Sub-Saharan Africa pay TV thrives despite falling prices

Monday, January 16th, 2017Most of the main pay TV operators in Sub-Saharan Africa lowered their prices during 2016 to ward off competitors. The knock-on effect was that other platforms lowered their fees.

Simon Murray, Principal Analyst at Digital TV Research, said: “With a limited number of DTT licenses on offer, StarTimes is focusing more on its satellite TV operations, which is disrupting the sector. StarSat is much cheaper than DStv and Canal Plus and not that much more expensive than pay DTT.”

Source: Digital TV Research

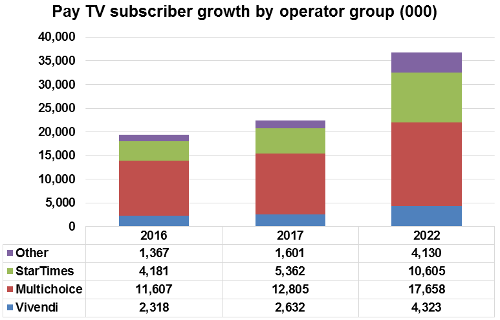

The Sub-Saharan Africa Pay TV Forecasts report estimates that three groups will continue to account for 90% of Sub-Saharan Africa’s pay TV subscribers.

Multichoice had 11.61 million subscribers across satellite TV platform DStv and DTT platform GOtv by end-2016, which will grow to 17.66 million by 2022. Vivendi had 2.32 million subs to its Canal Plus satellite TV platform and Easy TV by end-2016; climbing by 2 million to 4.32 million by 2022.

However, StarTimes/StarSat will enjoy the most impressive growth: from 4.18 million subscribers at end-2016 to 10.61 million by 2022 – only 1 million behind Multichoice. Much of this growth will be achieved from satellite TV subscribers in new countries.

From the 19.47 million pay TV subscribers across 35 countries at end-2016, 12.14 million were satellite TV and 6.76 million pay DTT. The pay total will nearly double to 36.72 million by 2022, with satellite TV contributing 18.36 million and pay DTT 15.84 million.

South Africa supplied 6.39 million of the 2016 total pay TV subscribers, which will grow to 9.14 million by 2022. Nigeria will close in on South Africa; increasing by 4 million from 4.46 million in 2016 to 8.45 million in 2022.

Sub-Saharan pay TV revenues will reach $6.59 billion in 2022, up from $4.20 billion in 2016 and $1.65 billion in 2010. South Africa and Nigeria will contribute nearly half of the region’s pay TV revenues by 2022.

Satellite TV accounted for 87% of the 2016 pay TV revenues, but this proportion will fall to 78% by 2022. By contrast, pay DTT will climb from 11% of the total in 2016 to 18% by 2022 – or from $467 million to $1,156 million.

For more information on the Sub-Saharan Africa Pay TV Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally