Western Europe pay TV subs up, revenues down

Monday, March 26th, 2018Western European pay TV will gain subscribers between 2017 and 2023. Although this only represents a 2.6% increase, the Western Europe Pay TV Forecasts report estimates nearly 3 million more subs to take the total to 106 million.

Simon Murray, Principal Analyst at Digital TV Research, said: “Much of the pay TV subscriber growth will come from countries with traditionally low pay TV penetration. More than half of the region’s next additions will come from Italy [up by 960,000 between 2017 and 2023] and Spain [up by 716,000]. Germany will add 913,000 subscribers.”

Source: Digital TV Research Ltd

Murray continued: “However, subscriber numbers will fall for six of the 18 countries covered in the report. The UK will be the worst affected, although it will only lose 234,000 subs between 2017 and 2023.”

IPTV is gaining share at the expense of the other pay TV platforms; having overtaken satellite TV in 2015. IPTV will add 8 million subscribers between 2017 and 2023 but pay satellite TV will lose more than 2 million.

Some telcos (especially Telefonica in Spain and Canal Plus in France) are actively moving their satellite TV subs to more lucrative broadband bundles. Spain and France will both lose 1 million pay satellite TV subs between 2017 and 2023. Sky will soon offer its full satellite TV line-up online. Some satellite TV subs are expected to convert to the online platform; resulting in 691,000 fewer pay satellite TV subs in the UK between 2017 and 2023.

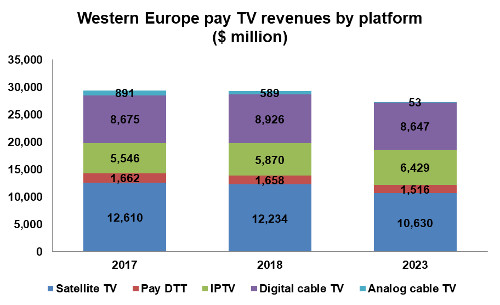

Despite subscriptions increasing, pay TV revenues will fall – by $2.11 billion between 2017 and 2023 to $27.27 billion.

Revenues will fall in all but three of the 18 countries covered in the report. The UK will lose $628 million over this period, although it will remain the most lucrative pay TV market by 2023. Regardless of having the most pay TV subs by some distance, Germany’s pay TV revenues will remain a lot lower than the UK – at $3.61 million by 2023. Italy will overtake Germany in 2023.

Satellite TV will remain the highest-earning pay TV platform, but its revenues will fall every year from 2011 – and will decline by $2 billion between 2017 and 2023. Mirroring its subscriber increases, IPTV revenues will climb by 16% between 2017 and 2023 to $6.43 billion – or up by $883 million. Cable TV revenues peaked in 2010. Cable TV will lose $866 million between 2017 and 2023.

Western Europe’s top three operators will account for 39% of the region’s pay TV subscribers by 2023. The same companies will take 50% of pay TV revenues.

Liberty Global has been the largest international pay TV operator in Europe for some time. However, Sky is closing the gap. By 2023, Liberty Global will have 17.89 million subscribers (including all of Ziggo) compared with Sky’s 14.86 million (satellite TV only). Third-placed Vodafone will have 8.85 million subscribers (excluding the Netherlands’ Ziggo). Vodafone may acquire at least some of Liberty Global’s European assets.

Sky will remain the pay TV revenue leader by some distance, with $8.49 billion from its satellite TV operations in 2023. Liberty Global will contribute a further $3.91 billion and Vodafone $1.21 billion.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally