Pay TV spending spree in Middle East and North Africa

Tuesday, April 11th, 2017

Pay TV Spending Spree in Middle East and North Africa, IHS Markit Says

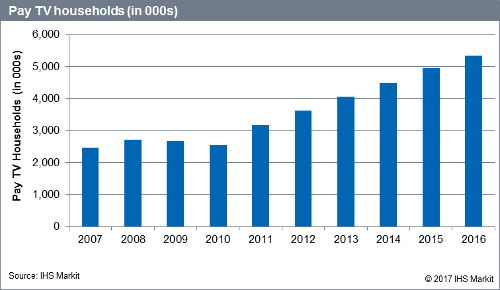

- For the first time, pay TV households topped five million mark; Region is among fastest growing globally

LONDON — The pay TV market in the Middle East and North Africa saw record growth in 2016 despite harsh economic conditions, according to new analysis released by IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

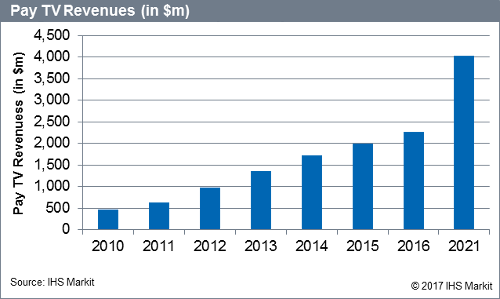

Pay TV households topped the five million mark for the first time in the region’s history, growing 8 percent year-on-year. Revenues rose 15 percent to $2.27 billion, double digit growth year-on-year.

“The Middle East and North Africa region is one of the fastest growing regions for pay TV, in both subscriber numbers and revenues,” said Constantinos Papavassilopoulos, senior analyst at IHS Markit. “The launch of services such as Netflix and Amazon Prime is fueling the market and is a good sign for further growth.”

IHS Markit expects that growth will continue, with pay TV homes reaching seven million in 2021. Revenues will almost double to $4.03 billion in 2021.

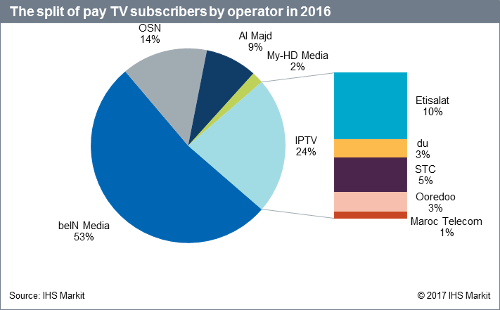

Two satellite operators, beIN Media Group and OSN, dominate the market controlling over 60 percent of subscribers and over 55 percent of revenues for the last seven years. 2016 marks the first full year that beIN Media Group and OSN competed directly against each other.

Subscription services will drive growth

Total online video market revenues in the Middle East and North Africa region stood at $500 million in 2016, a year-on-year growth of 51 percent from 2015.

Advertising remains the most successful business model for monetising online video – representing over 65 percent of total revenue in 2016. “The prevalence of advertising is corroborated by YouTube’s huge appeal in the region,” Papavassilopoulos said. “Countries such as Saudi Arabia are second only to the US in terms of time spent per person watching videos on YouTube.”

However, IHS Markit forecasts that the subscription business model will gain ground in the Middle East and North Africa region at the expense of advertising, with almost half of total online video revenues coming from online subscription services by 2020.

Going forward, subscription video will drive revenue growth. “Subscription services in the region saw 137 percent growth in 2016, spurred by the launch of Netflix and strong performance from local players,” Papavassilopoulos said. Subscription accounted for over 30 percent of the total online video market in 2016, and is expected to contribute 45 percent of total market revenues by 2020.

IHS Markit expects total online video revenues to grow by more than $1.5 billion by 2020.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally