A divided picture for pay TV subscriptions globally

Tuesday, June 1st, 2021Global pay TV fragments

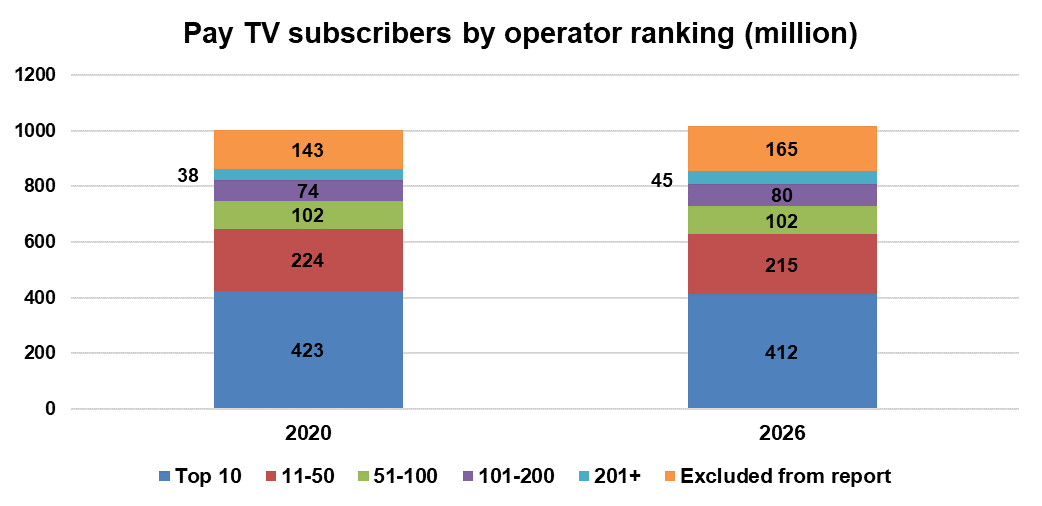

The top 503 pay TV operators will reach 853 million subscribers from the 1.02 billion global total by 2026. The top 50 operators accounted for 64% of the world’s pay TV subscribers by end-2020, with this proportion dropping to 62% by 2026.

The top 50 will lose 20 million subscribers over the next five years. However, operators beyond the top 100 will gain subscribers over the same period.

Simon Murray, Principal Analyst at Digital TV Research, said: “Most industries consolidate as they mature. The pay TV sector is doing the opposite – fragmenting. Most of the subscriber growth will take place in developing countries where operators are not controlled by larger corporations.”

By end-2020, 13 operators had more than 10 million pay TV subscribers. China and India will continue to dominate the top pay TV operator rankings, partly as their subscriber bases climb but also due to the US operators losing subscribers.

Between 2020 and 2026, 307 of the 503 operators (61%) will gain subscribers, with 13 showing no change and 183 losing subscribers (36%).

In 2020, 28 pay TV operators earned more than $1 billion in revenues, but this will drop to 24 operators by 2026.

The Global Pay TV Operator Forecasts report covers 503 operators with 726 platforms [132 digital cable, 116 analog cable, 279 satellite, 142 IPTV and 57 DTT] across 135 countries.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally