Liberty Global extends its dominance in Europe

Wednesday, November 13th, 2013Pay TV subscriptions for the 102 operators across 26 countries covered in a new report from Digital TV Research will increase from a collective 105.8 million in 2008 to 131.9 million in 2012 and onto 147.1 million by 2018. The European Pay TV Operator Forecasts report estimates that these operators represented 85% of European pay TV subscribers by end-2012.

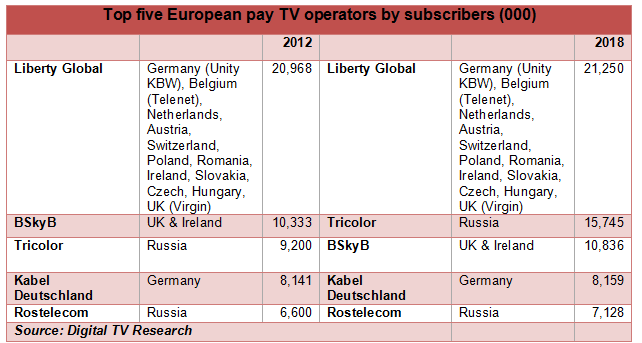

Liberty Global/UPC extended its lead as Europe’s largest pay TV operation with the acquisition of the UK’s Virgin Media. The group had twice as many subscribers as second-placed BSkyB at end-2012. However, Liberty Global’s subscriber count is not expected to grow by too much. The company has to deal with the conversion of 13.9 million analog cable subs in 2008 to virtually none by 2018.

Russia’s Tricolor will become the second largest operator by 2018, with 15.7 million subscribers. The low-cost DTH player also has many “subscribers”, which do not pay to receive the service and have therefore not been included in this report.

However, not all of these operators will increase their subscriber bases, with 37 (36%) expected to decline between 2012 and 2018. Traditional pay TV operators now face greater rivalry than ever before – either from other pay TV platforms such as IPTV or satellite or from “free” multichannel TV services such as DTT and online TV and video.

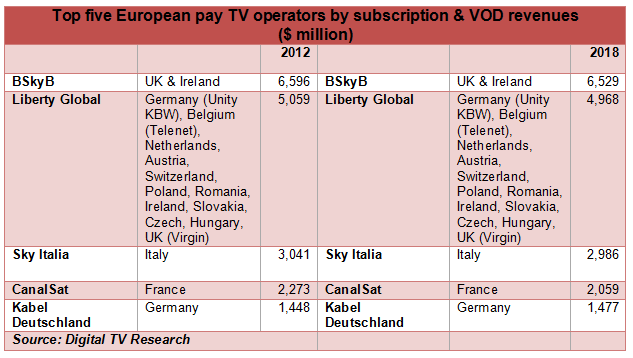

Total subscription and VOD revenues for the 102 operators increased from $26.8 billion in 2008 to $34.5 billion in 2012. However, the total will only grow to $35.1 billion by 2018. These operators account for nearly 90% of European pay TV revenues.

Subscription and VOD revenues will fall for 45 of the 102 operators (44%) covered in this report between 2012 and 2018, including eight of the top ten operators.

BSkyB will remain at the top earner, recording $6.5 billion subscription and VOD revenues by 2018. Liberty Global closed the gap on BSkyB considerably with the acquisition of Virgin Media.

More: European Pay TV Operator Forecasts

Links: Market Research Store

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization