Netflix on pay TV benefits operator business

Friday, February 12th, 2016

Netflix on Pay TV Benefits Operator Business, IHS Survey Finds

- No meaningful revenue-generating opportunity in working with Netflix but operators embrace marriage of convenience to negate cord-cutting threat

LONDON — IHS Inc. (NYSE: IHS), the leading global source of critical information and insight, today announced key findings from its survey of pay TV providers working with Netflix.

The new report from IHS Technology entitled “Netflix on Pay TV: A Marriage of Convenience,” was compiled from interviews with executives from companies across the pay TV value chain, including operators and their technology partners. The data underlying the analysis is sourced from company reports and from IHS market intelligence and forecasts.

Conclusions from the report:

- Integrating Netflix into traditional pay TV services, such as Virgin Media and BT TV, has had a net positive impact on these operators’ performance;

- These partnerships are not appropriate for all, though – operators investing in their own movies and entertainment content, such as Sky, typically remain wary of working with Netflix;

- In the longer-term, there is a risk that Netflix will put pressure on some of operators’ core services, including premium movie packages and video-on-demand (VoD) offerings.

Netflix has partnerships in place with 25 pay TV providers, IHS says, with many more likely to follow after the over-the-top (OTT) video giant expanded to 130 new territories last month.

“Many of the operators working with Netflix have seen customer satisfaction ratings improve under the partnerships, which have helped foster positive operational performances,” said Ted Hall, Research Director at IHS Technology.

Revenue-wise, however, operators typically receive a share of the ongoing subscription fees only for customers that sign up via that operator’s set-top box, the IHS report says. This is insignificant, as most Netflix users either already have an account or sign up via a more user-friendly device, such as a PC/laptop or tablet.

“Netflix is a both less lucrative and more dangerous content partner to work with than the other premium networks pay TV providers traditionally partner with, such as HBO,” Hall said. “But collaborating with the ever-popular streaming service is necessary for many operators positioning their platforms as one-stop-shop ecosystems for TV and video content.”

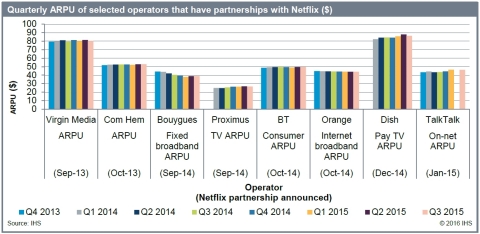

The results from the IHS survey generally support the view that third-party video-steaming services positively impact operators’ performance and complement traditional channels and VoD offerings. However, caution remains over how this dynamic could change as Netflix becomes more popular, with some operators wary that it has the potential to negatively impact core pay TV services and, in turn, average revenue per user and revenues overall.

“Netflix plays at least some – likely small – role as an upsell driver for some operators, whose customers can only access the app via their most advanced set-top boxes,” Hall said. “This is the case for 10 of Netflix’s 25 operator partners, primarily those using TiVo as their technology partner, in addition to Orange, Bouygues and Elisa.”

However, concerns were also expressed that some of operators’ core channel packages and VoD services could be at risk in the longer term, as growing numbers of pay TV subscribers access Netflix.

Diminishing appeal of premium movie channels

Growing Netflix usage could also prompt pay TV customers either subscribing to or considering premium movie services to reconsider their need for these higher-cost packages. “Europe, where HBO has achieved consistent subscriber growth in recent years, will be more resilient to this than the US,” Hall said.

According to IHS estimates, Showtime, The Movie Channel, Flix and Encore all experienced US subscriber declines in 2014. HBO was among those to achieve positive net additions – along with sister channel Cinemax and rival Starz – largely thanks to the launch of its direct-to-consumer streaming offering, HBO Now. In spite of the tough conditions, IHS still forecasts subscriber and revenue growth for most of the major players in the years to come.

Latest News

- Larger-sized TVs to drive 8% growth in display area demand

- DASH Industry Forum (DASH-IF) becomes part of the SVTA

- Sky Stream to launch in Germany on July 31st

- Bitcentral ViewNexa integrates Pixalate Analytics

- Canal+ could be listed on the London Stock Exchange

- OKAST and Bouygues Telecom launch app for tourists in France