U.S. cable performance improves

Tuesday, May 26th, 2015

Calm Before the Storm? U.S. Cable Performance Improves, but Pay TV Market Headwinds Remain

- As telco Internet-protocol television (IPTV) and satellite TV growth slows, the cable industry cut subscriber losses in the first quarter

SANTA CLARA, Calif. — While cable operators continue to show improvement, the overall pay TV market still faces strong headwinds. According to IHS (NYSE: IHS), the leading global source of critical information and insight, U.S. cable companies improved on normal quarterly losses in the first quarter (Q1) of 2015, losing only 132,900 subscribers since the fourth quarter (Q4) of 2014. Many pay TV operators have already seized the initiative to attract non-pay TV households, starting with the launch of Sling TV by Dish, as well as customizable packages from Verizon and new “cord-cutter” packages at Cablevision.

“Cable’s strong performance in the first quarter signals that the maturation of the U.S. pay TV business is nearly complete,” said Erik Brannon, senior analyst, television media for IHS Technology. “Significant gains for telco IPTV players are coming to an end, as cable companies have lately done a better job reducing churn. Growth in high-speed data and bundling are significant components of the cable industry’s growth strategy; however, better execution and technological developments are also playing significant roles in reducing subscriber losses.”

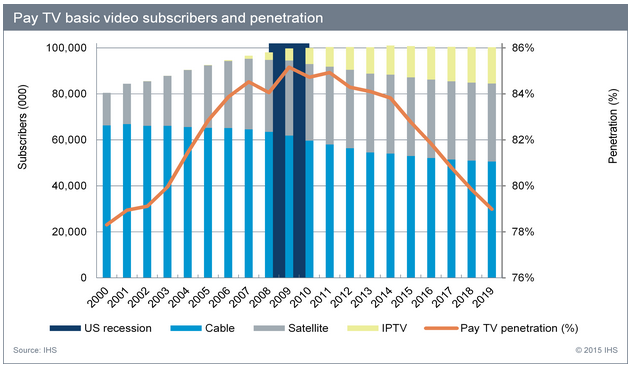

Even as the cable industry finds ways to mitigate losses, the number of U.S. TV households without a pay TV subscription is still expected to grow from 18.6 million in 2008 to 26.7 million in 2019. According to the latest information in the IHS State of the U.S. TV Operator Market report, nominal declines in cord-cutting are expected to be the norm, with pay TV households falling slightly from 101.0 million in 2014 to 100.3 million in 2019.

“This decline does not signal the death of the pay TV business, as gains in average revenue per user are likely keep video revenue on a slow-growth trajectory,” Brannon said. “Even so, the number of pay TV households in the United States is forecast to remain fairly flat, as pay TV over-the-top television (OTT) solutions become more attractive.”

Source: IHS State of the U.S. TV Operator Market report, Q1 2015

For information about purchasing the IHS State of the U.S. TV Operator Market report, contact the sales department at IHS in the Americas at (844) 301-7334 or AmericasLeads@ihs.com; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or technology_emea@ihs.com; or Asia-Pacific (APAC) at +604 291 3600 or technology_APAC@ihs.com.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally