Korean and US content power online video consumption in SE Asia

Monday, March 1st, 2021

Korean & US Content Power Online Video Consumption As Streaming Minutes Soar In 2020

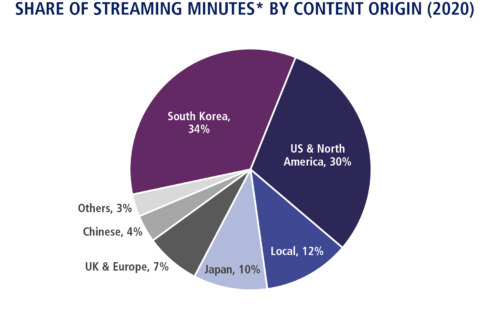

- The Korean wave gained further strength in Southeast Asia in 2020, accounting for 34% of online video streaming minutes across the four markets in aggregate

- Netflix and Viu are at the forefront of Korean content distribution and consumption in the region; WeTV and iQIYI capture long-tail consumption on free layer

- US/Hollywood content retains strength, with 30% of streaming minutes, bolstered by entry of Disney+ Hotstar into Indonesia

- Local content critical in Indonesia and Thailand, championed by local content leaders Vidio and Line TV respectively. Local content represented 13% of overall streaming minutes in 2020.

SINGAPORE — Korean, US and local content form the core of online video content consumption across Southeast Asia, according to a study published today by Media Partners Asia (MPA). The report, entitled Southeast Asia Online Video Consumer Insights & Analytics: A Definitive Study, wraps up 2020 with key insight to online video content consumption trends across four Southeast Asian markets: Indonesia, The Philippines, Singapore and Thailand. The report leverages MPA’s proprietary consumption insights platform, AMPD Research.

– Indonesia: Amazon Prime Video, Disney+ Hotstar, iflix, iQIYI, Netflix, Vidio, Vision+, Viu, WeTV

– Thailand: iflix, iQIYI, Line TV, Netflix, True ID, Viu, WeTV

– Singapore: Amazon Prime Video, iQIYI, Netflix, Viu, WeTV

– Philippines: Amazon Prime Video, iflix, iQIYI, Netflix, Viu, WeTV

Note: WeTV and iQIYI content consumption was measured actively from Q4 2020 onwards.

Source: AMPD Research

Commenting on the findings, MPA Analyst Dhivya T said: “A steady stream of original and acquired Korean dramas from Netflix and Viu in 2020 has significantly boosted Korean content consumption in Southeast Asia, pushing K-dramas further into the mainstream of online entertainment. US content maintains strength, largely driven by Netflix, while Disney+ Hotstar’s growing scale in Indonesia has boosted US content consumption and we expect its successful launch in Singapore to drive similar results in Q1 2021. We are also seeing strong demand for local content in Indonesia and Thailand addressed by Vidio and Line TV respectively. Both platforms leverage FTA dramas and some originals. We expect to see more platforms drive local content investment in 2021 and beyond while the battleground for Korean content will remain costly. Netflix and Viu have appeared to be able to monetize Korean content investments better than most because of multi-market scale with Netflix in particular benefiting from global SVOD leadership.”

Decoding Content Trends

- Korean content outperformed US content consumption in Singapore, Indonesia and Thailand in 2020, contributing 34% of online video streaming minutes overall. Korean content demand is strongest in Singapore and Indonesia, where it accounts ~38% of streaming minutes. Netflix and Viu are at the forefront of Korean content distribution and consumption in the region. WeTV and iQIYI capture long-tail Korean content consumption on the free layer.

- US movies and series contributed an average of 30% of 2020 streaming minutes in Southeast Asia, largely driven by Netflix. US content demand is strongest in the Philippines, accounting for 38% of streaming minutes in 2020. In Indonesia, US content consumption (22%) has been boosted by the entry of Disney+ Hotstar, which leverages Disney’s large vault of franchise content from Marvel, Pixar and others.

- Local content pulls significant weight in Indonesia (18%) and Thailand (38%), championed by Vidio and Line TV respectively. FTA sinetrons, linear channels and originals shine on Vidio, while Line TV’s romantic dramas and original series are popular. In Thailand, Viu’s locally acquired Thai dramas have been key drivers of AVOD consumption. WeTV has had early success with local originals in Indonesia and Thailand. Disney+ Hotstar’s aggressive local movie acquisitions have proven astute; local films contribute outsize consumption on the platform.

- Japanese anime is consistently popular in SEA, contributing 9% of streaming minutes, largely through Netflix. Both fresh and long-tail library titles have proven important.

- The growth of WeTV and iQIYI has strengthened Chinese content consumption across the region, boosted by the significant volume of free content on the platforms. Chinese content demand is strongest in Thailand (10%) and Singapore (8%); 5% of streaming minutes overall across the four markets.

About This Report & Methodology

This report is produced by Media Partners Asia (MPA) using its proprietary AMPD Research platform. AMPD used two key tools to conduct research & frame analysis:

I. Passive Measurement. The AMPD Vision® platform uses a permission-based panel of consumers who consent to the collection of their session-based activity. For this report, the platform passively measured real consumption on mobile devices across 4 SEA markets in Q4 2020. Sample sizes by market are Indonesia, N=1,256; Philippines, N=931; Singapore, N=402; Thailand, N=1,076. The data reported is anonymized and conforms to data privacy legislation in markets where the service operates including European Union’s General Data Protection Regulation (GDPR) and the Republic of Singapore’s Personal Data Protection Act (PDPA) which delivers parallel compliance in Asia-Pacific Economic Cooperation (APEC) member states. AMPD Vision® was used by MPA to provide a consolidated granular view of streaming media consumption across global and regional VOD services on mobile devices. Data from AMPD Vision® informs key metrics reported in this study including: (1) Total minutes streamed by VOD & social media platforms and (2) Users, MAUs, WAUs & DAUs by VOD platform.

II. Consumer Survey. MPA used the results of a Consumer Survey, which serves as a VOD Profiling Study conducted continuously across Indonesia, the Philippines, Singapore and Thailand. Data is collected through an interactive online survey among internet users aged 15 years and above who use both mobile and / or home broadband. Respondents are sampled according to representative quotas for age, gender and regions corresponding to AMPD Research’s online universe estimates modelled using official government statistics and MPA analysis. The samples are sourced using AMPD Research’s proprietary online panels, pre-screened for actual VOD consumption. For this report, a sample size of 20,854 respondents completed a structured survey of mostly closed-end questions. Sample sizes by market are Indonesia, N=13,101; Philippines, N=5,245; Singapore, N=623; Thailand, N=10,038. Data from the Consumer Survey informs key metrics reported in this study including: (1) Socio-economic & demographic indicators by VOD platform; (2) Consumer spend on VOD services; (3) Paying subscribers by VOD platform; and (4) Net Promoter Scores.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally