U.S.-China trade dispute makes Roku top Smart TV OS in North America

Wednesday, July 24th, 2019

U.S.-China trade dispute makes Roku the top smart-TV operating system in North America

In an unintended consequence of the U.S.-China trade dispute, the North American television market has increased its adoption of smart TVs—particularly those based on the Roku TV operating system (OS).

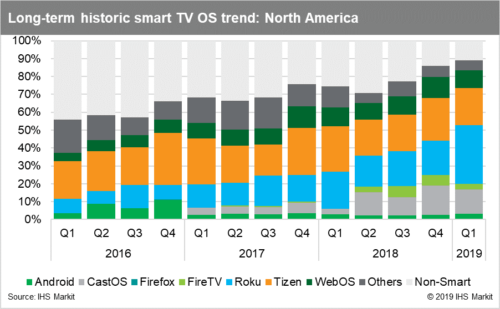

Smart TVs in the first quarter of 2019 accounted for 89 percent of television shipments into North America, a record high for the region. This represents a significant increase from 75 percent during the first quarter of 2018.

Shipments of Roku-based sets represented 37 percent of the total North American smart TV market in the first quarter, up from 23 percent in the fourth quarter. This made Roku the top smart TV OS in the region in a given quarter for the first time since 2017. Roku’s North American market share stands out sharply compared to other regions, given that the OS holds only an 8 percent share of smart TV shipments worldwide.

Ironically, U.S.-based Roku’s achievement is tied to the success of Chinese television makers—companies that are among the targets of U.S. tariffs.

“Fears of increased tariffs arising from the U.S.-China trade dispute spurred TCL and other TV brands reliant on Chinese manufacturing to increase shipments to North America in early 2019,” said Paul Gray, research director at IHS Markit. “These companies hoped to build safety stocks and generate as much sales volume as possible before pricing was impacted by the tariffs. This strategy boosted sales of Chinese-made smart TVs during the quarter.”

Chinese smart TVs make extensive use of the Roku OS, in contrast to more established brand names, which often employ their own operating systems.

“The boom in Chinese TV sales put Roku at the top of the North American market for the first time since the third quarter of 2017,” Grey said. “Roku outstripped Samsung’s Tizen and LG’s webOS because of the popularity of the low-priced Chinese smart TVs. In turn, Chinese TV prices dropped due to the unforeseen consequences of the tariff threats, leading to a short plunge in pricing.”

Overall, smart TVs have moved to center stage in the global television business. Xiaomi now leads TV shipments in China based of its internet services. Meanwhile, Samsung is increasingly building seamless Tizen apps that work with local pay TV services in Europe. These valuable features mean that for most consumers buying a non-smart TV is inconceivable.

As a result, IHS Markit has boosted its smart TV forecast. Smart TV shipments in all regions are expected to exceed 60 percent of total television shipments in 2023. In North America, Western and Eastern Europe, China and Latin America, smart TVs are forecast to rise to more than 85 percent of shipments in 2023.

About the IHS Markit TV Design & Features Tracker

The IHS Markit TV Design & Features Tracker offers extensive analysis of the trends driving today’s TV set market. This report looks inside the TV box, analyzing every key video and display component within every major brand TV. The product planner’s guide to the constantly evolving TV market, this report links broadcasting standards, display technology and TV-set characteristics into a single report.

Latest News

- Amagi report shows rise of a diverse global FAST marketplace

- Broadpeak to power targeted advertising on new TF1 video service

- AA/WARC reports UK 2023 ad spend at £36.6bn

- FCC restores net neutrality

- Five leading TV stations launch NextGen TV in Portland, Maine

- U.S. digital video ad spend growing ~80% faster than media overall