Western Europe exceeds 100 million pay TV subscribers

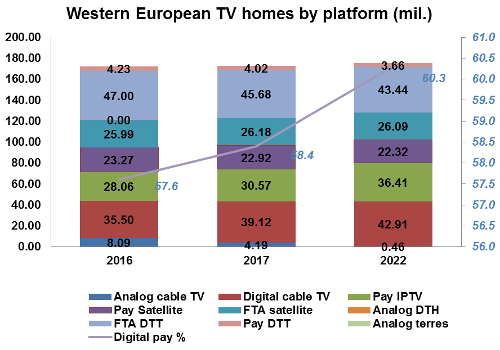

Tuesday, May 2nd, 2017Western Europe will avoid the curse of cord-cutting – at least for the next five years, according to the Western Europe Pay TV Forecasts report. The Western European pay TV market is mature, but, unlike North America, it will still gain subscribers between 2016 and 2022. Although this only represents a 6.7% increase, it means nearly 7 million more subs to take the total to 106 million. Western Europe will cross the 100 million pay TV subs mark in June this year.

Source: Digital TV Research

Simon Murray, Principal Analyst at Digital TV Research, said: “Better news is that the number of digital pay TV subscribers will increase by 15.6% (14 million) over the same period. Analog cable subs will fall from 8.0 million in 2016 to 0.5 million in 2022.”

Much of the subscriber growth will come from countries with traditionally low pay TV penetration: Two-thirds of the region’s net additions will come from Italy (up by 1.47 million or 20% between 2016 and 2022), Spain (up by 1.36 million or 23%) and France (up 1.41 million or 11%). However, subscriber growth will be lower than 3% for eight of the 18 countries covered in the report.

IPTV will add more than 8 million subscribers between 2016 and 2022, but pay satellite TV will lose nearly 1 million subs. Digital cable TV will gain 7.4 million subs, but analog cable will shed almost exactly the same number. Pay DTT will drop by 567,000 subscribers.

Despite the number of pay TV homes increasing, pay TV revenues will remain flat at around $28 billion. Satellite TV will remain the most lucrative pay TV platform, but its revenues will decline by nearly $1 billion between 2016 and 2022. Mirroring its subscriber increases, IPTV revenues will climb by 27.6% between 2016 and 2022 to $5.87 billion – or up by $1.27 billion. Digital cable TV revenues will grow by $0.71 billion, but analog cable revenues will decline by $1.13 billion.

Liberty Global, Sky and Vodafone will together account for 42% of the region’s pay TV subscribers by 2022. The same companies will take 53% of pay TV revenues.

For more information on the Western Europe Pay TV Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally