Nordic households spending €149pm on media and access services

Wednesday, May 27th, 2020Nordic Operators Play Big Role in Maturing Online Video Market

In the newly released analysis Insight: Nordic TV & Streaming, Mediavision concludes that Nordic households now spend on average EUR 149 per month on media and access services. Operators such as Telia, Telenor and TDC account for a majority of that spend. Moreover, telcos increasingly drive the market through several new initiatives and services, especially in video.

Nordic households spent on average EUR 149 on media and access (broadband and mobile telephony) per month during spring 2020, according to Mediavision’s newly released analysis of the Nordic media industry. Comparing the Nordic countries, there are several differences:

- Norway has, by far, the highest total spend – driven by high access spend.

- Denmark stands out with the highest media spend per household.

- Finland pay the most for text media, still a high household penetration of printed daily press.

- Total spend in Sweden has increased by 5% compared to 2019, driven by increased media spend.

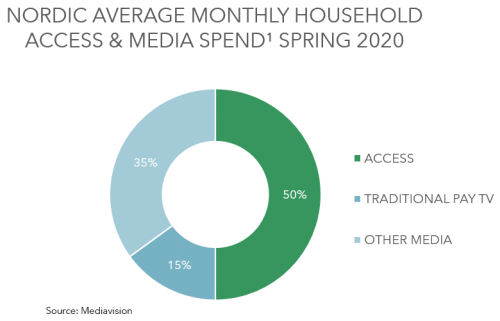

Looking at the total Nordic region, access and media hold almost equal shares. On average, households pay approximately EUR 75 for access and the same amount for media per month during spring 2020. Access is dominated by mobile telephony and broadband. Telia holds the market leading position for access in the Nordics, both in broadband and mobile telephony. And, in line with the overarching trend of bundling access + media, Telia’s purchase of TV4 Media has also significantly strengthened its position on the content side.

For consumers, the bulk of media spend is allocated to video. We believe that this is a development likely to be strengthened as the Nordic online video market moves into maturity. Households are going to sign up for more subscriptions – not less. All the while efficient access + video bundling efforts are likely to continue in order to fight dropping traditional pay TV spend.

This spring, it has become clear that the telcos play an increasingly important role in forming the new Nordic media landscape. They are expanding their offerings, in aspiration for a bigger slice of the pie, by mergers with media companies, new sub-brands and online services. The latter also expanding in distribution outside the existing customer base. And this is likely only the beginning. An observation right now, is that streaming growth here in the Nordics is becoming increasingly dependent on the operators and their role as content aggregators. The results being a significant increase of both the number of services and household penetration.

The consequence? Competition is ramping up and we can expect price pressure – at least in a shorter perspective. And we can probably expect that market leader Netflix will aim to increase its footprint even further through partnerships with Nordic operators – yet another sign of changing times as the streaming market moves further into the homes of the “laggards”.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally