Amazon dominates U.S. Direct-to-Consumer TV network subscriptions

Wednesday, May 16th, 2018

Amazon Dominates Direct-to-Consumer TV Network Subscriptions

- Prime Channels Accounts for 55% of All DTC A La Carte Purchases

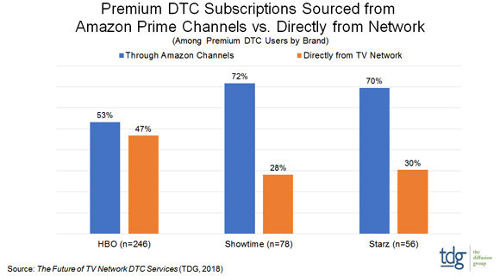

PLANO, Texas — New research from The Diffusion Group (TDG) finds that Amazon Prime Channels accounts for more than half of all direct-to-consumer subscriptions. Its dominance is especially prominent among premium DTC apps including HBO, Showtime, and Starz.

More than half (53%) of HBO DTC subscribers used Amazon Prime Channels to purchase their service. Rates are even higher for Showtime and Starz, with seven-in-ten DTC subscribers using Prime Channels, and only three-in-ten using the TV network’s website or app.

“While Amazon Prime Video continues to receive the lion’s share of attention from industry media, Amazon has quietly built a stronghold in the burgeoning direct-to-consumer market,” notes Michael Greeson, President of TDG. “Even with Apple’s pending entry into this space, we expect this dominance to expand further in the next five years.”

According to recent reports, Apple plans to launch a new feature in its TV app that, instead of pushing interested viewers to download and purchase individual network apps from the App Store, will sell a la carte DTC apps directly to consumers. Put simply, Apple plans to mimic Amazon Prime Channels by allowing Apple users the opportunity to subscribe to third-party streaming services from within the TV app now included on Apple TV set-top boxes, iPhones, and iPads.

Amazon gets a slice of subscription revenue from DTC sales and owns the consumer relationship, while the broadcast partner shoulders the costs of hosting, streaming, and customer support. If Apple can repeat this formula, notes Greeson, it could be successful, especially given that TV Network DTC subscriptions will increase four-fold in the next five years.

“And Apple would have a key advantage over Amazon Channels: it would not require a $120/year membership before one can aggregate a la carte purchases through its TV app.”

The research featured is from TDG’s The Future of Direct-to-Consumer Video Services – Analysis & Forecasts, 2018-2022, the most thorough analysis of this emerging space available for public purchase.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally