Western Europe to reach 65 million SVOD subscribers

Thursday, September 21st, 2017Western European SVOD revenues will increase to $6.5 billion by 2022, up from $2.8 billion in 2016. SVOD [subscription video on-demand] became the region’s largest OTT revenue source in 2016 by overtaking AVOD. SVOD’s share of OTT revenues will continue to grow, according to the Western Europe OTT TV & Video Forecasts report.

OTT TV episode and movie revenues for 18 Western European countries will reach $14.65 billion in 2022; more than double the $6.90 billion recorded in 2016. Revenues are expected to climb by $1.69 billion in 2017 alone.

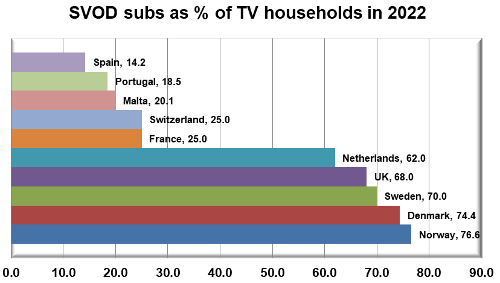

Source: Digital TV Research. Note: This chart only shows the top and bottom five countries. The report covers 18 countries.

Digital TV Research forecasts 65.07 million SVOD subscribers by 2022, up from 33.96 million by end-2016. About 10.69 million subscribers were added in 2017.

Simon Murray, Principal Analyst at Digital TV Research, explained: “These are gross SVOD subscriptions where one household can pay for more than one platform. Multiple SVOD subscriptions are already popular in Scandinavia and the UK.”

He continued: “However, SVOD subscriber growth will be much more modest in countries such as France, Italy and Spain. In fact, Sweden will have more SVOD subscribers than Spain in 2022, despite only having a quarter of the population.”

By 2022, 37.1% of Western European TV households will subscribe to an SVOD platform; up from 19.7% at end-2016. This means that Germany, Italy, France and Spain will all still be under the regional average by 2022.

With a rare and ill-advised attempt at humor, Murray continued: “SVOD penetration is higher the further North that you travel. This has nothing to do with the weather or beer-drinking countries versus wine-drinking ones. Penetration will be particularly high in the Scandinavian countries, which have high pay TV, broadband and smartphone penetration. There are also plenty of platforms on offer.”

Netflix will remain the largest pan-regional SVOD platform by some distance, with an expected 29.61 million paying subscribers in 2022 – or 46% of the region’s total (down from a 55% share in 2016). Amazon Prime Video will be the second largest platform by 2022, with 15 million paying subscribers.

For more information on the Western Europe OTT TV & Video Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally