TV Panel makers cut capacity to reduce losses

Monday, October 7th, 2019

Suffering from Increasing Loss of Money, TV Panel Makers Began to Massively Reduce Capacities in Sep., Says TrendForce

According to WitsView, a division of TrendForce, its latest survey showed that TV panel prices generally have been lower than the cash costs. Thus, panel makers’ loss of money has continually expanded. Korean, Taiwanese and Chinese panel makers all started to lower their utilization rates (UT) of TV panel products from September on, in order to improve the severely unbalanced supply and demand and stabilize the prices.

Anita Wang, a senior research manager of TrendForce, pointed out, in this wave of capacity reduction, Korean panel makers decreased their capacities the most among panel makers. In particular, for Samsung Display (SDC), because TV brands’ procurement demand has suddenly dropped in 4Q19, SDC has massively moved down its UT of Korean Gen. 7 and Gen. 8.5 fabs in September and October. SDC’s Gen. 7 input is predicted to drop by more than 50% in September and October, and input of its Gen. 8.5 fabs is expected to fall by 30%~40%.

LG Display (LGD) plans to shut down some capacities of Gen. 7.5’s Fab P7 and Gen. 8.5’s Fab P8. The Fab P8 is projected at only have 25% of capacity by the end of 2019, and its Fab P7 is rumored to shut down one-third of capacity in October.

A Taiwanese panel maker, AUO began to reduce its input in Gen. 8.5’s Fab 8A and Gen. 6’s Fab 6B. Particularly, the Fab 8A’s input is estimated at only 50% remained in 4Q19 primarily because of the 55″ panel prices and bad demand. Its Fab 6B is predicted to reduce by 20% of input in 4Q19 because it moved down the input of 65″.

China’s panel makers also suffered from TV panel segment’s loss of money. However, their capacity reduction scales have been lower than that of their rivals. CSOT modified its machinery in Gen. 8.5’s Fab T2. Therefore, from September to the end of 2019, the input of Fab T2 is expected to drop by 20%. Gen. 10.5’s fab in Hefei of BOE Technology (BOE) and CEC-CHOT’s Gen. 8.6 fab both reduce their input by around 20% until the end of 2019. Sharp’s Gen. 10.5 fab in Guangzhou temporarily paused its plan to enter mass production phase in 2019 because TV’s market demand has been weak.

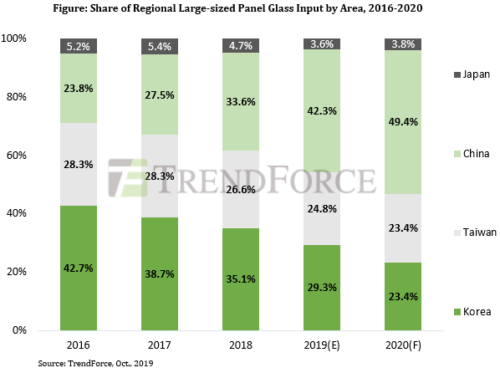

China’s large-sized panel input by area surpassed that of Korea, and China’s share might reach nearly 50% in 2020

By regional large-sized panel input by area, Korean panel makers massively shut down several fabs in 2019. By contrast, China’s panel makers increase their capacity. Therefore, China’s share of large-sized glass input by area grows to 42.3%. China is now the region whose input by area is the largest in the world. This figure is projected at nearly 50% in 2020.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally