YouTube, Line TV and Yahoo TV lead online video consumption in Taiwan

Monday, August 30th, 2021

AMPD Research: Taiwan Online Video, YouTube, Line TV and Yahoo TV lead consumption

- 53 billion minutes streamed in Q2, 3.4 million SVOD subscribers.

- YouTube, Line TV and Yahoo TV lead consumption.

- Netflix approaching 20% market share in the SVOD sector.

- Line TV, LiTV and iQIYI dominated fragmented freemium market.

Total streaming minutes measured across AVOD, SVOD and live streaming platforms increased to ~53 billion in Q2 2021, representing a ~2.3 billion net quarterly growth in minutes, according to a new report published by Media Partners Asia (MPA) today. The report, titled Taiwan Online Video Consumer Insights & Analytics, leverages MPA’s proprietary AMPD Research platform to measure and analyse streaming media consumption across VOD services on mobile devices.

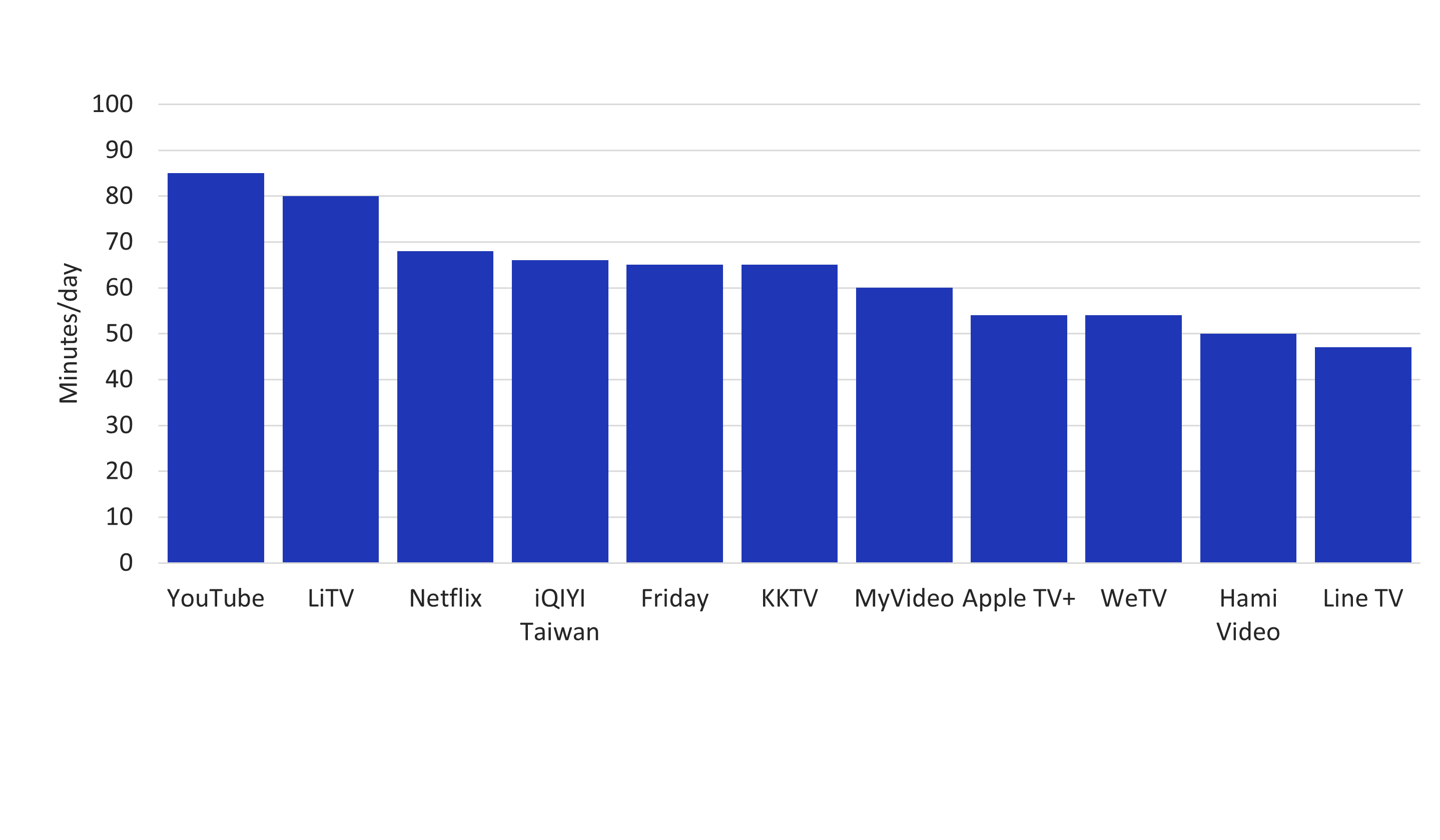

Source: AMPD Research, Q2 2021

YouTube, Line TV and Yahoo TV lead consumption. YouTube led the online video category with a 70% share as MAUs reached 16 mil. versus 14 mil. in Q1. AVOD player Yahoo TV and freemium platform Line TV were in second and third place respectively in Q2 with a 7% and 3% share of streaming minutes.

Total streamed minutes across SVOD & freemium categories reached 10 billion in aggregate during Q2. SVOD platforms contributed 16% of the pie, led by Netflix. In the freemium category, Line TV, LiTV and iQIYI Taiwan were the most streamed services. SVOD adoption continues to grow with total paying subs reaching 3.4 million in Q2 2021 versus 3.0 million in Q1 with the average household subscribing to 2.9 services. Netflix led with close to a 20% share of paying subscribers.

Commenting on the key findings of the report MPA senior analyst Adrian Tong said: “Netflix’s performance is attributable to its increasing focus on Asian content offerings (i.e. Korean and Japanese, local Taiwanese and Chinese content), while consumption of its US content remains strong. iQIYI’s growth remains driven largely by Chinese and Korean dramas. Separately, during Q2, promotional offerings that granted free 14-30 day access to premium content were launched by multiple SVOD platforms including Friday, MyVideo, KKTV, Line TV and CatchPlay+. These promotions were intended to help limit community spread of COVID by encouraging people to consume content at home. As a result, a number of platforms experienced a healthy spike in their subs base by the upselling and gifting of TVOD vouchers.”

About This Report & Methodology

This report leverages MPA’s proprietary AMPD Research Platform to evaluate consumer behaviour and usage patterns across VOD media services in Taiwan. The report includes analysis and profiles of 13 unique OTT video platforms focusing on paying subscribers, monthly active users, streaming minutes, average daily time spent, viewer profiles and demographics. Title-level analysis, including country of origin and genre split, and viewership by age and gender demographics are provided for key SVOD and freemium platforms. The report is updated quarterly.

Two key tools were used to conduct research and frame analysis: (1) Passive Measurement. The AMPD Vision® platform uses a permission-based panel of consumers who consent to the collection of their session-based activity. For this report, the platform passively measured real consumption on all android mobile devices in Taiwan in Q2 2021 with a sample size of 1,500+. The data reported is anonymized and conforms to data privacy legislation in Taiwan; and (2) Consumer Survey. MPA used the results of a Consumer Survey, which serves as a VOD Profiling Study conducted in Taiwan. Data is collected through an interactive online survey. The survey was conducted among internet users aged 15 years and above who use both mobile and / or home broadband. A sample size of 4,076 respondents completed a structured survey of mostly closed-end questions.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally