Eastern Europe to lose 1 million pay TV subs

Monday, April 10th, 2017Tough times continue in Eastern Europe, with poor job prospects forcing many to seek work abroad. This migration married with low birth rates mean that populations will fall in 15 of the 22 countries covered in the Eastern Europe Pay TV Forecasts report between 2016 and 2022.

Simon Murray, Principal Analyst at Digital TV Research, said: “There will be a knock-on effect for the TV sector. The number of TV households will fall in 18 countries between 2016 and 2022 – with the region’s total declining by almost 2 million. Pay TV will struggle, losing 1 million subscribers over the same period.”

Source: Digital TV Research Ltd

Murray continued: “Eastern Europe is slowly ridding itself of the legacy of analog cable TV. Belated DTT launches in some countries have resulted in some analog cable TV laggards converting to FTA DTT rather than the (more expensive) digital pay TV platforms.”

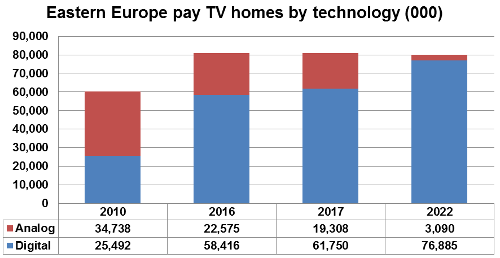

The number of digital pay TV subscribers will increase from 25 million (20.2% of TV households) in 2010 to 58 million (45.8%) in 2016 and onto 77 million (61.0%) by 2022.

2017 will be the peak year for pay TV in Eastern Europe. Analog cable represented 28% of the 81 million pay TV subscribers at end-2016, so some of these 23 million subscribers will choose to convert to FTA DTT rather than to a digital pay platform.

Russia will account for nearly half of the region’s pay TV subscribers in 2022. However, the number of pay TV subs will fall in 10 countries between 2016 and 2022.

Pay TV revenues in Eastern Europe will peak at $6.11 billion in 2017 before settling at the $6 billion mark. Analog cable will contribute $1 billion to the 2017 total, falling to $184 million in 2022.

Russia’s low pay TV fees for analog cable subscribers was continued by most satellite TV platforms. This means that Poland generates higher pay TV revenues than Russia, despite having far fewer subscribers.

Pay TV revenues will fall in half of the 22 countries between 2016 and 2022. Revenues for market leader Poland will be lower in 2022 than they were in 2010.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally