Connected TV continues to drive U.S. digital video ad growth

Tuesday, May 4th, 2021

Connected TV is the Driving Force in 2020 Digital Video Advertising Spend

- Outlook for Digital Video Ad Spend Expected to Outpace Linear TV in 2021

NEW YORK — Digital video advertising growth continues, and is expected to represent more than half (56%) of total video spend projected in 2021. Connected TV (CTV) continues to outpace other formats and shows no signs of slowing down, according to IAB’s “Video Ad Spend 2020 and Outlook for 2021” report, released at the IAB 2021 NewFronts.

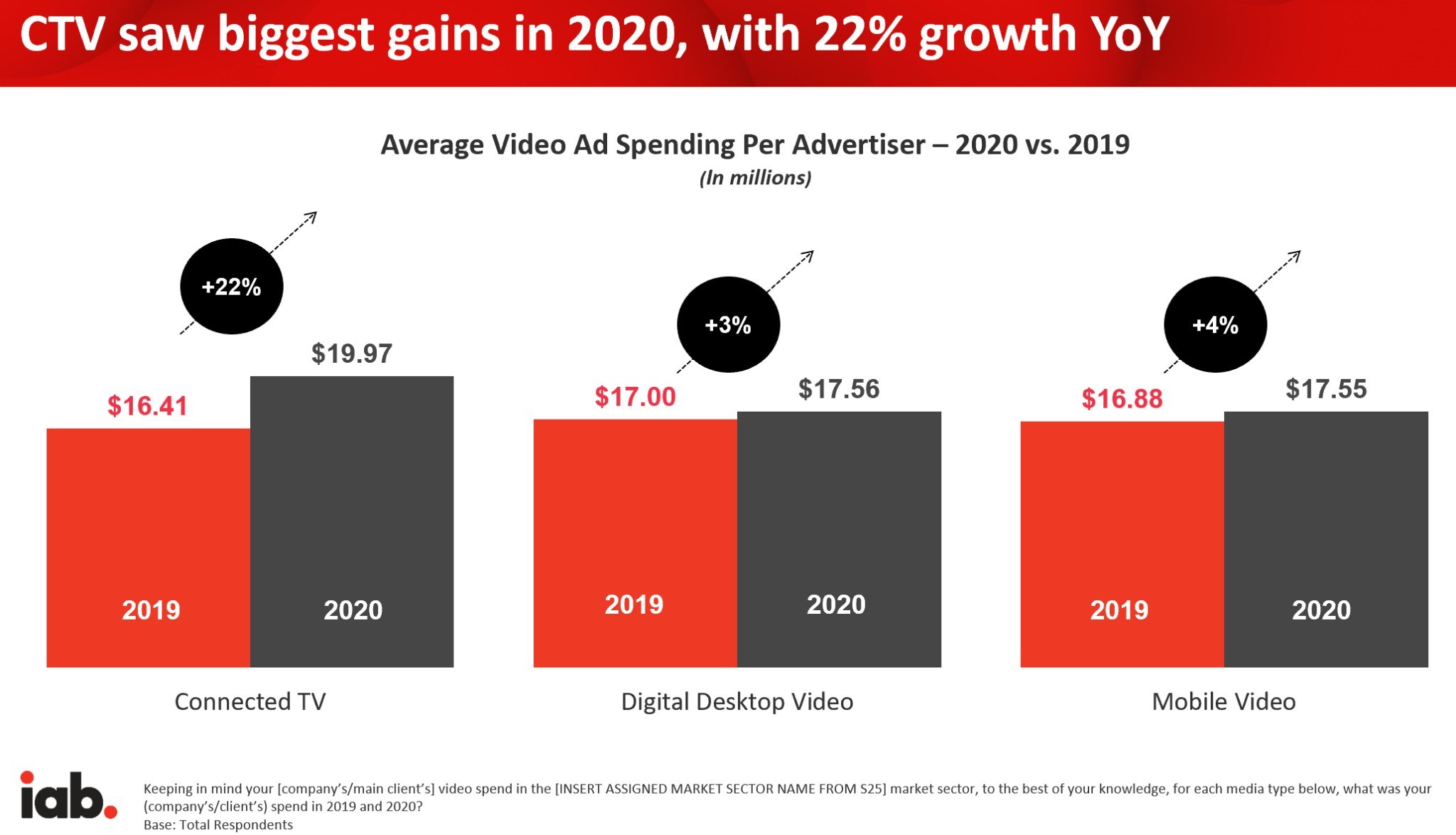

CTV saw its highest gains to date in ad spend in 2020: 22% growth year-over-year

Nearly three quarters (73%) of CTV buyers report shifting budget from broadcast and cable to CTV in 2021. Advertisers, on average, spent $20M on CTV in 2020, and more than a third (35%) of buyers expect to increase CTV video ad spending in 2021.

“This is a bellwether moment in media that reflects the continued acceleration and shift to digital,” said Eric John, VP of IAB Media Center. “While we are seeing growth across all digital video, the movement to more audience-based buying approaches has resulted in increased buyer demand for CTV.”

Buyers cite premium, high quality content, as well as targeting, and brand safety as the key benefits of CTV. Sixty percent of advertisers rated CTV highly on providing “a trusted, brand safe environment,” and nearly half (46%) cite targeting as a key benefit of CTV. In terms of expected category-specific spend on CTV in 2021, buyers are optimistic for Health and Wellness (+144%), Finance (+97%), Travel (+92%), Telecom (+71%), and Media and Entertainment (+48%). When it comes to mobile, buyers expect to increase spend in Health & Wellness (+181%), and in Fashion / Apparel (+81%) as well.

“Viewers have come to expect optimized video experiences. The days of dog-owner households seeing cat food ads are ending, even on the big screen,” said John. “Flexibility, addressability, and the opportunity to reach specific audiences in real time has put streaming at the big kids table, in some cases at the head of the negotiation table, right alongside traditional linear.”

More than three quarters of advertisers say “robust first-party data” is important

Escalation of the audience-based buying trend and the impending loss of third-party identifiers makes first-party data a critical differentiator: more than three quarters of advertisers indicated that “robust first-party data” is important when selecting video partners.

“This year’s study shows us that advertisers are looking to buy video in the ways that people are actually watching it. We now have the ability to move beyond legacy demo-based approaches to reach the specific audiences that matter most to brands. Publishers that offer more addressability and robust first-party data, while effectively measuring results, will win the day,” concluded John.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally