Asia Pacific online video to reach $55 billion by 2025

Monday, January 11th, 2021

Asia Pacific Online Video Opportunity To Scale To US$55 Billion By 2025

- Asia Pacific online subscription video-on-demand (SVOD) grew 34% in 2020 to US$16.3 bil. in revenues with China contributing 58%.

- Ex-China, the Asia Pacific SVOD sector grew revenues by 47% to US$6.8 bil. in 2020. SVOD revenue is projected to reach US$15.3 bil. in APAC ex China by 2025 ex-China and US$31.3 bil. with China.

- Weak advertiser demand resulted in Asia Pacific online advertising video-on-demand (AVOD) revenues declining 3% in 2020 to US$14.2 bil.

- AVOD outlook is improving with a recovery evident in China, India, Korea and Southeast Asia. 2021 Asia Pacific AVOD revenues are set to expand 13% to US$16.1 bil. and grow to US$23.2 bil. by 2025.

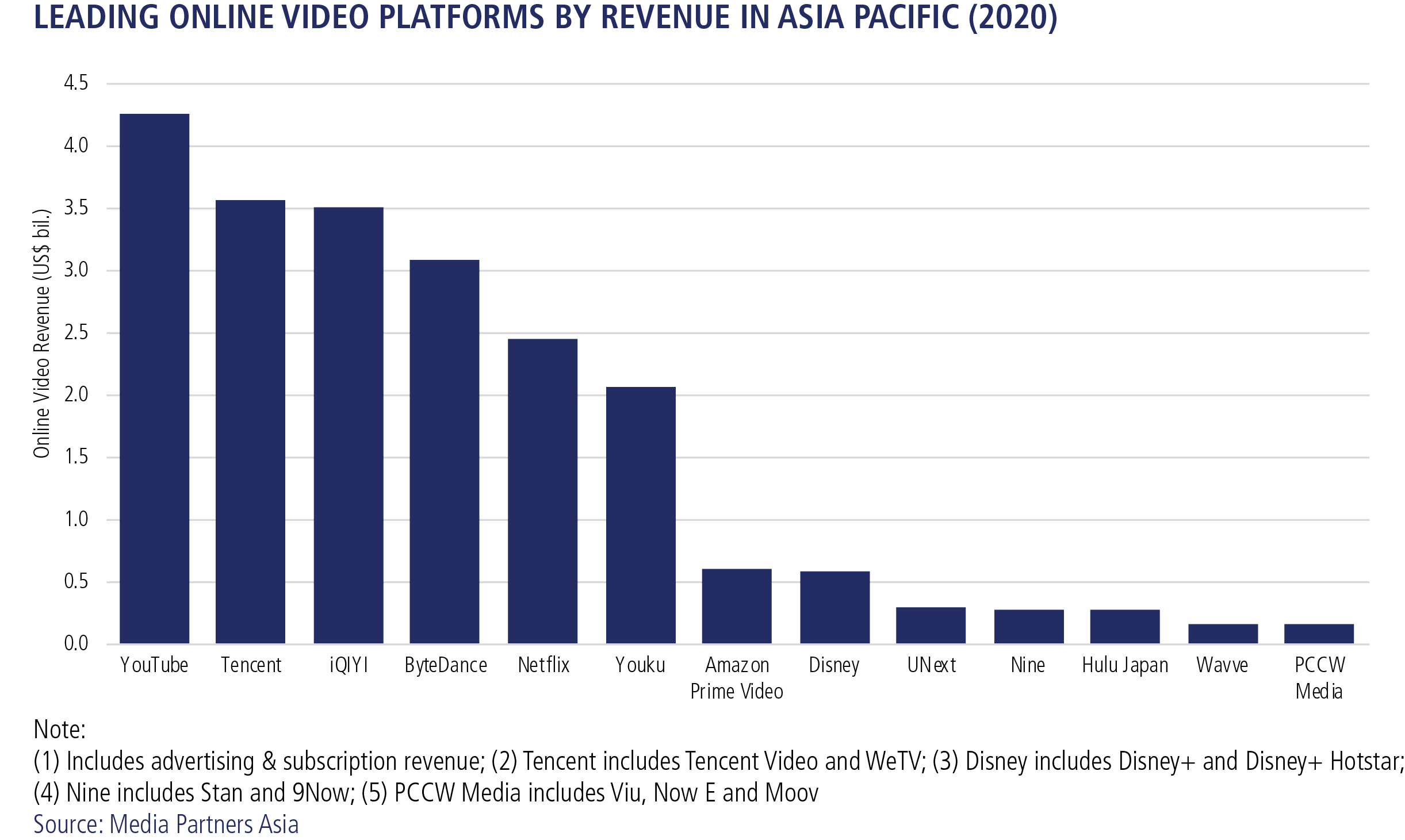

- Top 13 OTT operators accounted for more than 70% of total online video revenue in APAC in 2020, including Tencent, ByteDance, Netflix, Amazon, Disney, iQiyi, UNext, Nine, Wavve and PCCW Media.

SINGAPORE — Media Partners Asia (MPA) announced today that the Asia Pacific online video industry grew revenue by 14% Y/Y in 2020 to reach US$30.5 bil., according to the new report Asia Pacific Online Video & Broadband Distribution 2021 published by MPA. SVOD overtook AVOD to contribute 53% of total revenues; AVOD contributed 47%. Total online video revenues are projected to grow at a CAGR of 12% to reach US$54.5 bil. by 2025, with SVOD contributing 57% and advertising, 43%. Ex-China, total Asia Pacific online video revenues grew 14% in 2020 to reach US$14 bil. with SVOD contributing 48% and AVOD, 52%. Ex-China Asia Pacific online video revenues are forecast to climb at a CAGR of 16% to ~US$30 bil. by 2025 with the SVOD:AVOD ratio moving to 52:48.

Commenting on the findings of the report, MPA executive director Vivek Couto said: “During 2020, the COVID-19 pandemic created a work-from-home (WFH) environment that scaled the adoption of online services, including SVOD. The average number of SVOD services subscribed by customers outside of China grew through 2020, reaching 3.8 in Australia and Japan and 2.8 in markets such as India and Southeast Asia. While subscriber growth will decelerate in 2021 and the production of new content will remain impacted in 1H 2021, the scale and velocity of investment in premium content should ensure that net new customer additions will remain robust over the medium term. Moreover, profitability should grow more rapidly than revenues and subscribers as online businesses scale. This is particularly true in larger markets such as Australia, China, Japan and Korea.

In the emerging markets of India and Southeast Asia, the landscape for SVOD is promising but is still being shaped because of growing competitive intensity with increased investment in content and distribution. Theatrical windows are narrowing for online video operators while key genres are moving rapidly and exclusively online. Mobile plans and low ARPU pricing are becoming common to drive affordability, reach and customer adoption across large pre-paid consumer segments. ARPUs will remain compressed as platforms scale in markets such as India and Indonesia. The future will also see more distribution deals with mobile, fixed broadband, pay-TV and smart TV operators to drive consumption and payment on small and big screens. Evolving regulations may impact content creation and investment as governments look to introduce censorship and impose content quotas.”

Asia Pacific SVOD Sector

The SVOD sector grew 34% in 2020 to US$16.3 bil. in revenues. China’s share of Asia Pacific SVOD peaked in 2017 with 67% of sector revenues, falling to 58% in 2020. Ex-China, the SVOD sector grew 47% to US$6.8 bil. in 2020. Japan, Australia and New Zealand contributed 70% to ex-China SVOD revenues in 2020 followed by Southeast Asia (10%), Korea (9%), and India (7%).

China’s unique SVOD subscribers are projected to grow from 298 mil. in 2020 to 375 mil. in 2025. Driven by ARPU expansion, China’s SVOD revenues are forecast to grow at an 11% CAGR between 2020-25. While mobile consumption of content initially drove VOD demand, big screen TV consumption is an increasingly important driver of demand. ARPUs will climb with greater consumption of VOD.

SVOD benefited significantly in India as the country went into its COVID-19 lockdown. Key players continue to invest in premium local content while leveraging sports, movie rights and aggressive consumer pricing to drive adoption.

In Japan, SVOD overtook AVOD as the larger revenue contributor in 2020, accounting for 56% of online video revenues in Japan. Net SVOD subscriber additions reached a record 8.9 mil. in 2020, driven by WFH conditions with Netflix emerging as market leader. In Korea, SVOD revenue doubled in 2020, driven by Netflix. New entrants in Korea in 2021 will include Disney+, which will join Softbank-owned Coupang, which is expanding its video offering.

In Australia, SVOD grew rapidly with revenues climbing an estimated 32% in 2020 to US$1.4 bil. Netflix leads the market with 6.1 mil. subs and ~US$710 mil. in revenue. Nine’s Stan is the second largest player with 2.3 mil. subs while Disney+ and Amazon Prime Video have 1.8 mil. subs each.

Southeast Asia’s SVOD future will largely be defined by the growth of Indonesia, Philippines and Thailand while Vietnam has significant long-term potential. Indonesia’s SVOD industry made significant strides in 2020, with key global, regional and local platforms investing to make SVOD more accessible to the largely mobile mass market.

Asia Pacific AVOD Sector

YouTube is the dominant player with ~60% of total AVOD revenue in Asia Pacific ex-China. The platform is a destination for promotional clips and often entire episodes of professional content in Korea, Japan and Southeast Asia. Content creators source, trial and market concepts on the platform. Libraries of professional content are available on the site. While YouTube is dominant, local players are slowly growing share, as broadcasters with local content and sports rights transition online.

China will remain the largest AVOD market in the Asia Pacific. In 1H 2020, the COVID-19 pandemic led to steep budget cuts and a flood of digital ad inventory associated with ByteDance and Kuaishou depressed CPMs. A broader macroeconomic recovery has since boosted the sector. ByteDance is the largest AVOD operator in China.

In India, YouTube dominated AVOD with an estimated share of 67% in 2020. Its contribution is forecast to decline to 55% by 2025 as broadcaster-backed OTTs and short form video platforms gain share.

In Korea, YouTube and Facebook had more than 75% of AVOD revenues in 2020. Kakao and Naver are important domestic platforms for advertising. Kakao is capitalizing on the success and scale of its instant messaging platform Kakao Talk to launch Kakao TV, which debuted in Q4 2020. Korea’s AVOD revenues are expected to more than double in the future to reach with local players’ share reaching 30%, up from 23% in 2020.

In Southeast Asia, key local TV broadcasters transitioning to online will shape the future AVOD opportunity. Local and regional platforms’ share of AVOD revenue is expected to grow in the future driven by platforms such as Viu, Vidio, RCTI+ and Line TV.

Broadband Market & Telco Partnerships

Advances in broadband will continue to boost to online video reach, consumption and monetization. MPA projects mobile broadband penetration, including 5G, in Asia Pacific ex-China will reach 86% (per capita) by 2025 versus 66% in 2020, with key growth from India, Indonesia, Thailand and Vietnam. 5G penetration will grow rapidly in China, Korea, Japan and Taiwan. Average fixed broadband penetration in Asia Pacific is forecast to grow from 61% to 64% of households over 2020-25. Networks are being upgraded using fiber and next-generation cable technologies. OTT partnerships with telecom and broadband pay-TV operators can be vital for reach and billing, particularly in markets with limited online payment mechanisms. Their marketing clout and knowledge of end-user behaviour can be influential Partnerships range from carrier billing to hard bundles with a fixed fee component to revenue shares.

Market Leaders

According to MPA analysis (next page), 13 online video operators accounted for more than 70% of Asia Pacific online video revenues in 2019, generating US$21.1 bil. in aggregate. Bytedance, Tencent Video and iQIYI remain strong in China and have expanded globally with Tencent Video’s WeTV and iQIYI slowly making inroads into Southeast Asia. Netflix has built a strong business in Asia Pacific, on the back of growing success in Japan, Korea and Australia Amazon Prime Video is successful in India and Japan and is growing in Australia.

Disney’s global SVOD expansion has been a success to date. Its subscribers in India are low-ARPU but the platform could secure more than 80 mil. subscribers in India if it can retain key sports rights and continue to invest in local originals. The launch of Disney+ Hotstar in Indonesia has met with early success especially in terms of reach and paid subscribers. The core Disney+ service has succeeded in Australia and New Zealand and is growing in Japan. These markets will benefit from the launch of Star (as part of Disney+) in 2021 as access to series and movies from ABC, Fox and FX brands should help drive customer growth.

Local broadcasters have moved online or are licensing to key OTT players, and in some cases, doing both. Southeast Asian regional major Viu has grown its SVOD business with Korean content and local acquisitions. In Indonesia, Emtek’s Vidio has passed 1 million paying subscribers with premium local content and sports rights. Line TV is Thailand’s largest AVOD platform after YouTube and Facebook. In Korea, a number of local platforms compete including Wavve, TVing, Coupang Play and Kakao TV Talk. In Australia, the most significant local player is Nine Entertainment, which owns and operates two OTT platforms – 9Now (AVOD) and Stan (SVOD).

In Japan, local broadcaster content is key to tier 1 and 2 OTT operators. Key tie-ups include Nippon TV (Hulu Japan and TVer); TV Asahi (Telasa and Abema TV); TBS (Paravi); and (4) Fuji TV (FOD). Meanwhile, U-Next’s SVOD service performed strongly in 2020.

About Asia Pacific Online Video & Broadband Distribution 2021

This comprehensive report reviews the drivers and dynamics shaping the fast-moving online video and telecoms industries across 14 Asia Pacific markets with analysis of online video subscribers and ARPUs; advertising & subscription revenues; SVOD, AVOD and total Online Video market share across key operators; content costs; mobile & home broadband subscribers, ARPUs and revenues; online video distribution, pricing & packaging, telco partnerships & integrations across more than 100 operators; and key regulatory, commercial and infrastructural developments.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally