UK Video Connected Devices to Grow 74% in 2012 to 24 Million

Wednesday, June 27th, 2012

LONDON, UK — The United Kingdom is Western Europe’s leading market for connected devices, with an estimated 13.8 million devices receiving over-the-top video content at end-2011, a figure up 114.1% year-over-year from 2010, according to SNL Kagan research.

In 2011, U.K. households averaged 0.51 connected devices per home, up from 0.24 in 2010. SNL Kagan estimates the U.K. connected device population will nearly double in 2012 to 24.0 million before growing to 122.7 million by the end of 2017, a 44.0% 2011-2017 compound annual growth rate. By 2017, SNL Kagan estimates there will be an average of 4.45 connected devices for each U.K. home, the highest among the five major markets of Western Europe. The connected device forecast includes game consoles, smart TVs and Blu-ray players, standalone set-top boxes, PCs networked to TVs and tablets.

In 2011, U.K. households averaged 0.51 connected devices per home, up from 0.24 in 2010. SNL Kagan estimates the U.K. connected device population will nearly double in 2012 to 24.0 million before growing to 122.7 million by the end of 2017, a 44.0% 2011-2017 compound annual growth rate. By 2017, SNL Kagan estimates there will be an average of 4.45 connected devices for each U.K. home, the highest among the five major markets of Western Europe. The connected device forecast includes game consoles, smart TVs and Blu-ray players, standalone set-top boxes, PCs networked to TVs and tablets.

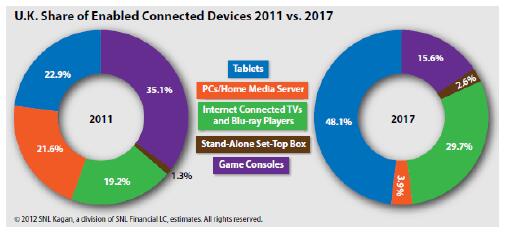

SNL Kagan analysis indicates the most heavily adopted connected device type in the U.K. is the game console, of which 4.8 million received OTT content at end 2011. Consoles were followed by tablets at 3.1 million, PC media servers at 3.0 million, connected TV/Blu-ray players at 2.6 million and standalone set-top boxes at 172,000.  By 2017, SNL Kagan projects tablets and connected TVs will make up a substantial portion of the market as television sets with Internet capabilities become the norm. By 2017, tablets are forecast to account for 48.1% of all active connected devices in the U.K., surpassing smart TVs and game consoles in 2012 thanks to iPad and Android growth plus adoption of Amazon’s Kindle Fire.

By 2017, SNL Kagan projects tablets and connected TVs will make up a substantial portion of the market as television sets with Internet capabilities become the norm. By 2017, tablets are forecast to account for 48.1% of all active connected devices in the U.K., surpassing smart TVs and game consoles in 2012 thanks to iPad and Android growth plus adoption of Amazon’s Kindle Fire.

“The U.K.’s mass market is well-primed for multiplatform video consumption, with higher broadband speeds, affordable services and a growing availability of quality content,” says Mohammed Hamza, SNL Kagan analyst for Western Europe. “We’re seeing a range of OTT service innovations in the U.K., as Now TV from Sky, BBC iPlayer, Virgin Media Online Movies, Netflix and LoveFilm aggressively evolve their products to maintain competitive viability.”

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization