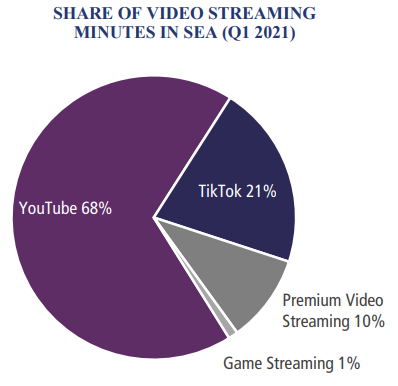

Premium video captures 10% of video streaming minutes in SE Asia

Tuesday, May 18th, 2021

MPA Report: Premium Video Captures 10% Of Total Video Streaming Minutes In Southeast Asia; SVOD Platforms Add 5 Million New Subscribers In Q1 2021.

- Premium video platforms, led by Netflix, Viu, WeTV, iQIYI and Vidio, accumulated 114 mil. streaming minutes in Q1 2021, or 10% of total streaming minutes. YouTube and TikTok dominate with nearly 90%.

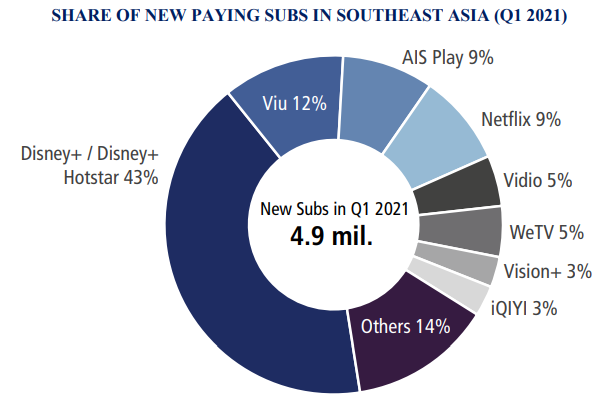

- Indonesia, Malaysia, the Philippines, Singapore, and Thailand added 4.9 mil. new SVOD subscriptions in Q1 2021 to reach a cumulative subscriber base of 24.2 mil.

- Disney’s streaming platforms Disney+ Hotstar in Indonesia and Disney+ in Singapore captured 41% of new paying subscriptions, boosted by growth in Indonesia, and a successful launch in Singapore.

- Other key drivers of SVOD growth were Viu, Netflix, Vidio, WeTV and iQIYI, as well as authenticated platforms AIS Play in Thailand and Vision+ in Indonesia.

SINGAPORE — Premium video platforms, led by Netflix, Viu, WeTV, iQIYI and Vidio, captured 10% of total video streaming minutes in Q1 2021, according to a study published today by Media Partners Asia (MPA). The quarterly report, titled Southeast Asia Online Video Consumer Insights & Analytics: A Definitive Study, leverages MPA’s proprietary AMPD Research Platform to measure the video streaming economy in five Southeast Asian (SEA) markets: Indonesia, Malaysia, the Philippines, Singapore and Thailand.

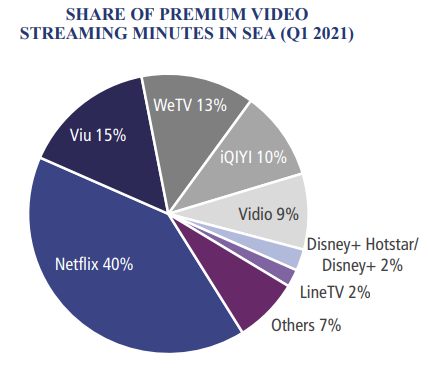

According to the report, Netflix led premium video consumption with 40% share, driven by the broad appeal of its international catalogue. Viu, leveraging premium and library Korean content, pulled in a consistent 11-14% of premium streaming minutes across SEA, outperforming in Indonesia with 20% share. Tencent-owned WeTV captured 13% of premium video streaming minutes, with strong growth in Indonesia, where its local originals have proven breakout hits. iQIYI had 10% share, leveraging premium Chinese content and FTA dramas in Thailand and Malaysia. Indonesia’s Vidio experienced a massive spike in streaming minutes in Q1 2021, driven by original dramas, sports, led by local and international football, and FTA content.

Note: Premium Video excludes YouTube, TikTok & Game Streaming | Source: AMPD Research

Commenting on the report’s findings in Q1 2021, MPA Analyst Dhivya T said: “With streaming minutes growing each quarter, we find that the battle for consumer time is not zero-sum, but certainly competitive for smaller streaming platforms. In Thailand, for example, Line TV consumption has softened significantly as new Thai titles are no longer limited to Line TV but also available on WeTV, Viu and so on. New breakout titles are critical to capture and sustain consumption share – this is evident with WeTV and Vidio originals in Indonesia, Disney+ in Singapore, Viu and Netflix’s new Korean titles across the region and iQIYI in Malaysia and Thailand.”

Southeast Asia added 4.9 mil. new SVOD subscriptions in Q1 2021 to reach a cumulative subscriber base of 24.2 mil. Key drivers of growth include:

• Disney+/Disney+ Hotstar added ~2 mil. subscribers in Q1 2021, driven by growth in Indonesia and a successful launch in Singapore in late-Feb. Disney has overtaken Viu to occupy second place in Southeast Asia after Netflix with a cumulative 4.6 mil. subs. While consumption has slowed significantly in Indonesia, consumption and uptake is expected to grow steadily in Singapore with the expansion of Disney+’s Star content and release of new Marvel original series. Southeast Asia is also expected to benefit from Q2 launches in Malaysia and Thailand

• Viu grew considerably in Q1, largely due to traction in the Philippines where Viu’s partnership with Smart boosted subscriber growth through a strong local marketing campaign. The strength of Viu’s first-window Korean drama slate and telco integrations (data packages, sachet pricing, direct carrier billing) across Southeast Asia helps sustain subscriber uptake.

• AIS Play experienced strong uptake of its Family pack in Q1. The pack is promotionally bundled as a free top up for AIS mobile and fibre customers and leverages linear pay channels and corresponding VOD.

• Netflix remains the SVOD leader in SEA, with significant penetration in the Philippines and Thailand. Growth is largely organic and driven by the popularity of Korean and US content. • Vidio’s growth in Q1 was boosted by the return of key sports including local football Liga 1 and UEFA Champions League and originals dramas.

• Vidio’s growth in Q1 was boosted by the return of key sports including local football Liga 1 and UEFA Champions League and originals dramas.

• WeTV’s growth is concentrated in Thailand and Indonesia. In Thailand, WeTV’s premium Chinese drama and variety series are gaining popularity while WeTV’s hit local originals in Indonesia drove subscriber uptake.

• MNC Group’s freemium platform Vision+ added 0.2 mil. subscribers in Q1 2021, a combination of MNC’s pay-TV linked and new direct customers.

• iQIYI’s subs growth was driven by Malaysia, where a partnership with Astro provides discounted iQIYI subscription to Astro pay-TV customers. iQIYI’s premium Chinese dramas and variety is steadily gaining popularity across SEA.

About This Report & Methodology

This report is produced by Media Partners Asia (MPA) using its proprietary AMPD Research platform. AMPD used two key tools to conduct research & frame analysis:

I. Passive Measurement. The AMPD Vision® platform uses a permission-based panel of consumers who consent to the collection of their session-based activity. For this report, the platform passively measured real consumption on mobile devices across 5 SEA markets in Q1 2021. Sample sizes by market are Indonesia, N=1,228; Malaysia, N=613; Philippines, N=1,267; Singapore, N=302; Thailand, N=818. The data reported is anonymized and conforms to data privacy legislation in markets where the service operates including European Union’s General Data Protection Regulation (GDPR) and the Republic of Singapore’s Personal Data Protection Act (PDPA) which delivers parallel compliance in Asia-Pacific Economic Cooperation (APEC) member states. Data from AMPD Vision® informs key metrics reported in this study including streaming minutes & consumption share by platform, genre and country of origin.

II. Consumer Survey. MPA used the results of a Consumer Survey, which serves as a VOD Profiling Study conducted continuously across Indonesia, the Philippines, Singapore and Thailand. Data is collected through an interactive online survey among internet users aged 15 years and above who use both mobile and / or home broadband. Respondents are sampled according to representative quotas for age, gender and regions corresponding to AMPD Research’s online universe estimates modelled using official government statistics and MPA analysis. The samples are sourced using AMPD Research’s proprietary online panels, pre-screened for actual VOD consumption. Sample sizes by market are Indonesia, N=9,123; Malaysia, N=3,960; Philippines, N=7,198; Singapore, N=501; Thailand, N=3,381. Data from the Consumer Survey informs key metrics reported in this study including: (1) Socio-economic & demographic indicators by VOD platform; (2) Consumer spend on VOD services; and (3) Paying subscribers by VOD platform.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally