Satellite TV reception in Europe, North Africa and Middle-East shows continued strong take-up

Wednesday, September 15th, 2010

Eutelsat releases key highlights of its two-yearly survey of satellite and cable homes

- Overall satellite and cable universe

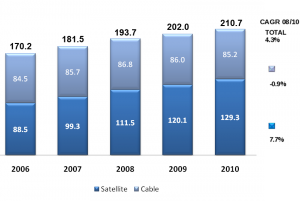

- Satellite and cable TV reception in Europe, North Africa and the Middle East up by 8.8% to 210.7 million homes, compared to 193.7 million homes in 2008.

- Growth is driven by satellite reception (DTH/SMATV), which expanded almost two times faster, by 16% to 129.3 million homes, from 111.5 million in 2008.

- Satellite pay-TV continues to gain traction, growing by 22.7% to 51.4 million homes and underlining the increasing strength of satellite platforms operating in Eutelsat’s footprint.

- Eutelsat reaffirms pole position in Europe, Middle East and North Africa

- Satellite and cable homes receiving channels from a Eutelsat satellite break the barrier of 200 million, to 204 million.

- More than 9 satellite and cable homes out of 10 receive channels broadcast by Eutelsat.

- 107 million satellite homes receive channels via Eutelsat, reaffirming the strength of the Group’s video orbital positions serving Europe, Middle East, North Africa.

PARIS — Eutelsat Communications (Euronext Paris: ETL) one of the world’s largest satellite operators and the leading supplier of capacity for television and radio broadcasting in Europe, the Middle East and North Africa, today announced the key highlights of its two-yearly survey of television reception by satellite and cable homes.

Set up in 1994 and covering Europe, North Africa and the Middle East, the key objective of the survey is to measure the trends of three main indicators in the broadcasting market:

- Type of reception by TV homes (satellite, cable, IPTV, terrestrial);

- Ratio of analogue to digital;

- Market share of free-to-air (FTA) and pay-TV.

The survey also monitors the number of antennas pointing towards Eutelsat satellites, which overall broadcast over 3 600 television channels and interactive services.

The fieldwork was carried out between January and April 2010 in 32 countries representing 89% of TV households in the 46 countries covered by the study. More than 41,000 face-to-face interviews took place using a single questionnaire shared by leading market research institutes: TNS, Ipsos and GfK.

Main results

Satellite and cable and homes have increased to 210.7 million, up from 193.7 million in 2008. With 8.8% growth over two years, satellite and cable homes account for 58.4% of the total 360.5 million TV homes covered in the survey (up from 54.6% in 2008).

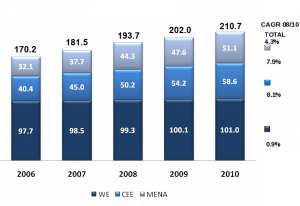

- Satellite and cable homes in Central and Eastern Europe, North Africa and the Middle East continue to show double-digit growth, progressing in Central and Eastern Europe by 16.7% and in North Africa and the Middle East by 15.3%.

- 58.9% of TV homes in Western Europe are satellite or cable homes (stable from 2008). The figures in Central and Eastern Europe are 50.9% (up from 43.6% in 2008), while North Africa and the Middle East also increased, to 69.2% compared to 61.9% in 2008.

Satellite reception continues to drive growth

Of the 210.7 million satellite and cable homes, satellite reception, with 129.3 million homes, is the growth driver, accounting for 61.4% of the total base against 85.2 million cable homes. Satellite reception has progressed over two years by 16% from 111.5 million homes in 2008 while cable penetration decreased by 1.8% to 85.2 million homes from 86.8 million in 2008,

While Western Europe, as a more established market for satellite reception posted a 5.8% growth rate, double digit growth was recorded in other regions, notably North Africa and the Middle East which saw 16% growth in satellite reception to 48.7 million homes from 42 million, and especially Eastern Europe where it climbed by 44% to 26.2 million homes from 18.2 million.

The 1.8% decrease in cable homes is mainly the result of the development of IPTV in Western Europe (principally France) and also in Eastern Europe.

Total Satellite and Cable Homes 2010

|

|

|

| Number of homes (in millions) receiving satellite channels through cable or satellite reception (DTH or community antenna). | Number of homes (in millions) receiving satellite channels through cable or satellite reception by region. | |

| Total TV-equipped population base: 360.5 million homes. | ||

IPTV

IPTV homes have grown by 25.6% to 11.3 million, up from 9 million. This increase was at the expense of cable homes (which decreased by 1.8%) and also of terrestrial TV homes (which decreased by 8.7% to 138.5 million from 151.7 million) despite DTT deployment in Western European countries.

- After initial rapid take up between 2006 and 2008, the pace of IPTV growth decreased between 2008 and 2010 (11.9% CAGR).

Analogue Reception

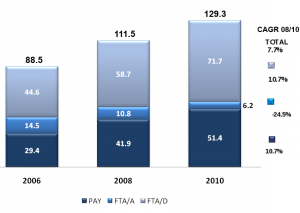

Of the 210.7 million satellite and cable homes in the footprint surveyed, only 31.9% (67.2 million homes) are still equipped for analogue reception compared with 79.6 million in 2008.

- Satellite analogue reception has been steadily decreasing to 6.2 million homes in 2010 from 10.8 million in 2008. Germany, France and Austria account for the majority of the remaining analogue universe.

- This reduction reflects the natural transition to digital platforms and the deployment of ad hoc DTT over satellite platforms (eg. France with the FRANSAT platform).

- Although analogue cable reception maintains its majority market share, serving 71.7% (or 61 million) of the 85.2 million homes in Europe, the Middle East and North Africa, it continues to decrease in favour of digital cable (analogue market share was 86% in 2008).

Satellite Reception Breakdown

|

| Number of homes (in millions) receiving channels through satellite reception. |

Satellite pay-TV grows by 22.7%

Of the 129.3 million satellite homes, 51.4 million (39.7%) subscribe to digital pay-TV, up from 41.9 million in 2008.

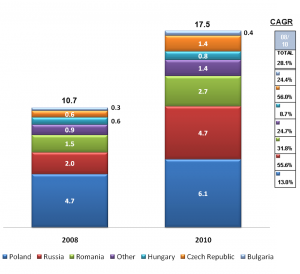

- In Eastern Europe in particular, pay-TV satellite reception has increased by 63.5% (from 10.7 million homes in 2008 to 17.5 million in 2010), as a result of new platform launches and the previously limited installed base of pay-TV homes. Growth has in particular been fuelled by strong performance of the Russian and Polish markets.

- Poland’s satellite pay-TV market, which expanded to 6.1 million homes from 4.7 million, represents 34.8% of homes in Central and Eastern Europe.

- The Russian satellite pay-TV market more than doubled, from two million homes in 2008 to 4.7 million in 2010, representing 26.8% of the satellite pay TV market in the region.

Digital free-to-air (FTA) reception increased by 22.1%, reaching a total audience of 71.7 million homes, from 58.7 million in 2008.

- In Western Europe, digital FTA increased by 36.6% to 22.4 million homes.

- In Central and Eastern Europe, FTA increased by 29.8% to 8.7 million homes.

- In North Africa and the Middle East, FTA increased by 14% to 40.6 million homes, accounting for 83% of satellite TV reception.

| Satellite Pay Western Europe | Satellite Pay Eastern Europe | |

|

|

Eutelsat in pole position

With 204 million satellite and cable homes now receiving channels via Eutelsat, up from 190 million in 2008, the combined penetration of its fleet stands at more than 9 out of 10 homes in the countries covered by the survey.

Highlights of Eutelsat video positions include:

- W4 and W7, that serve Russia and the Ukraine from 36ËšE. Their satellite audience has experienced spectacular growth, more than doubling to 8.1 million homes from 3.7 million in 2008.

- The 16ËšE position, addressing Central and Eastern Europe via SESAT 1, W2M and EUROBIRD™ 16, increased its satellite audience by 17.9%, to 2.9 million from 2.5 million homes in 2008.

- EUROBIRD™ 9A, which went into service in early 2009 at 9°E, whose audience has rapidly climbed to an installed base of five million homes (of which 3.7 million cable and 1.3 million satellite).

- ATLANTIC BIRD™ 4A at 7ËšW whose audience in its main market of North Africa and the Middle East progressed by 11.3% to 27.1 million homes, from 24.3 million in 2008.

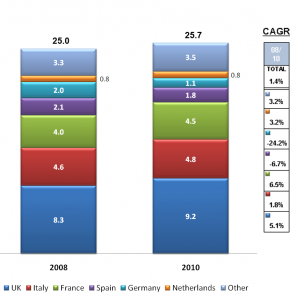

- The satellite and cable audience of the HOT BIRD™ satellites remained overall stable, with an audience of 122 million homes, reaffirming its rank as the leading video position in Europe, North Africa and the Middle East.

- 107 million homes receive satellite services via a Eutelsat satellite (up from 97.9 million) further consolidating Eutelsat’s pole position for satellite reception in Europe, the Middle East and North Africa.

Unless otherwise stated all comparisons are made against the previous study conducted in spring 2008 covering a period of two-years.

“Satellite” refers to homes equipped for direct or community (SMATV: see note below) reception.

“Cable” refers to homes receiving channels distributed by satellite to a cable network.

“Cable/satellite homes” covers both user populations, i.e. all homes receiving channels over satellite, either through satellite or cable.

SMATV (Satellite Master Antenna Television) refers to a collective antenna shared by several homes.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally