Record Smart TV shipments in India in 2021

Thursday, March 3rd, 2022

India Smart TV Market Records Highest Ever Shipments in 2021

- Smart TV share in overall TV shipments in India reached 84% in 2021, compared to just 67% in 2020.

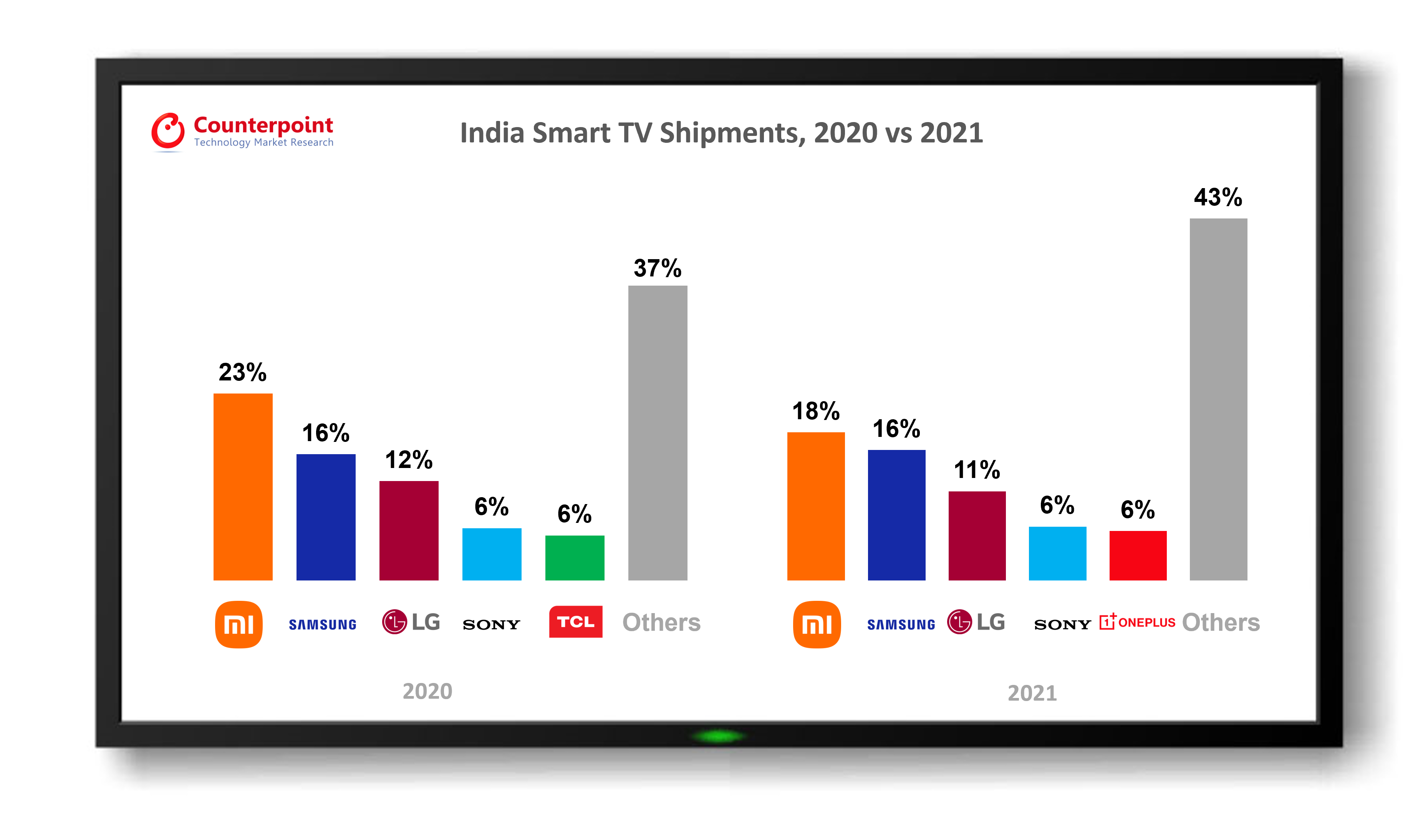

- Xiaomi led the smart TV market with an 18% share, followed by Samsung with a 16% share.

- Advanced display technologies are gaining traction with the launch of many devices by different brands.

- Above 40” TVs are becoming more popular with increasing affordability and attractive features. They now contribute over 42% of the shipments.

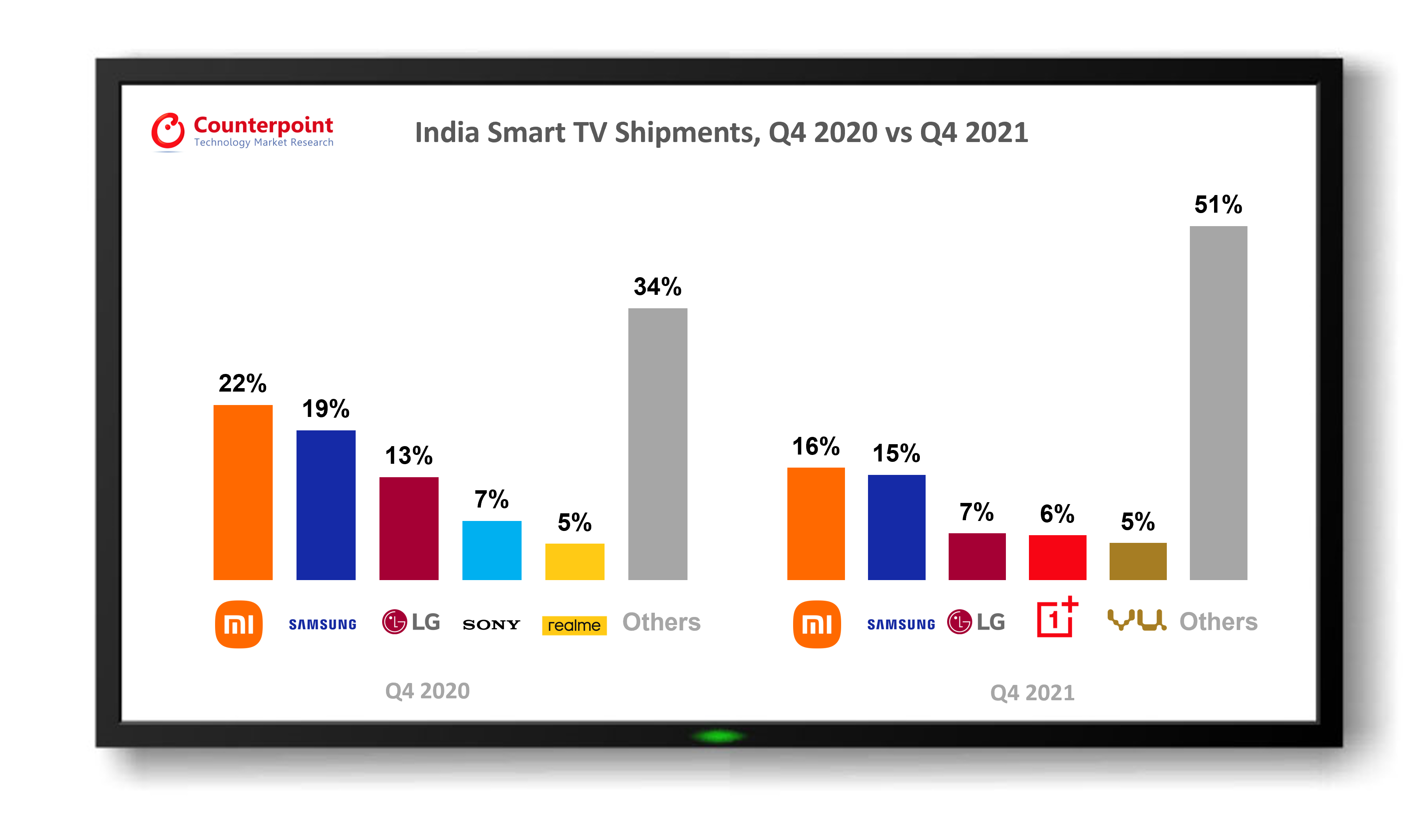

NEW DELHI, BEIJING, HONG KONG, TAIPEI, SEOUL, BOSTON, LONDON — India’s TV shipments grew 48% YoY in Q4 2021 (December quarter) and 24% YoY in 2021, according to the latest research from Counterpoint’s IoT Service. The smart TV market grew even faster at 55% YoY in 2021 and 65% YoY in Q4 2021 to reach its highest ever shipments for a calendar year. The overall smart TV share in the TV market soared to 84% in 2021 from 67% in 2020. The post-pandemic economic recovery, faster upgrades in the entry tier and pent-up demand aided by festive sales were the major reasons for this growth in the TV market.

Commenting on the market trends, Research Analyst Akash Jatwala said, “The smart TV market is showing tremendous growth, which is attributed to increase in demand for home entertainment amid lockdown, newer launches at affordable prices, growth of new entrants, discount schemes, and premium features at attractive prices. Newer brands are offering advanced display technologies like OLED and QLED at attractive prices, which is also helping in enhancing the viewer experience. Besides, features such as Dolby Atmos and Vision, better sound system, higher refresh rate and larger screen size are gaining ground among buyers.”

On the display size, Jatwala said, “The share of TVs which are above 40” reached 42% in 2021, compared to 31% a year ago, which implies Indian consumers are moving towards bigger-size TVs, especially for watching OTT content and communicating with their dear ones virtually. With brands offering bigger-size TVs at affordable prices, this share is expected to grow much more in the coming period.”

Commenting on channel share, Senior Research Analyst Anshika Jain said, “Online channel continues to grow at a faster pace and its contribution increased to around 31% in 2021. The pandemic changed the buying habits of many consumers, making them prefer online shopping from the comfort of their homes. Apart from it, TV brands are partnering with e-commerce players and launching their websites to cater to a wide range of consumers and benefit them in terms of accessibility and affordability.”

India Smart TV Market Share of Top 5 Brands, 2020 vs 2021

Source: India Smart TV Shipments Model Tracker, 2021*

Note: Figures may not add up to 100% due to rounding

India Smart TV Market Share of Top 5 Brands, Q4 2020 vs Q4 2021

Source: India Smart TV Shipments Model Tracker, Q4 2021*

Note: Figures may not add up to 100% due to rounding

Market Summary:

- Xiaomi* continued to lead the smart TV segment in 2021 with an 18% market share. The MI TV 4A, MI TV 4X, MI TV 4A Horizon edition and Redmi Smart TV X series were its best-selling models. Xiaomi is constantly expanding its product portfolio by offering newer features to its customers, the latest being the MI LED TV 4C series that comes with PatchWall and offers 77 free live channels.

- Samsung led the overall TV shipments in 2021 with an 18% share. It had a 16% share in the smart TV segment. The entry-level T4000 series was Samsung’s main volume driver in 2021 and helped it lead the overall TV market. The new launches from the Crystal series also performed well during the year. Samsung’s QLED TV segment grew about 2x during the year.

- LG captured an 11% share in 2021 driven by its entry-level models. During the year, LG launched the premium NanoCell TVs which saw great traction.

- Sony was the most sought brand in the >INR 40,000 price range, although the affordable W series was its main volume driver. In the ultra-premium category (>INR 70,000), the X series was one of the top-selling series in 2021.

- OnePlus saw a record 354% shipment growth during the year and ranked fifth in smart TV shipments. Its entry-level Y series was the volume driver, whereas the U1S was among the sought-after models in the >INR 40,000 range.

- realme shipments grew 72% YoY in 2021. It was one of the most preferred smart TV brands in the entry-level segment (

- In the “Others” category, there were many brands that performed well in 2021, such as Nokia, TCL, Panasonic, BPL, Kodak and Blaupunkt, which were able to make a mark through portfolio expansion.

- Newer models from existing players, entry of new brands, enhanced features, bigger displays and attractive prices helped in increasing the penetration of smart TVs in 2021.

- India’s smart TV market is mostly offline-driven, with 69% of the shipments coming from offline channels.

* Xiaomi’s share includes Redmi’s share

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally