Chinese makers starting to dominate large LCD TV panel supply

Tuesday, April 30th, 2019

Chinese Panel Makers Starting to Dominate Large LCD TV Panel Market, IHS Markit Says

- Chinese panel suppliers increased market share nearly 10 times in the first quarter of 2019 from a year ago

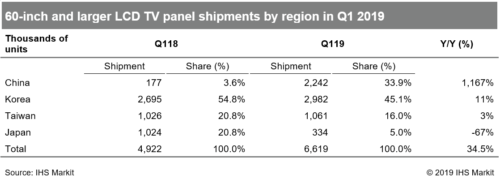

LONDON — With Chinese panel makers accelerating the mass production of large thin-film transistor (TFT) liquid crystal display (LCD) TV panels faster than expected, they accounted for 33.9 percent of the 60-inch and larger LCD TV panel shipments in the first quarter of 2019. Their market share has expanded nearly 10 times from 3.6 percent in just over a year, according to business information provider IHS Markit (Nasdaq: INFO).

South Korean panel makers still accounted for the largest share in the 60-inch and larger LCD TV panel shipments, with a 45.1 percent share in the first quarter. However, Chinese panel makers’ share in the large LCD TV panel market is expected to continue to grow.

“When BOE’s B9 10.5G fab started its mass production in the first quarter of 2018, the industry expected that its full ramp-up would take quite a time due to a learning curve,” said Robin Wu, principal analyst at IHS Markit. “However, it did not take as long and BOE has become the largest supplier of 60-inch and larger LCD TV panels since the end of 2018.”

BOE accounted for 29 percent of the total 60-inch and larger LCD TV panel shipments in the first quarter of 2019. It is estimated that the B9 10.5G fab has reached its maximum capacity of 120,000 sheets in the first quarter of 2019.

ChinaStar also started to mass produce large LCD panels at its T6 10.5G fab in the first quarter. CEC-Panda and CHOT ramped up mass production at their 8.6G fabs to the maximum design capacity in the first quarter. Foxconn/Sharp is forecast to begin mass production at their Guangzhou 10.5G fab in the second half of 2019.

“As both Chinese and South Korean panel suppliers are focusing on large LCD TV panels, competition between them will become more intense, pressuring the price of large LCD TV panels even further throughout 2019,” Wu said.

According to the Large Area Display Market Tracker by IHS Markit, shipments of larger than 9-inch TFT-LCD panels reached 178.3 million units in the first quarter of 2019, down 1 percent from a year ago. By area, the shipment increased by 6.7 percent to 49.1 million square meters during the same period.

BOE led the unit shipments of large TFT-LCD panels with a 24.6 percent share in the first quarter of 2019, followed by LG Display (18.8 percent) and Innolux (16 percent). By area shipments, LG Display accounted for the largest share of 20 percent, followed by BOE (19.9 percent) and Samsung Display (14.1 percent).

The Large Area Display Market Tracker by IHS Markit provides information on the entire range of large display panels shipped worldwide and regionally, including monthly and quarterly revenues and shipments by display area, application, size and aspect ratio of each supplier.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally