Subscriber numbers to fall for 40 of Europe's Pay TV operators

Wednesday, October 8th, 2014Pay TV revenues to fall for half of Europe’s top operators

BSkyB’s proposed acquisition of 21st Century Fox’s stakes in Sky Deutschland and Sky Italia will create a pay TV operation that will rival Liberty Global in subscriber terms. However, with limited pay TV subscriber expansion possible for their existing assets, both companies will not want to stop there.

BSkyB has many plans encourage German and Italian subscribers to take up value-added services. Liberty Global is doing the same – including the conversion of its analog cable subscribers.

Beyond this, the number of takeover targets is diminishing due to several recent high profile acquisitions– including approval for Liberty Global to buy Ziggo. Vodafone has upped its activity in the fixed environment, such as the purchases of Kabel Deutschland and Spain’s Ono.

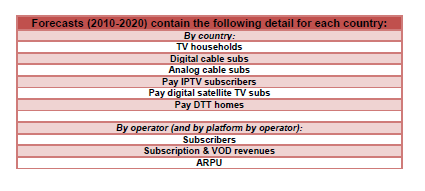

Covering 103 operators in 26 countries that represent 84% of subscribers, the European Pay TV Operator Forecasts report reveals how well the major players will perform – and shows which operators are the most attractive acquisition targets.

Covering 103 operators in 26 countries that represent 84% of subscribers, the European Pay TV Operator Forecasts report reveals how well the major players will perform – and shows which operators are the most attractive acquisition targets.

The report from Digital TV Research forecasts that subscriber numbers will fall for 40 of these operators between 2013 and 2020, due to greater competition (including online TV & video) and analog cable subscribers defecting to (often cheaper) digital platforms.

On the other hand, Russian satellite TV platform Tricolor will gain 3.8 million subscribers between 2013 and 2020. Subscriptions will more than double for six operators (Telecom Italia, Spain’s Telefonica, Bulgaria’s Vivacom, the UK’s TalkTalk, Greece’s OTE and Russia’s Vimpelcom) between 2013 and 2020.

Total subscription and VOD revenues for the 103 operators increased from $33.7 billion in 2010 to $35.8 billion in 2013. However, the total will only grow to $36.2 billion by 2020. These operators accounted for 91% of European pay TV revenues in 2013.

Subscription and VOD revenues will fall for 50 of the 103 operators (49%) between 2013 and 2020, including six of the top 10 operators. These revenues are for subscriptions and VOD only, and therefore do not include other revenues such as broadband, telephony, advertising, equipment sales and rental, etc.

BSkyB will remain at the top of the league, recording $6.44 billion subscription and VOD revenues by 2020. Liberty Global closed the gap on BSkyB considerably with the acquisition of Virgin Media.

However, these two companies will be among the highest revenue losers, although France’s CanalSat will lose the most ($355 million) between 2013 and 2020. The largest gainers will be Sky Deutschland, Kabel Deutschland and Sky Italia. Revenues will more than double for Telecom Italia, Bulgaria’s Vivacom, Greece’s OTE and Hungary’s MinDig.

More: European Pay TV Operator Forecasts

Links: Market Research Store

Latest News

- Amagi report shows rise of a diverse global FAST marketplace

- Broadpeak to power targeted advertising on new TF1 video service

- AA/WARC reports UK 2023 ad spend at £36.6bn

- FCC restores net neutrality

- Five leading TV stations launch NextGen TV in Portland, Maine

- U.S. digital video ad spend growing ~80% faster than media overall