Four companies control half of Western Europe’s pay TV subs

Thursday, September 22nd, 2016The 73 top operators collectively accounted for 93% of Western Europe’s pay TV subscribers by end-2015. Despite adding 7 million subscribers to take their total to 97.26 million, this proportion will fall slightly – to 92% – of the region’s 105 million pay TV subscribers by 2021. Liberty Global, Sky Europe, Vodafone and Altice will jointly continue to account for half the region’s pay TV subs.

Source: Digital TV Research. Note: 21 of the 24 cable platforms are both analog and digital and three are digital only.

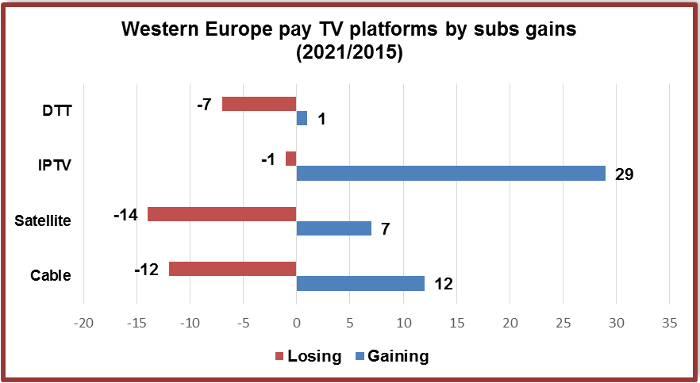

Covering 104 platforms across 17 countries in the Western Europe Pay TV Operator Forecasts report, 29 of the 30 IPTV platforms will gain subscribers between 2015 and 2021. However, 14 of the 21 satellite platforms and seven of the eight DTT operators will lose subscribers during the same period. Perhaps surprising considering the fall-off from the analog transition is that half of the cable platforms will gain subs.

Top five multinational pay TV operators by subscribers (000)

Operator 2015 Operator 2021 --------------------------- ------ --------------------------- ------ Liberty Global 18,542 Liberty Global 17,396 Sky Europe (satellite only) 16,938 Sky Europe (satellite only) 17,292 Vodafone 8,691 Vodafone 9,021 Altice 4,629 Altice 5,546 Telefonica 3,541 Telefonica 4,769

Source: Digital TV Research

With operations in eight Western European countries, Liberty Global is the region’s largest operator by pay TV subs. Counting only its satellite TV subs, Sky Europe (with operations in five countries) is rapidly closing the gap. Liberty Global will lose 1.15 million subs (mostly analog ones) between 2015 and 2021 whereas Telefónica will gain 1.23 million and Altice nearly 1 million.

The 73 top operators generated 93% of Western Europe’s $30.61 billion pay TV subscription and PPV revenues in 2015. This proportion will hold steady until 2021, although overall revenues will not grow. Liberty Global and Sky Europe will together continue to take just under half of the region’s revenues.

For more information on the Western Europe Pay TV Operator Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally