Record YoY growth for India's Smart TV market in Q2

Friday, September 17th, 2021

Record 65% YoY Growth for India’s Smart TV Market in Q2 2021

NEW DELHI, HONG KONG, LONDON, BOSTON, TORONTO, BEIJING, TAIPEI, SEOUL — India’s TV shipments grew 46% YoY in Q2 2021, according to Counterpoint Research’s TV Tracker Service. The post-pandemic economic improvement, aided by active retail channels fulfilling the pent-up demand, was the key reason for this growth.

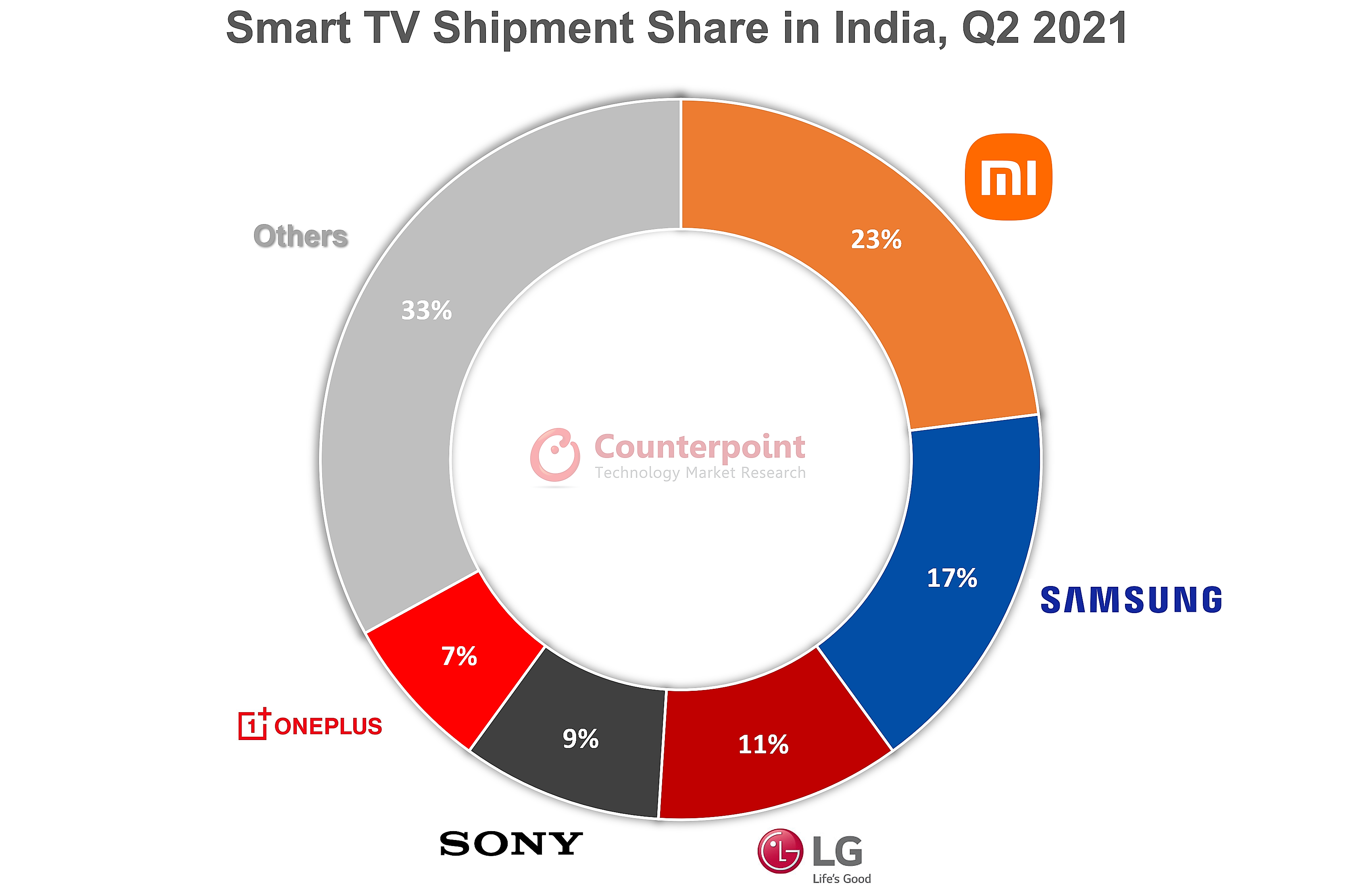

The smart TV market in India recorded an extraordinary 65% YoY growth in Q2 2021. Due to the increasing smart TV demand, OEMs are rapidly increasing smart TVs in their portfolios. Xiaomi, Samsung, LG and Sony held the lion’s share in the smart TV market in Q2 2021 while OnePlus retained its position in the top five with a 20% QoQ growth. The smart TV market continued to grab share from the non-smart TV market, taking an 80% share of the overall TV market during the quarter.

Non-smart TVs from Samsung and LG still have some traction in the market but have very little share in these brands’ product portfolios as some long-tail brands have rushed in to benefit from the void in this segment.

Source: Counterpoint Research Monthly India TV Tracker, June 2021

Research Associate Debasish Jana said, “India has always been a very lucrative market for TVs. With a large installed base of CRT and non-smart TVs, the country holds great potential for the growth of the smart TV segment.”

Jana added, “During the COVID-19 lockdowns, people were forced to remain at home for longer periods, resulting in a spurt in the demand for home entertainment, which in turn made the smart TV more popular in the country. Besides, OEMs are offering smart TVs with high specifications at very competitive prices, attracting consumers even more towards the smart TV.”

The sales channels, both offline and online, are playing a very important role in the market. The online channel continues to grow at a fast pace after the pandemic forced consumers to shop online while also permanently changing the shopping habit of some.

Commenting on the retail channels, Jana said, “TV brands in India are leveraging the growth of online channels. They are partnering with e-commerce websites and using them as a launch platform to attain countrywide reach. This symbiotic relationship between the brands and e-commerce websites is also benefiting the end consumer, both in terms of accessibility and affordability.”

The rise in prices of panels (or open cells) and other TV components, along with chip shortages, in the global market is keeping OEMs under pressure and we expect some price increase by a few top TV brands in the country. However, the Indian TV market is growing at a faster pace and is expected to reach pre-pandemic level by early 2022.

Market Summary

For Samsung, the entry-level T4000 series was the main volume driver in Q2 2021 and helped it to lead the overall TV market. Apart from that, the 2021 version of the Crystal series made its mark on the market. Samsung’s QLED TV business saw a 400% YoY growth in the quarter.

Xiaomi continued to lead the smart TV segment with a 23% market share. The MI TV 4A, 4A Horizon edition and 4A Pro were its best-selling models while the newly launched Redmi TVs also helped the brand grab volumes. Xiaomi is constantly pushing the boundaries towards the premium market as well, the latest effort being the launch of its QLED TV series.

LG continued to increase its share in the market with a 65% YoY growth. The brand has announced a new campaign, “Together We Can Make Life Better”, which offers exclusive deals and assured gifts.

Sony is mostly targeting the premium segment, although its affordable series is also doing well. In the premium category, the X series was in demand in Q2 2021. Sony held a sale for its TVs, targeting the IPL season with discounts and extended warranty. The promotions certainly gave some extra boost to its sales.

OnePlus and realme have established themselves in the market as strong players and are giving a tough fight, particularly in the affordable and mid-range price segments.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally