Potential U.S. broadband cord-cutters watch over six hours of mobile video per week

Monday, July 1st, 2019

Potential broadband cord-cutters watch more than six hours of mobile video per week

- Research examines use of data-intensive entertainment services among potential broadband cord cutters

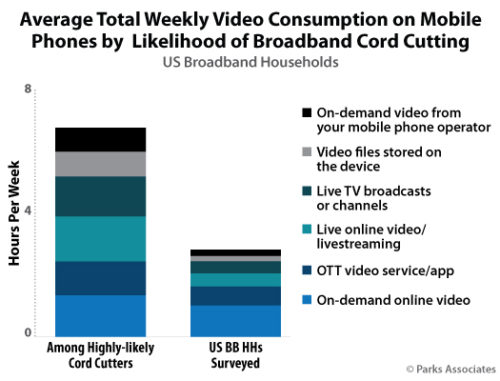

DALLAS — New research from Parks Associates shows US broadband households highly likely to cut the cord in the next 12 months watch more than six hours of video content on their mobile phone a week, compared to 2.5 hours among all US broadband households. Examining Broadband Cord Cutters notes that fixed broadband providers that do not offer mobile services are particularly susceptible to cord-cutting among their current subscribers. These market trends drove US cable operators Comcast and Charter to introduce mobile services as a way to extend their service-based product portfolios.

“Roughly 10% of broadband subscribers are likely broadband cord-cutters, with half of them highly likely to make the change in the next 12 months,” said Brett Sappington, Senior Research Director and Principal Analyst, Parks Associates. “Many are satisfied with their current provider overall, but these subscribers are aware of the other options available to them and could become actual cord-cutters if their current service does not continually meet their needs.”

The research notes that two-thirds of broadband households currently subscribe to a cable internet service, three in ten subscribe to DSL or fiber optic, and one-third use mobile data services. Verizon, AT&T, and Frontier are the largest providers of DSL and fiber-based fixed-line services.

“Potential broadband cord-cutters rely on their mobile devices for entertainment,” Sappington said. “They are significantly more likely to watch live video content via mobile, including live TV broadcasts and livestreaming, averaging an hour more per week each compared to average broadband households. As 5G mobile and 10G fixed broadband services start to deploy, the substantial performance improvements will be attractive to this segment of subscribers, which will drive many providers to match these offerings in order to achieve parity in competition and messaging.”

Examining Broadband Cord Cutters addresses the intent among existing broadband subscribers to disconnect their fixed broadband service and go with alternatives instead. It also identifies characteristics of potential broadband cord-cutters and examines their adoption and use of data-intensive entertainment services.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization