Top 50 operators take three-quarters of global pay TV revenues

Monday, May 22nd, 2017Despite adding 120 million subs between 2016 and 2022, subscription and PPV revenues for 522 operators will remain flat at around $185 billion. From this total, the Global Pay TV Operator Forecasts report estimates 30 pay TV operators earned more than $1 billion in 2016.

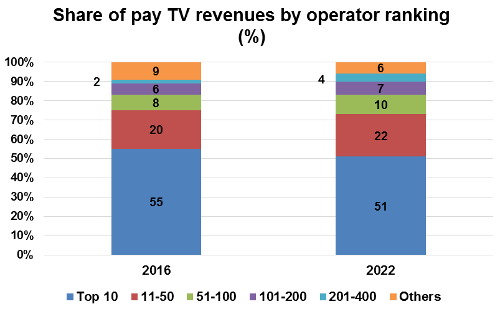

The revenue share for the top 10 operators will fall from 55% in 2016 to 51% in 2022. The share of the top 50 operators will fall from 75% in 2016 to 73% in 2022. The US dominates the top 10.

Simon Murray, Principal Analyst at Digital TV Research, said: “As global revenues are flat this can mean only one thing: the top operators will lose revenues. In fact, 114 of the 522 operators will lose TV revenues between 2016 and 2022.”

Top 10 operators by revenues ($ million)

Ranking Operator Country 2016 Ranking Operator Country 2022 ------- ---------------------------- ------- ------ ------- ---------------------------- ------- ------ 1 AT&T (total) USA 30,730 1 AT&T (total) USA 29,469 2 Comcast (total) USA 21,730 2 Comcast (total) USA 17,470 3 Charter merged (total cable) USA 16,312 3 DISH Network (satellite) USA 14,152 4 DISH Network (satellite) USA 13,614 4 Charter merged (total cable) USA 13,093 5 China Radio & TV (total) China 9,060 5 China Radio & TV (total) China 8,297 6 BSkyB (satellite) UK 5,704 6 BSkyB (satellite) UK 5,580 7 Verizon Fios (IPTV) USA 4,300 7 Sky (satellite) Brazil 3,703 8 Cox (total) USA 3,923 8 Verizon Fios (IPTV) USA 3,392 9 Sky (satellite) Brazil 3,680 9 Cox (total) USA 3,133 10 Sky Italia (satellite) Italy 2,479 10 Altice USA (total cable) USA 2,651

Source: Digital TV Research

Source: Digital TV Research. Note: This chart shows the concentration of pay TV revenues by operator, so the top 10 operators accounted for 55% of global pay TV revenues by end-2016.

Pay TV subscriptions for the 522 operators will increase from a collective 839 million in 2016 to 963 million by 2022. These operators took 87% of the 959 million global subscribers by end-2016, with this level expected to inch up to 88% of the 1,093 million total by 2022.

The top 50 operators accounted for two-thirds of the world’s pay TV subscribers by end-2016, with this proportion not expected to change over the next five years.

By end-2016, 15 operators had more than 10 million paying subscribers, and this will climb to 18 operators by 2022.

China Radio & TV is the world’s largest pay TV operator by a long, long way. Government policy to consolidate cable TV means that China Radio & TV quickly became the world’s largest pay TV operator, with 227 million subs by end-2016 – more than the next 11 operators combined.

A total of 28 operators will add more than 1 million subscribers. The Asia Pacific region will dominate the ranking of operators by subscriber gains between 2016 and 2022 – taking 13 of the top 15 places. Only 93 of the 522 operators will lose subscribers between 2016 and 2022.

The Global Pay TV Operator Forecasts report covers 522 operators with 758 platforms [144 digital cable, 128 analog cable, 292 satellite, 128 IPTV and 66 DTT] across 135 countries.

For more information on the Global Pay TV Operator Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally