowdown in production capacity transfer and the growth rate of complete products output gradually decreasing, China’s IC market has continuously decreased. However, China’s IC market will meet its peak in 2008 and the growth rate will exceed last year. The major reasons include 2008 Olympics, the application of digital TV and 3G. However, the cardinal numbers of complete machine’s output and IC market will stay at high level which suggest a trend towards saturation. Therefore, the growth rate of China’s IC market will slow down in the future.

Figure 5. Forecast of scale and growth rate of China’s IC market, 2008- 2012

Source: Jan 2008, CCID Consulting

Although the growth rate of China’s IC market will slowdown, it is still an important force int the global market in the next five years. It is forecasted that the compound growth rate of China’s IC market will reach 16.2% in the next five years. The scale of China’s IC market will reach 1.0806 trillion Yuan in 2011.

Latest News

- Larger-sized TVs to drive 8% growth in display area demand

- DASH Industry Forum (DASH-IF) becomes part of the SVTA

- Sky Stream to launch in Germany on July 31st

- Bitcentral ViewNexa integrates Pixalate Analytics

- Canal+ could be listed on the London Stock Exchange

- OKAST and Bouygues Telecom launch app for tourists in France