OTT revenues poised to surpass pay TV revenues in MENA by 2024

Monday, November 29th, 2021

Is the acceleration of SVOD undermining the pay TV market’s value in MENA?

In advanced TV markets, OTT developments have initially entailed revenue losses for operators who had been counting on high pay TV penetrations for years, often associated with a preponderance of expensive cable offers, as is the case in North America. In MENA, the TV market follows an opposite model, characterised by the predominance of free-to-air consumption and the overwhelming role of satellite in reception technologies. Against this background, and several years after the emergence of the SVOD model, are pay TV operators adequately prepared for the accelerated efforts of international streaming platforms to capture market share?

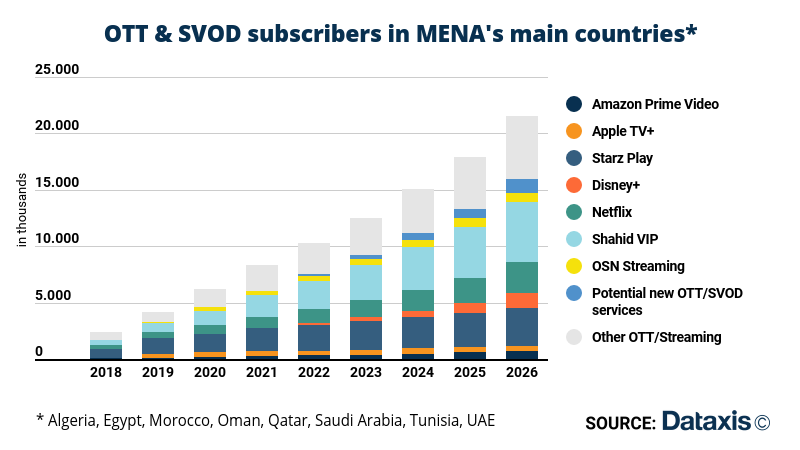

Many players have already made their way into the OTT market in the region. Among them are local players Shahid VIP, Starzplay and OSN streaming, currently holding the leading position in the market, while international challengers such as Netflix, Amazon Prime and soon Disney+ are also present.

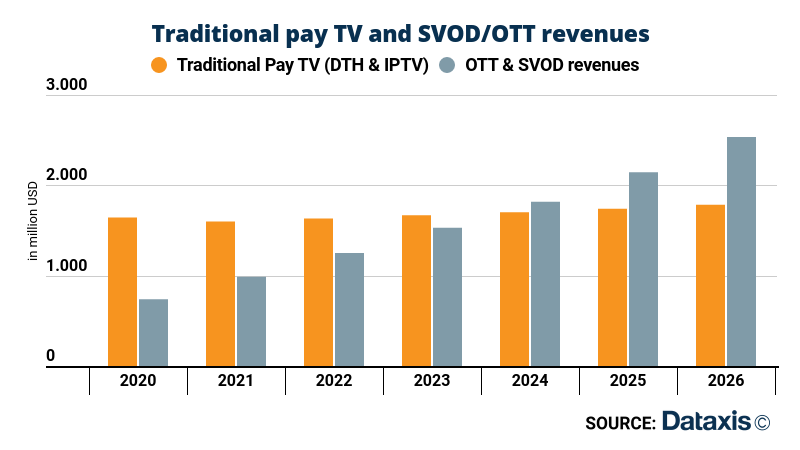

In the traditional pay TV market, the share of DTH (direct-to-home) pay TV subscribers has stagnated in recent years and DTH revenues are gradually declining in MENA. Simultaneously, the SVOD market has grown by 36% in 2020 and is expected to reach 45.6 million subscribers by 2026 for the overall region, according to Dataxis’ figures. Concurrently, OTT revenues are poised to surpass pay TV revenues by 2024, exceeding $1.9 billion across the region.

Given the well-established appeal of the OTT market, a range of international SVOD players, who had initially preferred to access the market through their TV networks, may now reconsider offering their services on a direct-to-consumer basis. Indeed, Disney+, whose originals have been distributed by OSN in the region since Q2 2020, will be launched in MENA by winter 2022. Simultaneously, efforts to tap into the market continue through strategic partnerships implemented with telecom operators and massive investments in original content. Netflix is working closely with local producers and has already launched several original series in the region, the most recent being the Jordanian series “Al Rawabi School for Girls”. A major competitor, Starzplay, secured $25 million in debt financing in February 2021 to support its content investments and strengthen its presence in MENA.

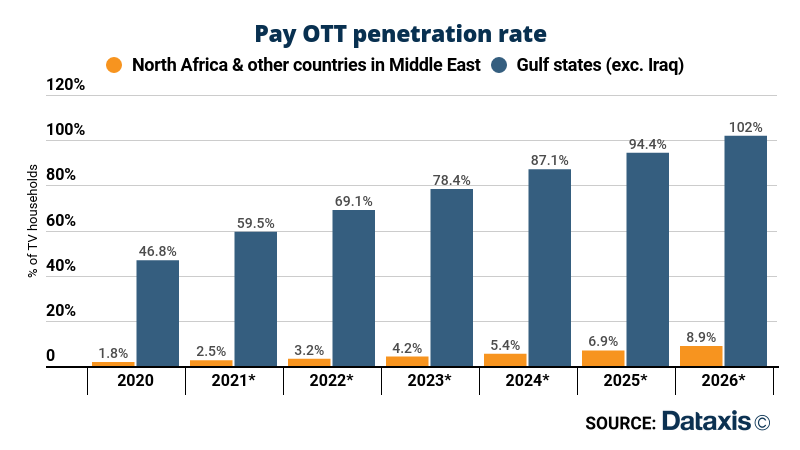

SVOD services have therefore started to invest and build compelling content offerings, pressurising the operations of existing video players. Yet, due to their increased involvement in OTT and their ability to bundle services, the pressure for operators is now shifting onto their ability to provide their subscribers with powerful and enhanced viewing experiences and access to relevant, engaging and personalised content. The development of broadband internet in the Gulf countries suggests that the IPTV technology could be a driver of such evolution for operators in the upcoming years.

Ultimately, pay TV and OTT in MENA remains a two-tiered industry. First off, there are the Gulf States (except for Iraq) where 5G and fiber offers are being rolled out rapidly. FTTH deployment should also give OTT players real opportunities to thrive. Alternatively, pay OTT and SVOD penetration will remain relatively low in the North African market and other Middle Eastern countries (18% in Egypt in 2026).

One major consequence of the rise of SVOD and OTT services might be the impetus created to add more flexible, cheaper and consumer-oriented offers, combined with a relative transfer of value from pay DTH offers to digital streaming services. Ultimately, the crucial element to consider is the small size of the pay market (traditional and emerging with OTT), which indicates that SVOD and pay TV actors have the same threat: pirate services. An increase in market value could imply a shared overall growth. Herein lies the main challenge for existing TV players in the MENA region: to present appealing and well-priced offers to the local audience, in parallel with an extended collaboration to tackle piracy.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally