Singapore multiplay service revenue to show 7% CAGR

Wednesday, March 17th, 2021

Singapore’s multiplay service revenue will grow at 7% CAGR over 2020-2025, forecasts GlobalData

Steady rise in household penetration of multiplay service bundles and increase in average monthly household spending on tripleplay and quadplay services are set to drive the multiplay service revenue in Singapore at a compound annual growth rate (CAGR) of 7% from US$1.09bn in 2020 to US$1.53bn in 2025, according to GlobalData, a leading data and analytics company.

GlobalData’s Singapore Multiplay Services Forecast reveals that the multiplay service penetration will increase from an estimated 74.0% in 2020 to 85.8% by the end 2025, supported by fiber-optic network expansion by fixed operators to deliver bundled plans built around high speed Internet services.

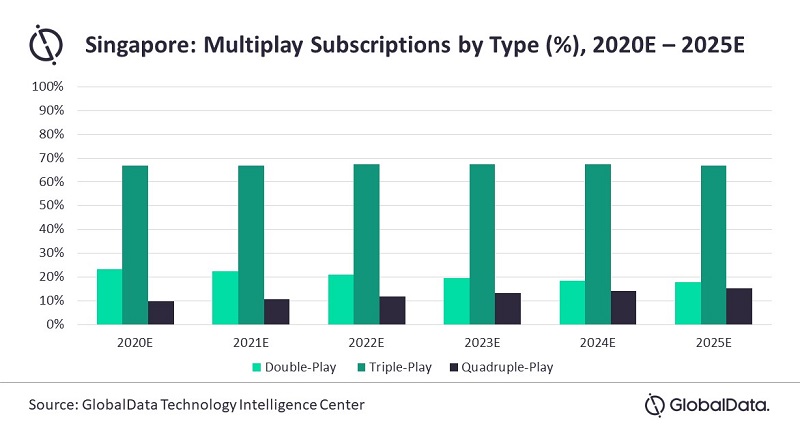

Kantipudi Pradeepthi, Research Analyst of Telecoms Market Data & Intelligence at GlobalData, comments: “Tripleplay services will account for the largest share of multiplay subscriptions in Singapore through the forecast period while quadplay services will see its subscription share grow from 9.8% in 2020 to 15.3% in 2025. However, doubleplay subscriptions will see a drop in the share of total subscriptions from 23.3% in 2020 to 17.9% by 2025.

“Singtel and StarHub are leveraging their vast fiber-to-the-home (FTTH) network to accelerate multiplay adoption, with the goal of lowering churn and increasing revenue-generating units (RGUs). Singtel will continue to lead the tripleplay and quadplay segments in terms of subscriptions through 2025, driven by promotional discount offers on bundled telecom plans to attract new subscribers.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally