Mediavision: Nordic AVOD viewing growing, local players gaining share

Thursday, January 31st, 2019A lot has been said on the development of SVOD, with international giants like NFLX and HBO fueling the growth. But just as important is the transformation of the ad market. AVOD (ad-based video on-demand) is currently capturing approximately a quarter of the Nordic video ad market (broadcast + web TV) revenue. Likely, we will see a significant increase of online video advertising in the coming years, mirroring the shift of consumption.

AVOD viewing across the Nordics has grown considerably over the last couple of years. Incumbent actors, both broadcasters and other traditional media companies, are contributing through their ad-funded offerings. With increased freedom of choice, great content libraries and fewer minutes of advertising, this migration of consumers is likely to continue – unless the actors themselves decide to move in another direction.

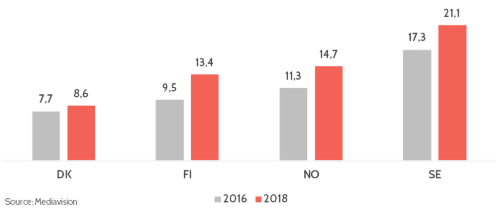

AVOD viewing has grown notably between 2016 and 2018, specifically so in Sweden, Norway and Finland.

Much like the SVOD market, the American giants take a considerable share also in AVOD. For the full year of 2018, Youtube’s viewing share in the Nordics is close to 60%. But local actors are finding their footing too. In a recent press release, Bonnier Broadcasting concluded that TV4 Play reached 4.7 million registered users during 2018. Late 2018 figures from Nent Group reveal that Viafree now reaches one million registered users in Sweden after introducing mandatory log-ins in August. A majority of the Nordic media companies are currently making a push in the AVOD direction. Ad revenues will be adjusted accordingly. In Sweden for example, IRM estimates that AVOD revenues are to grow +20% YOY during 2018. As a comparison, traditional ad revenues (broadcast) are estimated to grow +8% 2018.

Also outside of the Nordics there are signs of an AVOD upswing. For example, in its recently published Q4 report, Hulu presented a record-breaking advertising revenue (+45% YOY) – equaling +$1.5 billion. And Amazon recently launched an ad-based TV streaming service (“Free Dive”) in the US through its IMDb brand. Viacom last week announced a $340 million acquisition of the free video streaming service Pluto TV.

To conclude, the interest in the ad-supported segment of online video is clearly on the rise.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally