Prime Video, TVer, AbemaTV and Netflix lead streaming market in Japan

Monday, October 4th, 2021

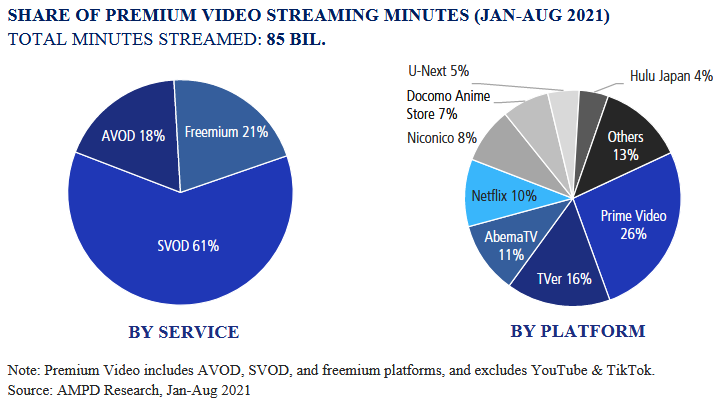

MPA Report: Premium Video Platforms Reached 85 Bil. Minutes Streamed In Jan-Aug 2021, Led By Prime Video, TVer, AbemaTV & Netflix

- Premium video platforms captured 13% of total video streaming minutes in Japan in Jan-Aug 2021.

- 8 platforms had an aggregate 87% share of premium video streaming minutes, led by Prime Video, TVer, AbemaTV and Netflix.

- SVOD subscribers topped 44 mil. in August 2021, led by Prime Video, Netflix and Hulu Japan.

- Anime is a defining attribute of premium video streaming in Japan, driving over 40% of consumption on both Prime Video & Netflix. Netflix has a competitive edge in Korean content while US content supports long-tail consumption on both platforms. Licensed content dominates.

SINGAPORE — Premium video streaming in Japan reached 85 bil. minutes during Jan- Aug 2021, or 13% of total time spent on video according to the first of a series of quarterly reports from Media Partners Asia (MPA) measuring the Japanese streaming economy. The report, titled Japan Online Video Consumer Insights & Analytics, leverages MPA proprietary AMPD Research Platform to measure and analyse streaming media consumption across key VOD services on mobile devices.

The report indicates that the SVOD paying subscribers topped 44 mil. in August 2021, with Prime Video (33%), Netflix (14%) and Hulu Japan (6%) in the lead. Commenting on the inaugural report’s findings, MPA Executive Director Vivek Couto said: “The premium video segment in Japan is increasingly competitive. Local content is critical, as illustrated by broadcast TV-consortium owned TVer’s growth over 2020-21, while Prime Video and Netflix’s licensed anime libraries have contributed over 40% of consumption on the platforms during 2021. More competition and category expansion is imminent as Disney+ expands with Star and local content in October 2021.”

AMPD Research’s Managing Director Anthony Dobson added: “Working with Intage, Japan’s premier research company, has powered us to provide our clients with unrivalled visibility into the video streaming ecosystem, informing their content strategies by delivering rich insights into what drives Japanese consumers’ content choices.”

Key premium video players include:

- Prime Video leads premium video in Japan with 26% share of premium video streaming minutes and more than 15 mil. monthly active users. Key factors behind Amazon’s lead in Japan include a large library of long-tail content, a bundled e-commerce service, satisfactory platform functionality, distribution partnerships with NTT Docomo and KDDI and competitive pricing. Local titles, particularly licensed anime, drive nearly 70% of Prime Video consumption. US movies and series account for 20%.

- TVer is a TV consortium owned streaming platform leveraging deeply local FTA dramas, variety, news and sports. TVer captured 16% of premium video streaming during Jan-Aug 21.

- AbemaTV had 11% share of premium video streaming and is a freemium platform co-owned by CyberAgent and TV Asahi. Consumption is driven by sports, including Major League Baseball, original dramas, local content and live events.

- Netflix drives 10% of premium video streaming with 6 mil. paying subscribers. Licensed anime is a key consumption driver in Japan and monetized globally, attracting significant viewership across SEA and beyond. Approximately 25% of Netflix consumption is driven by Korean dramas, a key competitive differentiator for Netflix, while US content drives 15%. Netflix’s originals (US, Japanese and anime) drive 10% of platform viewership.

- Hulu Japan is approaching 3 mil. paying subscribers with growth driven by co-productions by parent company Nippon TV, original dramas and movies.

About This Report & Methodology

This report, entitled Japan Online Video Consumer Insights & Analytics leverages MPA’s proprietary AMPD Research Platform to evaluate consumer behavior and usage patterns across VOD media services in Japan. The report includes analysis and profiles of 16 unique OTT video platforms focusing on paying subscribers, monthly active users, streaming minutes, average daily time spent, viewer profiles and demographics. The platforms are YouTube, Amazon Prime Video, Netflix, Hulu Japan, Disney+, AbemaTV, DAZN, dTV, Docomo Anime Store, FOD Premium, GYAO!, Niconico, Paravi, Telasa, TVer and U-Next. Title-level analysis, including country of origin and genre split, and viewership by age and gender demographics are provided for Prime Video and Netflix. Title-level analysis for other SVOD platforms will be included in future reports. MPA also releases studies using the AMPD Research Platform that feature other APAC regions and markets such as Southeast Asia, Australia, South Korea and Taiwan.

The AMPD Vision® platform uses a permission-based panel of consumers who consent to the collection of their session-based activity. For this report, the platform passively measured real consumption on all android mobile devices in Japan between January to August 2021 with a sample size of 14,089 sourced from our in-market research partner Intage Group (ITG), Japan’s largest market research institute. The data is anonymized and conforms to data privacy legislation in Japan. Consumption estimates are based on MPA’s proprietary weighting and projection techniques to be nationally representative of mobile consumption for individuals aged 15 to 69 with adjustments made to estimate iOS consumption. MPA’s future reports will include passive data for iOS devices from 2022 bringing the total panel size to 19,000 individuals.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally